Region:Global

Author(s):Rebecca

Product Code:KRAD7430

Pages:97

Published On:December 2025

By Modality:

The Real-time (Synchronous) Telemedicine segment is currently leading the market due to its ability to provide immediate consultations and care, which is particularly beneficial in emergency situations. The convenience of video consultations and the ability to connect with healthcare providers in real-time have significantly influenced consumer behavior, leading to increased adoption. Additionally, advancements in broadband connectivity, secure video platforms, and the growing acceptance of virtual visits among patients and providers have further propelled this segment's growth.

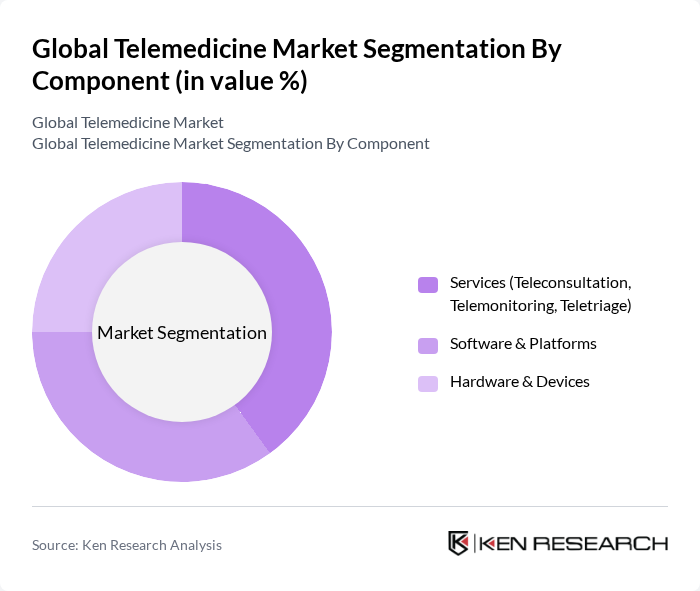

By Component:

The Services segment, which includes teleconsultation, telemonitoring, and teletriage, dominates the market due to the increasing demand for remote healthcare services. Patients are increasingly opting for teleconsultations to avoid long wait times and to receive timely medical advice. The convenience and accessibility of these services have made them a preferred choice for many, especially during the pandemic, leading to a significant rise in their adoption. In addition, the growing use of remote patient monitoring, integration of artificial intelligence for triage and decision support, and expansion of chronic disease management programs are reinforcing the dominance of service-led models in telemedicine.

The Global Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teladoc Health, Inc., Amwell (American Well Corporation), MDLIVE, Inc. (a Cigna / Evernorth Company), Doxy.me Inc., Included Health, Inc. (Doctor On Demand), HealthTap, Inc., PlushCare, Inc., Zocdoc, Inc., eVisit, Inc., InTouch Health (Teladoc Health Hospital & Health Systems), Maven Clinic Co., SimplePractice, LLC, CareClix, Inc., MyTelemedicine, Inc., Medici Technologies, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of telemedicine is poised for transformative growth, driven by technological advancements and changing patient expectations. As healthcare systems increasingly adopt digital solutions, the integration of artificial intelligence and machine learning will enhance diagnostic accuracy and patient engagement. Furthermore, the expansion of telehealth services into underserved regions will address healthcare disparities, ensuring broader access to essential medical services. This evolution will redefine patient-provider interactions, emphasizing convenience and efficiency in healthcare delivery.

| Segment | Sub-Segments |

|---|---|

| By Modality | Real-time (Synchronous) Telemedicine Store-and-Forward (Asynchronous) Telemedicine Remote Patient Monitoring (RPM) mHealth / Web-based Telemedicine |

| By Component | Services (Teleconsultation, Telemonitoring, Teletriage) Software & Platforms Hardware & Devices |

| By End-User | Hospitals & Health Systems Clinics & Ambulatory Care Centers Homecare & Patients (Direct-to-Consumer) Payers & Employers |

| By Application | Teleconsultation & Virtual Visits Tele-ICU & Acute Care Chronic Disease Management & RPM Telebehavioral & Mental Health Teleradiology, Teledermatology & Other Specialties |

| By Technology / Delivery Mode | Web & Cloud-Based Telemedicine Platforms Mobile Health (mHealth) Applications Telemedicine Kiosks & Point-of-Care Devices Integration with EHR/EMR & Connected Devices |

| By Payment & Business Model | Fee-for-Service (Visit-Based Reimbursement) Subscription / SaaS Licensing Value-Based & Risk-Sharing Contracts Employer & Payer-Sponsored Telehealth Programs |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Provider Telemedicine Adoption | 120 | Doctors, Clinic Administrators |

| Patient Experience with Telehealth Services | 110 | Patients, Caregivers |

| Technology Vendor Insights on Telemedicine Platforms | 80 | Product Managers, Technical Leads |

| Regulatory Impact on Telemedicine Implementation | 60 | Healthcare Policy Experts, Legal Advisors |

| Market Trends in Telehealth Services | 90 | Market Analysts, Industry Consultants |

The Global Telemedicine Market is valued at approximately USD 115 billion, reflecting significant growth driven by the adoption of digital health technologies and the increasing prevalence of chronic diseases, particularly accelerated by the COVID-19 pandemic.