Global Enterprise Video Market Overview

- The Global Enterprise Video Market is valued at USD 23 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for remote and hybrid communication solutions, the surge in video content consumption, and the need for advanced collaboration tools in enterprises. The market has experienced a notable increase in adoption due to accelerated digital transformation initiatives and the strategic integration of video technologies into corporate operations and employee engagement programs .

- Key players in this market include the United States, Canada, and the United Kingdom, which dominate due to their advanced technological infrastructure, high internet penetration rates, and a strong presence of major video conferencing and streaming service providers. These countries have also seen a surge in remote and hybrid work culture, further propelling the demand for enterprise video solutions .

- In 2023, the European Union implemented the Digital Services Act (Regulation (EU) 2022/2065), issued by the European Parliament and the Council. This regulation mandates that online platforms, including enterprise video services, ensure user safety, transparency, and accountability for content shared on their platforms. The Act requires compliance with risk management, content moderation, and reporting obligations, directly influencing how enterprise video solutions are designed, deployed, and managed within the EU .

Global Enterprise Video Market Segmentation

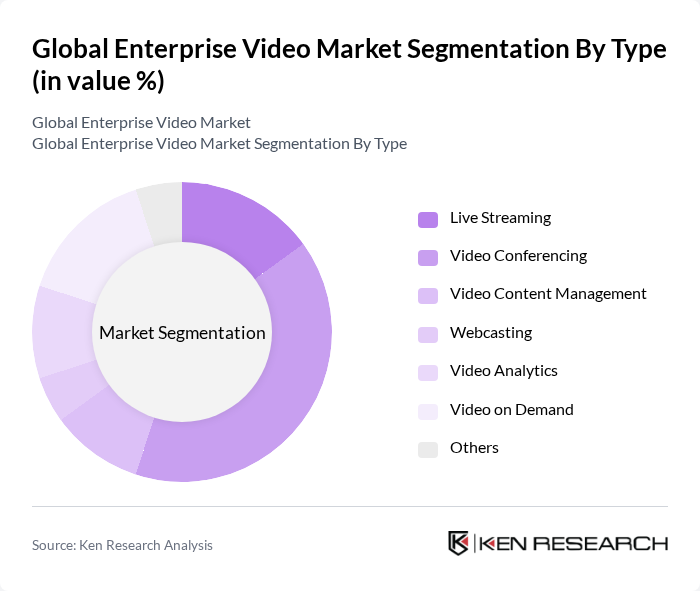

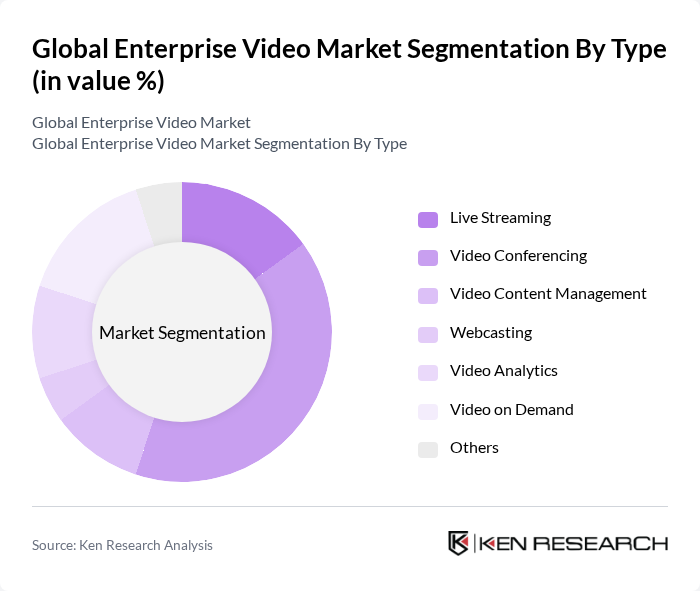

By Type:The segmentation of the market by type includes various subsegments such as Live Streaming, Video Conferencing, Video Content Management, Webcasting, Video Analytics, Video on Demand, and Others. Among these, Video Conferencing has emerged as the leading subsegment, driven by the increasing need for real-time communication and collaboration in remote and hybrid work environments. The rise in virtual meetings, webinars, and integrated unified communications platforms has significantly contributed to its dominance, as organizations seek efficient ways to connect with employees, clients, and stakeholders globally .

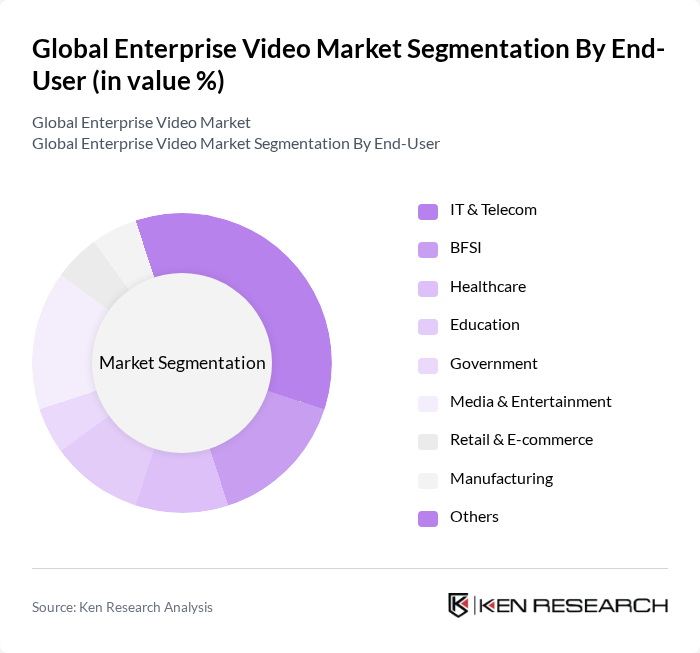

By End-User:The market is also segmented by end-user, which includes IT & Telecom, BFSI, Healthcare, Education, Government, Media & Entertainment, Retail & E-commerce, Manufacturing, and Others. The IT & Telecom sector is the dominant end-user, as it heavily relies on video solutions for internal communications, customer interactions, virtual training, and service delivery. The rapid digitalization and cloud adoption in this sector have led to increased deployment of video technologies, making it a key driver of market growth .

Global Enterprise Video Market Competitive Landscape

The Global Enterprise Video Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Zoom Video Communications, Inc., Microsoft Corporation, IBM Corporation, Adobe Inc., Google LLC, Vimeo, Inc., Kaltura, Inc., Brightcove Inc., Panopto, Inc., ON24, Inc., Haivision Systems Inc., Dacast, Inc., Wowza Media Systems, LLC, Qumu Corporation, BlueJeans by Verizon, Poly (Plantronics, Inc.), Lifesize, Inc., Vidyo, Inc., Avaya Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Enterprise Video Market Industry Analysis

Growth Drivers

- Increasing Demand for Remote Collaboration Tools:The global shift towards remote work has led to a significant increase in the demand for collaboration tools. In future, the number of remote workers is projected to reach 1.87 billion, up from 1.45 billion in 2020, according to the International Labour Organization. This surge necessitates robust video solutions to facilitate effective communication and teamwork, driving investments in enterprise video platforms that enhance productivity and connectivity across dispersed teams.

- Rise in Video Content Consumption:Video content consumption is expected to reach approximately 80% of all internet traffic in future, as reported by Cisco. This trend is fueled by the growing popularity of streaming services and social media platforms, which are increasingly integrating video features. Businesses are leveraging this shift to create engaging marketing content and training materials, thereby increasing their reliance on enterprise video solutions to meet the rising demand for high-quality video production and distribution.

- Advancements in Video Streaming Technology:Technological advancements in video streaming, such as improved codecs and adaptive bitrate streaming, are enhancing the quality and accessibility of video content. In future, the global video streaming market is expected to surpass $100 billion, according to Statista. These innovations enable enterprises to deliver seamless video experiences, even in bandwidth-constrained environments, thus encouraging wider adoption of video solutions for corporate communications and training initiatives.

Market Challenges

- High Initial Investment Costs:The implementation of enterprise video solutions often requires substantial upfront investments in infrastructure and technology. For instance, companies may need to allocate between $50,000 to $200,000 for initial setup, depending on the scale of deployment. This financial barrier can deter small and medium-sized enterprises from adopting video solutions, limiting market growth and innovation in the sector.

- Data Security and Privacy Concerns:As organizations increasingly rely on video conferencing and streaming, concerns regarding data security and privacy are paramount. In future, it is estimated that cybercrime will cost businesses over $10 trillion globally, according to Cybersecurity Ventures. This alarming statistic underscores the need for robust security measures in video solutions, as breaches can lead to significant financial and reputational damage, hindering market expansion.

Global Enterprise Video Market Future Outlook

The future of the enterprise video market appears promising, driven by the ongoing digital transformation across industries. As organizations continue to embrace hybrid work models, the demand for innovative video solutions will likely increase. Furthermore, the integration of artificial intelligence in video analytics and content personalization is expected to enhance user engagement. Companies that adapt to these trends will be well-positioned to capitalize on the evolving landscape, ensuring sustained growth and competitive advantage in the market.

Market Opportunities

- Expansion of 5G Technology:The rollout of 5G technology is set to revolutionize video streaming capabilities, offering faster speeds and lower latency. In future, it is projected that 1.6 billion 5G connections will be active globally, according to GSMA. This advancement will enable enterprises to deliver high-quality video content seamlessly, creating new opportunities for interactive and immersive experiences in corporate training and marketing.

- Integration of AI in Video Solutions:The incorporation of artificial intelligence in video solutions presents significant opportunities for enhancing user experience. AI-driven features such as automated transcription, real-time translation, and personalized content recommendations are gaining traction. In future, the AI market in video technology is expected to reach $2.5 billion, according to MarketsandMarkets, providing enterprises with tools to optimize their video strategies and improve engagement.