Region:Middle East

Author(s):Shubham

Product Code:KRAD1964

Pages:84

Published On:December 2025

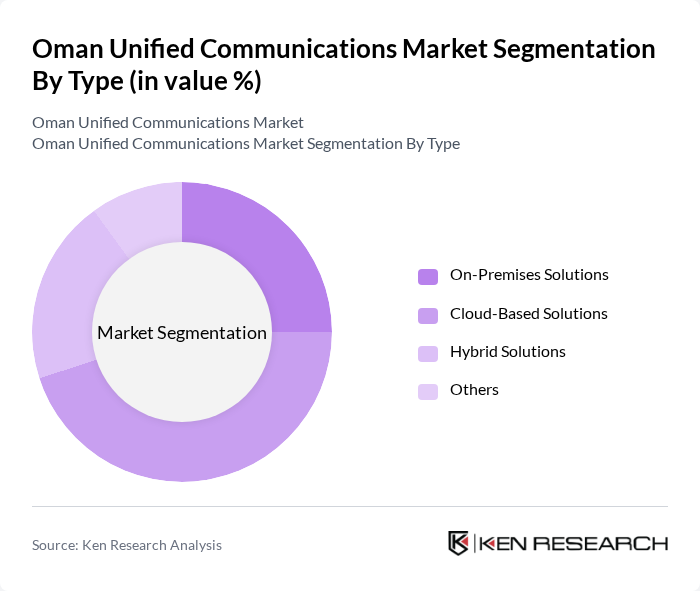

By Type:The Oman Unified Communications Market is segmented into various types, including On-Premises Solutions, Cloud-Based Solutions, Hybrid Solutions, and Others. Among these, Cloud-Based Solutions are gaining significant traction due to their flexibility, scalability, and cost-effectiveness, making them the preferred choice for many organizations. The increasing reliance on remote work and digital collaboration tools has further accelerated the adoption of cloud solutions.

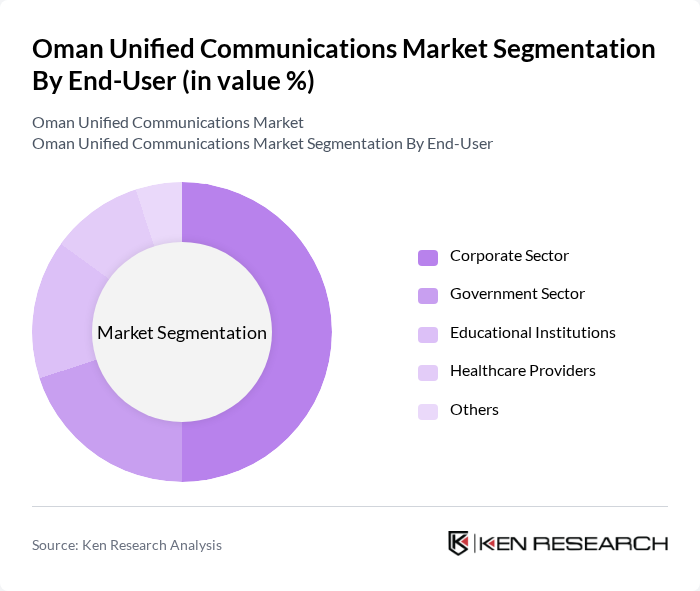

By End-User:The market is also segmented by end-users, which include the Corporate Sector, Government Sector, Educational Institutions, Healthcare Providers, and Others. The Corporate Sector is the dominant end-user, driven by the need for efficient communication and collaboration tools to enhance productivity and streamline operations. The increasing trend of digital transformation in businesses is propelling the demand for unified communication solutions.

The Oman Unified Communications Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omantel, Ooredoo Oman, Cisco Systems, Avaya Inc., Microsoft Corporation, Zoom Video Communications, RingCentral, Mitel Networks, Unify (Atos SE), Huawei Technologies, NEC Corporation, Alcatel-Lucent Enterprise, 8x8 Inc., Fuze, and StarLeaf contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman Unified Communications Market appears promising, driven by the expansion of 5G networks and the increasing integration of AI technologies. By mid-2024, Oman had deployed 5,431 operational 5G stations, enhancing connectivity and enabling low-latency communication. Additionally, government digital transactions exceeded 27 million, indicating a strong push towards digital transformation. This environment fosters innovation and the adoption of advanced communication solutions, positioning Oman as a competitive player in the unified communications landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premises Solutions Cloud-Based Solutions Hybrid Solutions Others |

| By End-User | Corporate Sector Government Sector Educational Institutions Healthcare Providers Others |

| By Industry Vertical | IT and Telecommunications Banking, Financial Services, and Insurance (BFSI) Retail Manufacturing Others |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud Others |

| By Communication Type | Voice Communication Video Communication Messaging Collaboration Tools Others |

| By Service Type | Managed Services Professional Services Support and Maintenance Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Unified Communications Adoption | 150 | IT Managers, CIOs, Communication Directors |

| SME Utilization of UC Solutions | 100 | Business Owners, Operations Managers |

| Government Sector Communication Needs | 80 | Public Sector IT Heads, Project Managers |

| Healthcare Communication Systems | 70 | Healthcare Administrators, IT Specialists |

| Education Sector UC Implementation | 60 | IT Coordinators, Educational Administrators |

The Oman Unified Communications Market is valued at approximately USD 6 billion, reflecting significant growth driven by digital adoption among SMEs and large enterprises, as well as government investments in digital infrastructure under Vision 2040.