Region:Global

Author(s):Geetanshi

Product Code:KRAA2836

Pages:85

Published On:August 2025

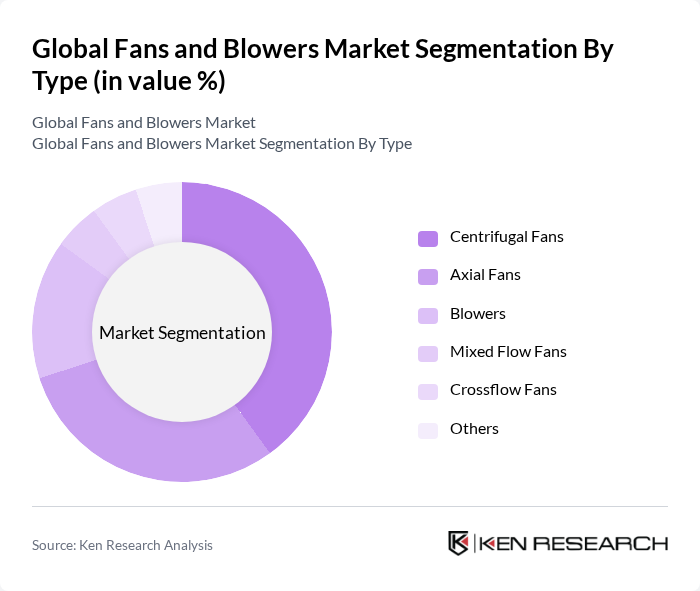

By Type:The fans and blowers market is segmented into centrifugal fans, axial fans, blowers, mixed flow fans, crossflow fans, and others.Centrifugal fansare the most widely used, valued for their ability to move air and gases at high pressures, making them essential in industrial processes, HVAC systems, and exhaust applications.Axial fansare prominent in applications requiring high airflow at lower pressures, such as ventilation and cooling in commercial and residential buildings. The demand forblowersis rising in sectors like automotive, food processing, and chemical industries, where precise and reliable air movement is critical.

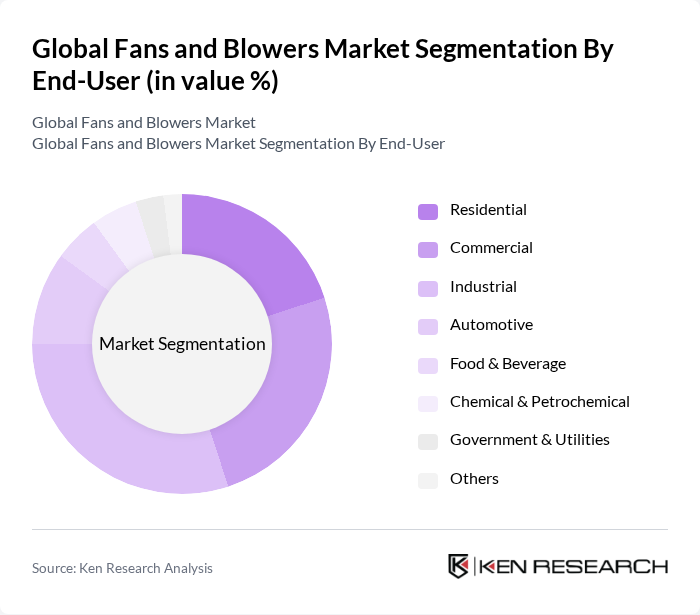

By End-User:The end-user segmentation includes residential, commercial, industrial, automotive, food & beverage, chemical & petrochemical, government & utilities, and others. Theindustrial segmentis the largest consumer, driven by the need for efficient ventilation, cooling, and process air systems in manufacturing, mining, energy, and chemical processing. Thecommercial sectorfollows, with rising installations in office buildings, data centers, and retail spaces to enhance air quality and meet regulatory standards. Theautomotive industryis a growing segment, utilizing blowers for engine cooling, HVAC, and cabin ventilation.

The Global Fans and Blowers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Greenheck Fan Corporation, Howden Group Ltd., ebm?papst Group, Systemair AB, Soler & Palau Ventilation Group, Continental Fan Manufacturing, Inc., Airmaster Fan Company, Inc., Twin City Fan Companies, Ltd., Tuthill Corporation, Vent-Axia Ltd., Maico Elektroapparate GmbH, Sodeca S.L., Air Control Industries Ltd., FläktGroup, Loren Cook Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fans and blowers market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt smart technologies, the integration of IoT in fan systems is expected to enhance operational efficiency and reduce energy consumption. Furthermore, the shift towards eco-friendly products will likely accelerate innovation, leading to the development of more efficient and sustainable fan solutions that meet evolving consumer demands and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Centrifugal Fans Axial Fans Blowers Mixed Flow Fans Crossflow Fans Others |

| By End-User | Residential Commercial Industrial Automotive Food & Beverage Chemical & Petrochemical Government & Utilities Others |

| By Application | HVAC Systems Process Cooling Material Handling Exhaust & Ventilation Systems Air Handling Units Cooling Towers Clean Rooms & Laboratories Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Technology | Standard Technology Energy-Efficient Technology Smart Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Fans and Blowers | 120 | Manufacturing Engineers, Production Managers |

| Commercial HVAC Systems | 90 | Facility Managers, HVAC Technicians |

| Residential Ventilation Solutions | 60 | Homeowners, HVAC Contractors |

| Energy-efficient Fan Technologies | 50 | Energy Auditors, Sustainability Consultants |

| Market Trends in Blower Applications | 70 | Product Development Managers, Market Analysts |

The Global Fans and Blowers Market is valued at approximately USD 7.2 billion, driven by factors such as the expanding construction sector and increasing demand for energy-efficient ventilation solutions across various applications.