Region:Global

Author(s):Geetanshi

Product Code:KRAA2751

Pages:92

Published On:August 2025

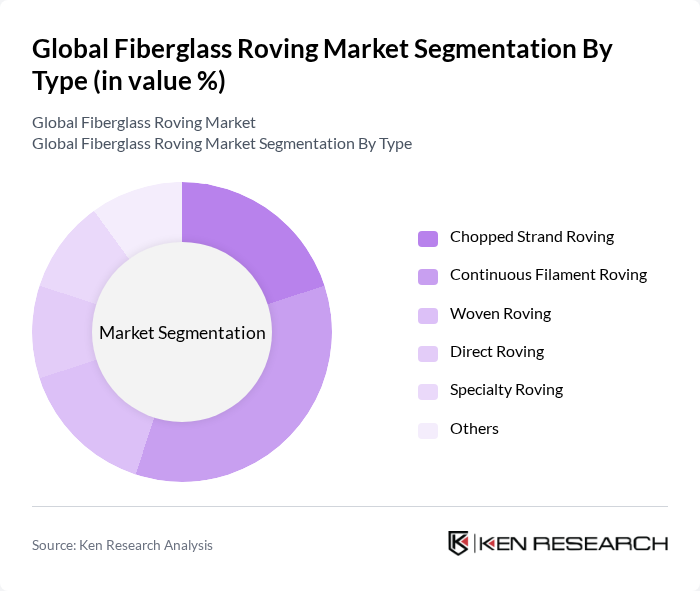

By Type:The market is segmented into various types of fiberglass roving, including Chopped Strand Roving, Continuous Filament Roving, Woven Roving, Direct Roving, Specialty Roving, and Others. Among these, Continuous Filament Roving is the most dominant segment due to its superior strength and flexibility, making it ideal for high-performance applications in industries such as automotive and aerospace. The demand for lightweight materials in these sectors has significantly increased the consumption of Continuous Filament Roving, leading to its market leadership. Multi-end roving also accounts for a major share due to its use in high-volume applications like spray-up and pultrusion processes, while single-end roving is preferred for advanced weaving and filament winding in aerospace .

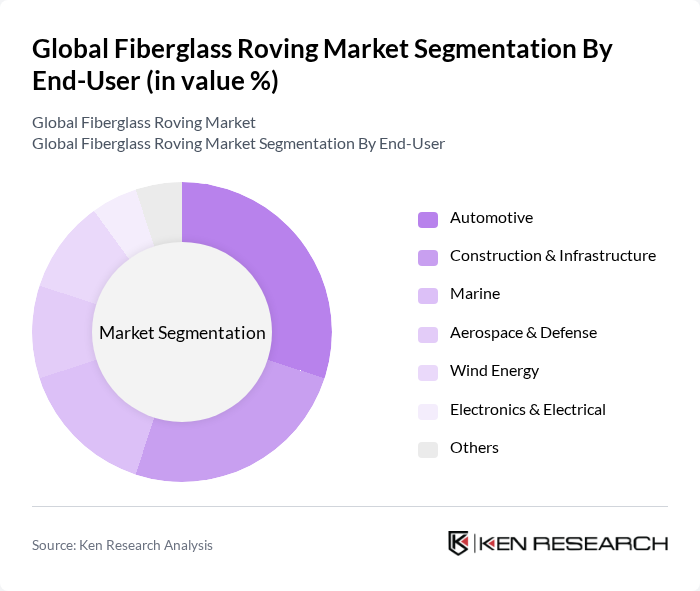

By End-User:The end-user segments include Automotive, Construction & Infrastructure, Marine, Aerospace & Defense, Wind Energy, Electronics & Electrical, and Others. The Automotive sector is the leading end-user of fiberglass roving, driven by the industry's shift towards lightweight materials to improve fuel efficiency and reduce emissions. The increasing production of electric vehicles and the need for durable components further enhance the demand for fiberglass roving in this sector. Wind energy is also a rapidly growing segment, as fiberglass roving is essential for manufacturing wind turbine blades, supporting global renewable energy initiatives .

The Global Fiberglass Roving Market is characterized by a dynamic mix of regional and international players. Leading participants such as Owens Corning, Chongqing Jushi Group Co., Ltd., Saint-Gobain Vetrotex, PPG Industries, Inc., Hexcel Corporation, AGY Holding Corp., China National Chemical Corporation (ChemChina), Nippon Electric Glass Co., Ltd., SGL Carbon SE, 3B Fibreglass S.A., Asahi Glass Co., Ltd. (AGC Inc.), Hexion Inc., Mitsubishi Chemical Group Corporation, BASF SE, Solvay S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fiberglass roving market appears promising, driven by increasing applications in emerging sectors such as renewable energy and automotive. As global investments in wind and solar energy projects are projected to reach $600 billion in future, the demand for fiberglass in turbine blades and solar panels will likely surge. Additionally, the trend towards lightweight materials in automotive manufacturing will continue to propel market growth, fostering innovation and sustainability in production processes.

| Segment | Sub-Segments |

|---|---|

| By Type | Chopped Strand Roving Continuous Filament Roving Woven Roving Direct Roving Specialty Roving Others |

| By End-User | Automotive Construction & Infrastructure Marine Aerospace & Defense Wind Energy Electronics & Electrical Others |

| By Application | Reinforcement (Composites, FRP) Insulation Electrical Components Chemical Processing Equipment Pipes & Tanks Others |

| By Distribution Channel | Direct Sales (Manufacturers to OEMs) Distributors/Dealers Online Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Product Form | Rolls Sheets Mats Custom Shapes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Fiberglass Applications | 100 | Product Engineers, Procurement Managers |

| Construction Industry Usage | 80 | Project Managers, Architects |

| Marine Fiberglass Products | 70 | Manufacturing Supervisors, Design Engineers |

| Aerospace Composite Materials | 60 | Quality Assurance Managers, R&D Specialists |

| Wind Energy Applications | 90 | Supply Chain Managers, Operations Directors |

The Global Fiberglass Roving Market is valued at approximately USD 9.5 billion, driven by the increasing demand for lightweight and high-strength materials across various industries, including automotive, construction, aerospace, and electronics.