Region:Global

Author(s):Dev

Product Code:KRAA3066

Pages:89

Published On:August 2025

Market.png)

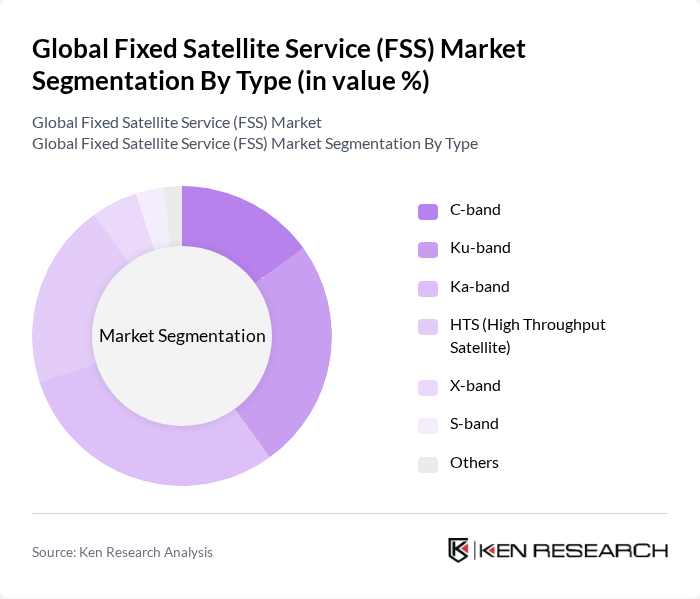

By Type:The market is segmented into various types of satellite services, including C-band, Ku-band, Ka-band, HTS (High Throughput Satellite), X-band, S-band, and others. Each type serves different applications and user needs, with specific advantages in terms of bandwidth, coverage, and cost-effectiveness. The HTS segment is particularly noteworthy for its ability to provide high data rates and efficient bandwidth usage, making it a preferred choice for many service providers. Ka-band and HTS are increasingly favored for broadband and mobility applications due to their high throughput and lower cost per bit, while C-band and Ku-band remain critical for broadcasting and enterprise connectivity .

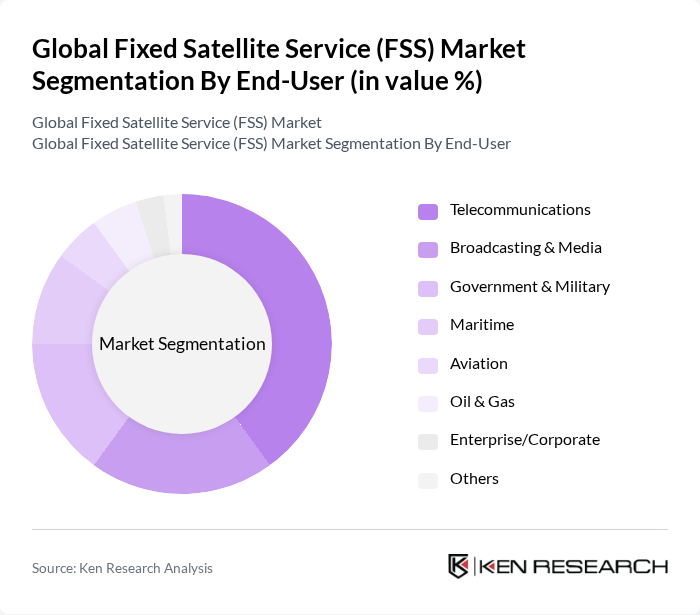

By End-User:The end-user segmentation includes telecommunications, broadcasting & media, government & military, maritime, aviation, oil & gas, enterprise/corporate, and others. The telecommunications sector is the largest end-user, driven by the increasing demand for mobile and internet services, particularly in rural and remote areas where terrestrial infrastructure is lacking. Broadcasting & media continue to be major users due to the need for reliable content delivery, while government and military applications are expanding with the adoption of secure and resilient satellite networks .

The Global Fixed Satellite Service (FSS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intelsat S.A., SES S.A., Eutelsat Communications S.A., Telesat Canada, Hughes Network Systems, LLC, Viasat, Inc., Inmarsat Global Limited, Iridium Communications Inc., Hispasat S.A., Arabsat, Thaicom Public Company Limited, SKY Perfect JSAT Holdings, Inc., Asia Satellite Telecommunications Co. Ltd. (AsiaSat), Globalstar, Inc., Embratel Star One, Nigerian Communications Satellite Ltd. (NigComSat), Singapore Telecommunications Ltd. (Singtel), Telenor Satellite AS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the FSS market appears promising, driven by technological advancements and increasing connectivity needs. The integration of artificial intelligence in satellite operations is expected to enhance efficiency and reduce operational costs. Additionally, the rise of low Earth orbit (LEO) satellites is set to revolutionize the industry by providing lower latency and higher bandwidth. As emerging markets continue to adopt satellite solutions, the FSS sector is poised for significant growth, addressing the connectivity gap in underserved regions.

| Segment | Sub-Segments |

|---|---|

| By Type | C-band Ku-band Ka-band HTS (High Throughput Satellite) X-band S-band Others |

| By End-User | Telecommunications Broadcasting & Media Government & Military Maritime Aviation Oil & Gas Enterprise/Corporate Others |

| By Application | Data Communication Video Broadcasting Internet Access/Broadband Remote Sensing & Monitoring Telephony/Voice Others |

| By Service Type | Managed Services Infrastructure/Capacity Leasing Value-Added Services Others |

| By Distribution Channel | Direct Sales Distributors/Resellers Online Platforms Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Broadcasting Services | 100 | Broadcast Engineers, Content Managers |

| Maritime Communications | 60 | Fleet Managers, Maritime Operations Managers |

| Aerospace Applications | 50 | Aerospace Engineers, Aviation Operations Managers |

| Government Satellite Services | 40 | Government Officials, Defense Procurement Managers |

| Broadband Internet Services | 80 | Telecom Executives, Network Operations Managers |

The Global Fixed Satellite Service (FSS) Market is valued at approximately USD 25 billion, driven by increasing demand for broadband connectivity and reliable communication services across various sectors, including telecommunications and broadcasting.