Region:Global

Author(s):Shubham

Product Code:KRAA1103

Pages:81

Published On:August 2025

By Type:The market is segmented into various types of analytics solutions that address different aspects of fleet management. The subsegments include Fleet Tracking & Monitoring Analytics, Fleet Maintenance & Diagnostics Analytics, Driver Behavior & Safety Analytics, Fuel & Energy Management Analytics, Route & Trip Optimization Analytics, Telematics Data Analytics, and Predictive & Prescriptive Analytics. These solutions are critical for improving operational efficiency, reducing costs, optimizing routes, monitoring driver performance, and ensuring regulatory compliance .

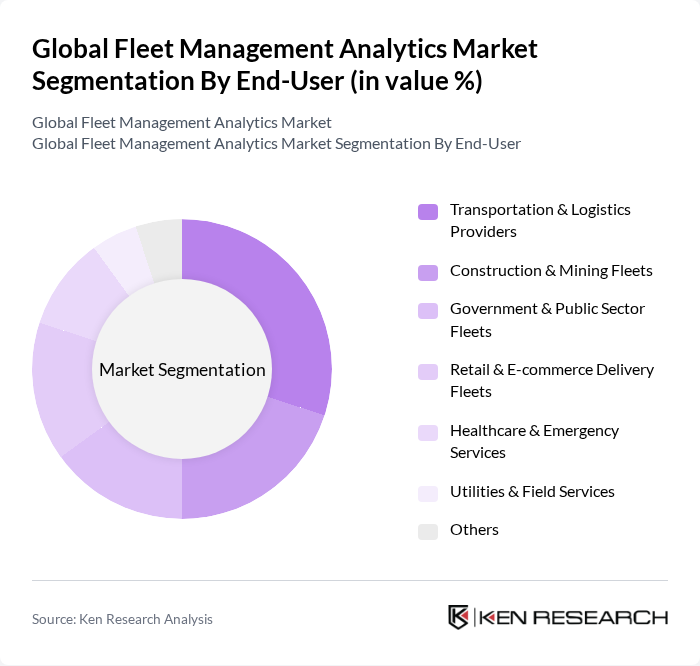

By End-User:The end-user segmentation includes a wide range of industries that leverage fleet management analytics to optimize their operations. The subsegments are Transportation & Logistics Providers, Construction & Mining Fleets, Government & Public Sector Fleets, Retail & E-commerce Delivery Fleets, Healthcare & Emergency Services, Utilities & Field Services, and Others. Each sector has unique operational requirements, regulatory pressures, and service delivery needs that drive the adoption of analytics solutions .

The Global Fleet Management Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab Inc., Verizon Connect, Samsara Inc., Trimble Inc. (Transportation & Logistics), Teletrac Navman, Omnitracs LLC, Fleet Complete, Zonar Systems, TomTom Telematics (now Bridgestone Mobility Solutions), Gurtam, Azuga (a Bridgestone Company), KeepTruckin (now Motive Technologies, Inc.), Fleetio, Zubie, Microlise Group PLC, Inseego Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The future of fleet management analytics is poised for significant transformation, driven by advancements in artificial intelligence and machine learning. As companies increasingly prioritize sustainability, the integration of green technologies will become essential. Furthermore, the demand for real-time data analytics will grow, enabling fleet operators to make informed decisions swiftly. This evolution will likely lead to enhanced operational efficiencies and reduced environmental impact, positioning analytics as a cornerstone of modern fleet management strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Tracking & Monitoring Analytics Fleet Maintenance & Diagnostics Analytics Driver Behavior & Safety Analytics Fuel & Energy Management Analytics Route & Trip Optimization Analytics Telematics Data Analytics Predictive & Prescriptive Analytics |

| By End-User | Transportation & Logistics Providers Construction & Mining Fleets Government & Public Sector Fleets Retail & E-commerce Delivery Fleets Healthcare & Emergency Services Utilities & Field Services Others |

| By Fleet Size | Small Fleets (1-50 vehicles) Medium Fleets (51-500 vehicles) Large Fleets (501+ vehicles) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Fleet Optimization & Utilization Compliance & Regulatory Analytics Risk & Safety Management Performance Monitoring & Benchmarking Sustainability & Emissions Analytics Others |

| By Sales Channel | Direct Sales Distributors & Resellers Online Sales |

| By Pricing Model | Subscription-Based (SaaS) One-Time License Fee Pay-Per-Use Freemium & Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Fleet Management | 100 | Fleet Managers, Operations Directors |

| Telematics Solutions Adoption | 80 | IT Managers, Fleet Technology Specialists |

| Analytics Software Utilization | 60 | Data Analysts, Business Intelligence Managers |

| Logistics and Supply Chain Optimization | 50 | Supply Chain Managers, Logistics Coordinators |

| Electric Fleet Transition Strategies | 40 | Sustainability Officers, Fleet Transition Managers |

The Global Fleet Management Analytics Market is valued at approximately USD 18 billion, driven by the need for operational efficiency, cost reduction, and enhanced safety measures in fleet operations.