Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA2008

Pages:94

Published On:August 2025

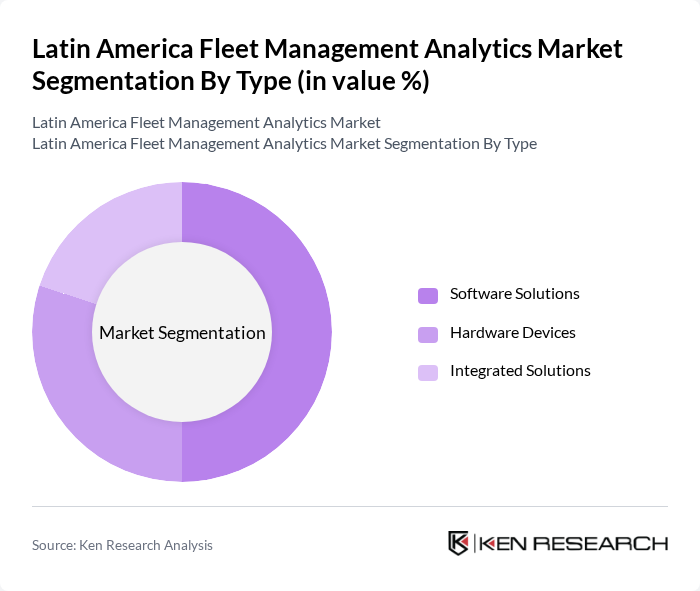

By Type:The market is segmented into Software Solutions, Hardware Devices, and Integrated Solutions. Each of these subsegments plays a crucial role in providing comprehensive fleet management capabilities.

The Software Solutions subsegment is leading the market due to the increasing demand for cloud-based fleet management systems that offer real-time data analytics, route optimization, and predictive maintenance management. Companies are increasingly adopting these solutions to enhance operational efficiency and reduce costs. The trend toward digital transformation in logistics and transportation sectors, along with the integration of artificial intelligence and IoT for predictive analytics, further supports the growth of software solutions, making them the preferred choice for fleet operators.

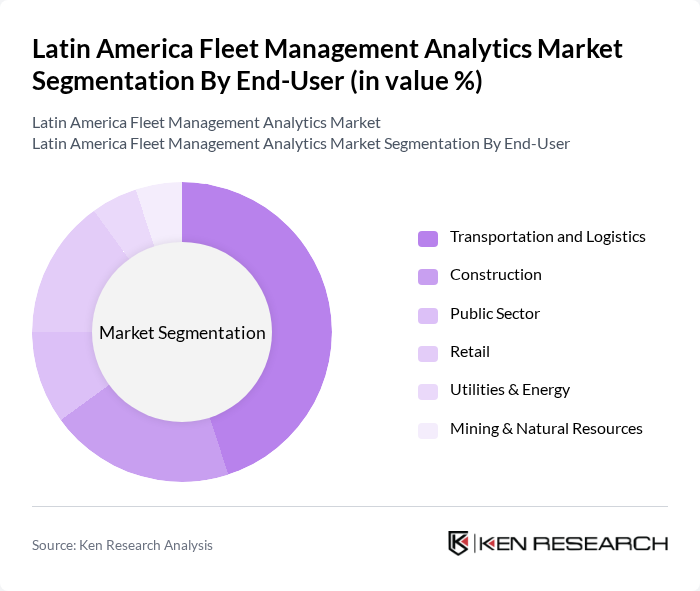

By End-User:The market is segmented into Transportation and Logistics, Construction, Public Sector, Retail, Utilities & Energy, and Mining & Natural Resources. Each end-user segment has unique requirements and applications for fleet management analytics.

The Transportation and Logistics sector is the dominant end-user of fleet management analytics, driven by the need for efficient route planning, fuel management, and compliance with evolving regulatory requirements. The rapid growth of e-commerce, increasing complexity of supply chains, and the adoption of connected fleet technologies have heightened the demand for analytics solutions that can provide actionable insights and improve overall fleet performance. This sector’s reliance on timely deliveries, cost management, and sustainability initiatives further solidifies its leadership in the market.

The Latin America Fleet Management Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geotab Inc., Teletrac Navman, Fleet Complete, Omnicomm, Verizon Connect, Trimble Inc., Zubie, Fleetio, Samsara, TomTom Telematics, Microlise, Inseego Corp., Nauto, Gurtam, Azuga, Pointer by PowerFleet, Webfleet Solutions (Bridgestone), Cobli, Sascar (Michelin), Locomobi World Inc., OnixSat, Autotrac, Sofitex, Moviloc, M2M Telemetria contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Latin America fleet management analytics market appears promising, driven by technological advancements and increasing regulatory pressures. As companies prioritize operational efficiency and sustainability, the integration of AI and machine learning into analytics solutions is expected to enhance decision-making processes. Furthermore, the growing trend of smart city initiatives will likely foster collaboration between fleet operators and local governments, paving the way for innovative solutions that address urban mobility challenges and improve overall fleet performance.

| Segment | Sub-Segments |

|---|---|

| By Type | Software Solutions Hardware Devices Integrated Solutions |

| By End-User | Transportation and Logistics Construction Public Sector Retail Utilities & Energy Mining & Natural Resources |

| By Fleet Size | Small Fleets (1-50 vehicles) Medium Fleets (51-250 vehicles) Large Fleets (251+ vehicles) |

| By Application | Route Optimization Fuel Management Maintenance Management Driver Behavior Analytics Asset Tracking & Security Compliance & Regulatory Reporting |

| By Distribution Channel | Direct Sales Online Sales Distributors |

| By Region | Brazil Mexico Argentina Chile Colombia Peru Rest of Latin America |

| By Pricing Model | Subscription-Based One-Time Purchase Freemium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transportation Analytics | 60 | Transit Authority Officials, Fleet Supervisors |

| Logistics and Supply Chain Optimization | 70 | Supply Chain Managers, Logistics Coordinators |

| Telematics and Fleet Tracking Solutions | 50 | IT Managers, Technology Officers |

| Fleet Maintenance and Repair Services | 40 | Maintenance Managers, Service Center Directors |

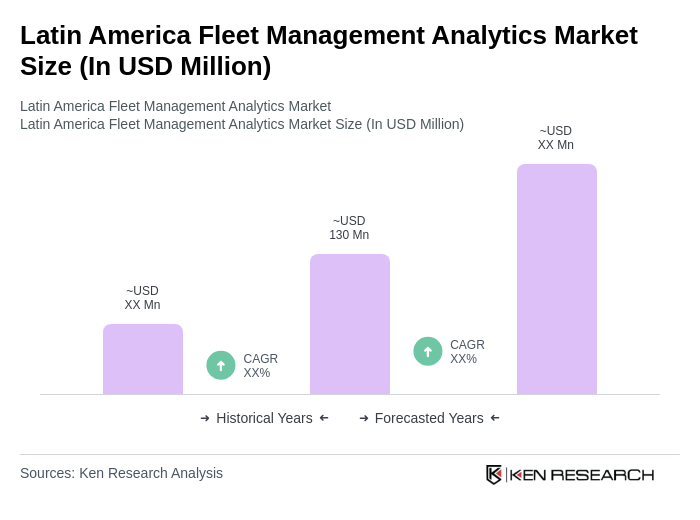

The Latin America Fleet Management Analytics Market is valued at approximately USD 130 million, driven by the increasing demand for operational efficiency, cost reduction, and enhanced safety measures in fleet operations across the region.