Region:Global

Author(s):Geetanshi

Product Code:KRAC0081

Pages:91

Published On:August 2025

By Type:The market is segmented into various types of software solutions that address different aspects of fleet management. The primary subsegments include Vehicle Tracking Software, Fleet Maintenance Software, Driver Management Software, Fuel Management Software, Route Optimization Software, Telematics Solutions, Compliance Management Software, Asset Management Software, and Others. Among these, Vehicle Tracking Software is the leading subsegment, driven by its essential role in real-time monitoring, route optimization, and cost reduction for fleet operators .

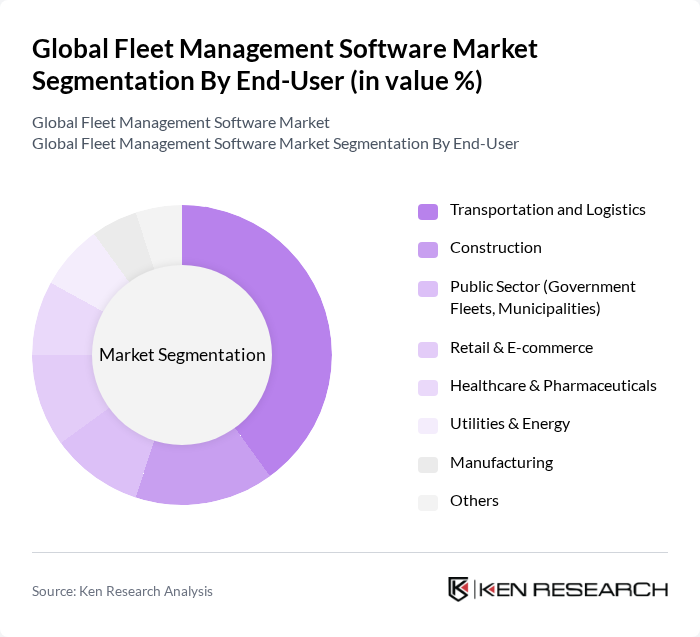

By End-User:The end-user segmentation includes industries that utilize fleet management software, such as Transportation and Logistics, Construction, Public Sector (Government Fleets, Municipalities), Retail & E-commerce, Healthcare & Pharmaceuticals, Utilities & Energy, Manufacturing, and Others. The Transportation and Logistics sector is the dominant end-user, driven by the need for efficient fleet operations, regulatory compliance, and real-time tracking capabilities to enhance service delivery and reduce operational risks .

The Global Fleet Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fleet Complete, Verizon Connect, Geotab Inc., Omnicomm, Teletrac Navman, Samsara Inc., Fleetio, Zubie, MiX Telematics, Microlise, Gurtam, TomTom Telematics, Chevin Fleet Solutions, Inseego, Trimble Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of fleet management software is poised for significant transformation, driven by technological advancements and evolving market demands. As companies increasingly prioritize sustainability, the integration of electric vehicles into fleets is expected to rise, necessitating advanced management solutions. Additionally, the growing trend of Mobility-as-a-Service (MaaS) will reshape fleet operations, emphasizing the need for flexible and scalable software solutions. These developments will create a dynamic environment for innovation and investment in the fleet management sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Vehicle Tracking Software Fleet Maintenance Software Driver Management Software Fuel Management Software Route Optimization Software Telematics Solutions Compliance Management Software Asset Management Software Others |

| By End-User | Transportation and Logistics Construction Public Sector (Government Fleets, Municipalities) Retail & E-commerce Healthcare & Pharmaceuticals Utilities & Energy Manufacturing Others |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) |

| By Deployment Mode | On-Premise Cloud-Based |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Service Type | Software as a Service (SaaS) Managed Services Consulting & Integration Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 120 | Fleet Managers, Operations Directors |

| Construction Equipment Tracking | 60 | Project Managers, Equipment Supervisors |

| Public Transportation Systems | 50 | Transit Authority Officials, Fleet Coordinators |

| Delivery Services Optimization | 80 | Logistics Analysts, Delivery Managers |

| Telematics and IoT Integration | 40 | IT Managers, Technology Officers |

The Global Fleet Management Software Market is valued at approximately USD 25 billion, driven by the increasing demand for operational efficiency, cost reduction, and enhanced safety measures in fleet operations.