Region:Global

Author(s):Shubham

Product Code:KRAA2637

Pages:87

Published On:August 2025

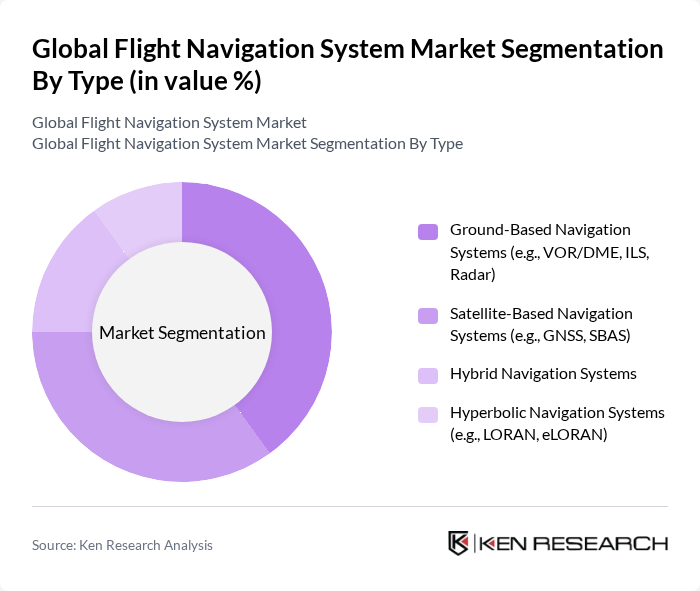

By Type:The market is segmented into Ground-Based Navigation Systems, Satellite-Based Navigation Systems, Hybrid Navigation Systems, and Hyperbolic Navigation Systems. Ground-Based Navigation Systems, such as VOR/DME and ILS, remain widely used due to their reliability and established infrastructure. Satellite-Based Navigation Systems, including GNSS and SBAS, are gaining traction owing to their global coverage, accuracy, and compatibility with modern airspace requirements. Hybrid systems combine both technologies for enhanced redundancy and performance, while Hyperbolic Navigation Systems (e.g., LORAN, eLORAN) are utilized in select applications for backup and resilience .

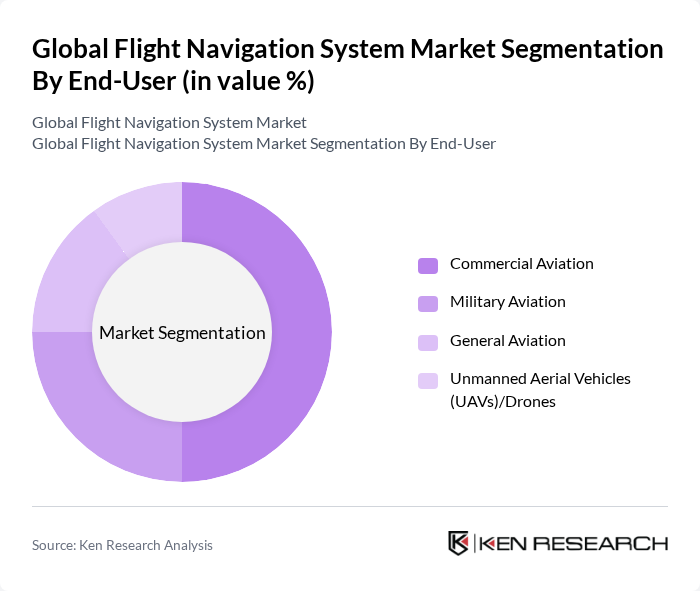

By End-User:The market is categorized into Commercial Aviation, Military Aviation, General Aviation, and Unmanned Aerial Vehicles (UAVs)/Drones. Commercial Aviation leads due to the rising number of air passengers and the critical need for efficient, safe navigation systems. Military Aviation follows, driven by investments in advanced navigation for defense and surveillance. General Aviation and UAVs are expanding segments, reflecting increased private flying and drone operations for commercial, recreational, and logistics purposes .

The Global Flight Navigation System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Garmin Ltd., Collins Aerospace (Raytheon Technologies Corporation), Thales Group, Northrop Grumman Corporation, RTX Corporation, L3Harris Technologies, Inc., BAE Systems plc, General Dynamics Corporation, Mitsubishi Electric Corporation, Indra Sistemas, S.A., SITAONAIR, Avidyne Corporation, Universal Avionics Systems Corporation, Cobham Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of flight navigation systems is poised for transformative growth, driven by the integration of artificial intelligence and machine learning technologies. These innovations will enhance predictive analytics, improving decision-making processes for airlines. Additionally, the increasing focus on sustainable aviation practices will drive demand for navigation systems that optimize fuel efficiency and reduce carbon emissions. As urban air mobility solutions gain traction, the need for advanced navigation systems will become even more critical, shaping the industry's landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Ground-Based Navigation Systems (e.g., VOR/DME, ILS, Radar) Satellite-Based Navigation Systems (e.g., GNSS, SBAS) Hybrid Navigation Systems Hyperbolic Navigation Systems (e.g., LORAN, eLORAN) |

| By End-User | Commercial Aviation Military Aviation General Aviation Unmanned Aerial Vehicles (UAVs)/Drones |

| By Component | Hardware (Flight Management Systems, Flight Control Systems, Autopilot, Sensors, Gyroscopes, Altimeters) Software (Navigation Software, Flight Planning Software) Services (Maintenance, Upgrades, Training) |

| By Application | Flight Planning Air Traffic Management Navigation and Guidance Surveillance & Communication |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aviation Navigation Systems | 100 | Flight Operations Managers, Chief Pilots |

| Military Flight Navigation Technologies | 80 | Defense Procurement Officers, Military Aviation Experts |

| General Aviation Navigation Solutions | 60 | Private Pilots, Aircraft Owners |

| Air Traffic Management Systems | 90 | Air Traffic Controllers, System Engineers |

| Emerging Navigation Technologies (e.g., GNSS) | 50 | Aerospace Engineers, Technology Developers |

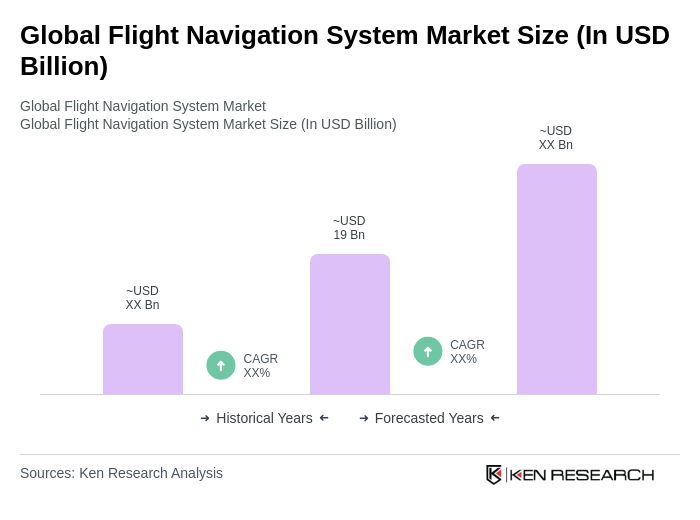

The Global Flight Navigation System Market is valued at approximately USD 19 billion, driven by increasing air travel demand, advancements in navigation technologies, and the need for efficient air traffic management systems.