Region:Global

Author(s):Dev

Product Code:KRAA3024

Pages:96

Published On:August 2025

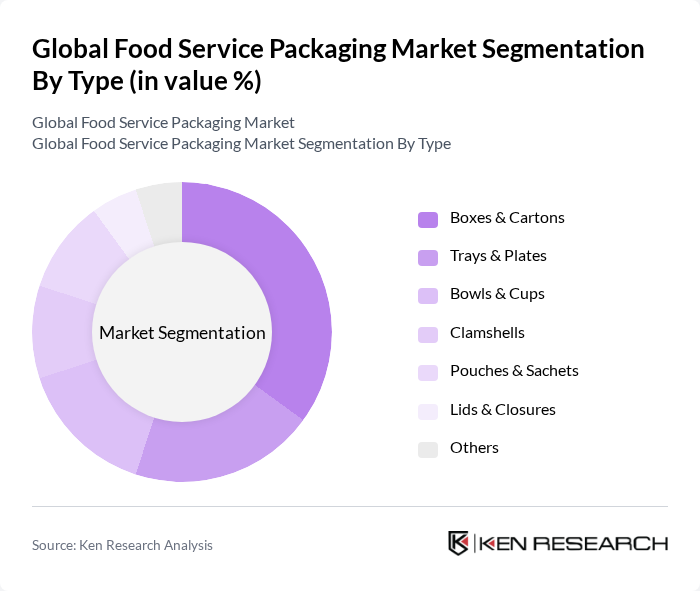

By Type:The food service packaging market is segmented into various types, including Boxes & Cartons, Trays & Plates, Bowls & Cups, Clamshells, Pouches & Sachets, Lids & Closures, and Others. Among these, Boxes & Cartons are leading the market due to their versatility and suitability for a wide range of food items, from takeout meals to desserts. The demand for eco-friendly packaging solutions is also driving innovation in this segment, as consumers increasingly prefer sustainable options .

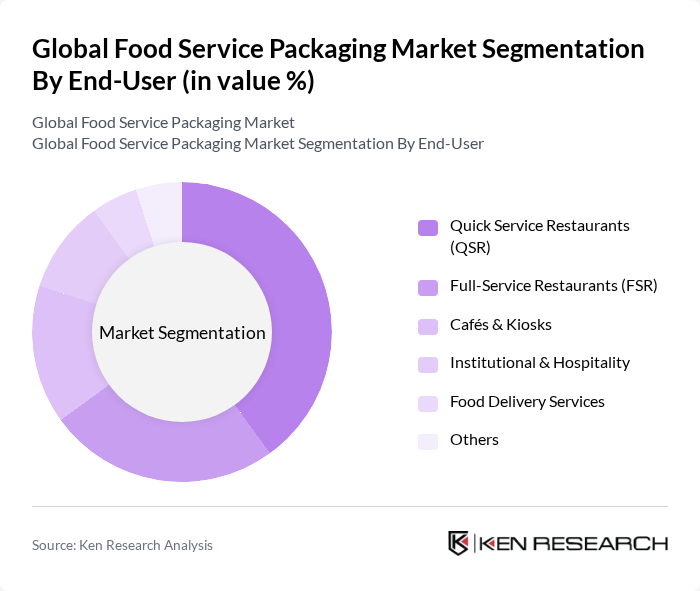

By End-User:The market is also segmented by end-user categories, including Quick Service Restaurants (QSR), Full-Service Restaurants (FSR), Cafés & Kiosks, Institutional & Hospitality, Food Delivery Services, and Others. The Quick Service Restaurants segment is the most dominant, driven by the increasing consumer preference for fast food and convenience. The rise of food delivery apps has further bolstered this segment, as QSRs adapt their packaging to meet the demands of takeout and delivery .

The Global Food Service Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Berry Global, Inc., Huhtamaki Oyj, WestRock Company, Smurfit Kappa Group plc, Mondi Group, Graphic Packaging Holding Company, International Paper Company, DS Smith Plc, Novolex Holdings, Inc., Pactiv Evergreen Inc., Winpak Ltd., Dart Container Corporation, Genpak LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of food service packaging in None is poised for transformation, driven by technological advancements and evolving consumer preferences. The integration of smart packaging technologies, such as QR codes for tracking freshness, is expected to enhance consumer engagement. Additionally, the focus on eco-friendly materials will likely intensify, as companies seek to align with sustainability goals. As e-commerce food delivery continues to expand, innovative packaging solutions will be essential to meet the demands of this growing market segment.

| Segment | Sub-Segments |

|---|---|

| By Type | Boxes & Cartons Trays & Plates Bowls & Cups Clamshells Pouches & Sachets Lids & Closures Others |

| By End-User | Quick Service Restaurants (QSR) Full-Service Restaurants (FSR) Cafés & Kiosks Institutional & Hospitality Food Delivery Services Others |

| By Material | Plastic Paper & Paperboard Aluminum Foil Biodegradable Materials Others |

| By Application | Food Packaging Beverage Packaging Snack Packaging Dessert Packaging Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Region | North America (U.S., Canada) Europe (U.K., Germany, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, Australia & New Zealand, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Mexico, Rest of Latin America) Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of Middle East & Africa) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Quick Service Restaurants (QSR) | 100 | Operations Managers, Procurement Directors |

| Catering Services | 60 | Supply Chain Managers, Product Development Leads |

| Food Delivery Platforms | 40 | Logistics Coordinators, Packaging Specialists |

| Institutional Food Services | 50 | Facility Managers, Sustainability Coordinators |

| Retail Food Outlets | 70 | Store Managers, Marketing Executives |

The Global Food Service Packaging Market is valued at approximately USD 134 billion, reflecting a significant growth trend driven by the increasing demand for convenient food options and the expansion of food delivery services.