Region:Global

Author(s):Geetanshi

Product Code:KRAA1315

Pages:85

Published On:August 2025

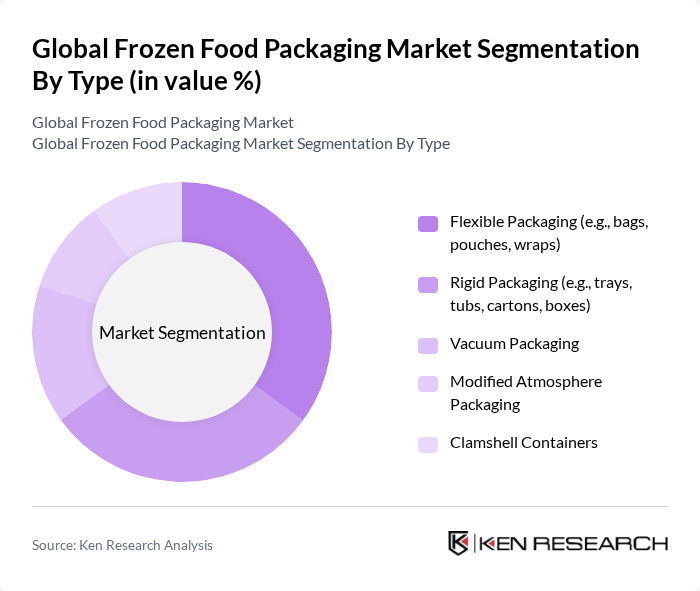

By Type:The frozen food packaging market is segmented into various types, including flexible packaging, rigid packaging, vacuum packaging, modified atmosphere packaging, and clamshell containers. Among these, flexible packaging is gaining traction due to its lightweight nature, cost-effectiveness, and ability to preserve food freshness. Rigid packaging is preferred for its durability and protection during transportation, especially for bulk and delicate items. The demand for vacuum and modified atmosphere packaging is also increasing as they extend shelf life and maintain product quality, with modified atmosphere packaging now adopted by over 60% of leading frozen food brands for its effectiveness in preserving freshness.

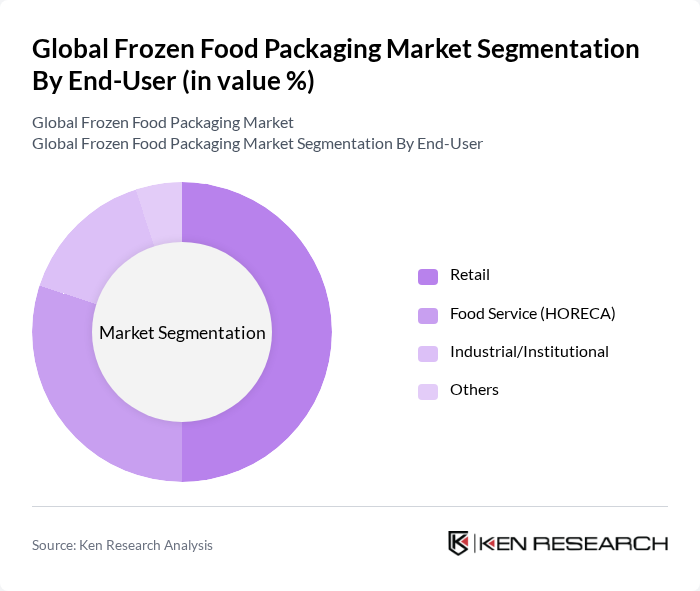

By End-User:The market is segmented by end-user into retail, food service (HORECA), industrial/institutional, and others. The retail segment is the largest due to the increasing consumer demand for frozen foods in supermarkets and grocery stores, supported by the expansion of organized retail and e-commerce. The food service sector is also significant, driven by the growing trend of ready-to-eat meals in restaurants and cafes. Industrial and institutional users are expanding their frozen food offerings, further boosting the market.

The Global Frozen Food Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Berry Global, Inc., Mondi Group, Sonoco Products Company, Smurfit Kappa Group, Graphic Packaging Holding Company, Winpak Ltd., Coveris Holdings S.A., Huhtamaki Oyj, International Paper Company, Reynolds Group Holdings Limited, Clondalkin Group Holdings B.V., Novolex Holdings, Inc., ProAmpac LLC, Cascades Inc., Ahlstrom, The Paper People LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the frozen food packaging market appears promising, driven by a growing emphasis on sustainability and technological advancements. As consumers become more environmentally conscious, the demand for eco-friendly packaging solutions is expected to rise significantly. Additionally, the integration of smart packaging technologies will enhance food safety and traceability, aligning with consumer preferences for transparency. These trends are likely to shape the market landscape, fostering innovation and creating new opportunities for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Packaging (e.g., bags, pouches, wraps) Rigid Packaging (e.g., trays, tubs, cartons, boxes) Vacuum Packaging Modified Atmosphere Packaging Clamshell Containers |

| By End-User | Retail Food Service (HORECA) Industrial/Institutional Others |

| By Material | Plastic (PE, PET, PP, PVC, etc.) Paperboard & Cardboard Metal (Aluminum Foil, Cans) Glass Biodegradable/Compostable Materials |

| By Application | Frozen Vegetables & Fruits Frozen Meat & Poultry Frozen Seafood Frozen Ready Meals Frozen Baked Goods & Desserts Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Convenience Stores Foodservice Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Frozen Food Manufacturers | 120 | Production Managers, R&D Directors |

| Packaging Suppliers | 80 | Sales Executives, Product Development Managers |

| Retail Chains | 60 | Category Managers, Procurement Officers |

| Logistics Providers | 50 | Operations Managers, Supply Chain Analysts |

| Regulatory Bodies | 40 | Compliance Officers, Policy Makers |

The Global Frozen Food Packaging Market is valued at approximately USD 46 billion, driven by increasing demand for convenience foods, consumer preference for frozen products, and advancements in packaging technologies that enhance product shelf life and safety.