Region:Asia

Author(s):Dev

Product Code:KRAC8674

Pages:90

Published On:November 2025

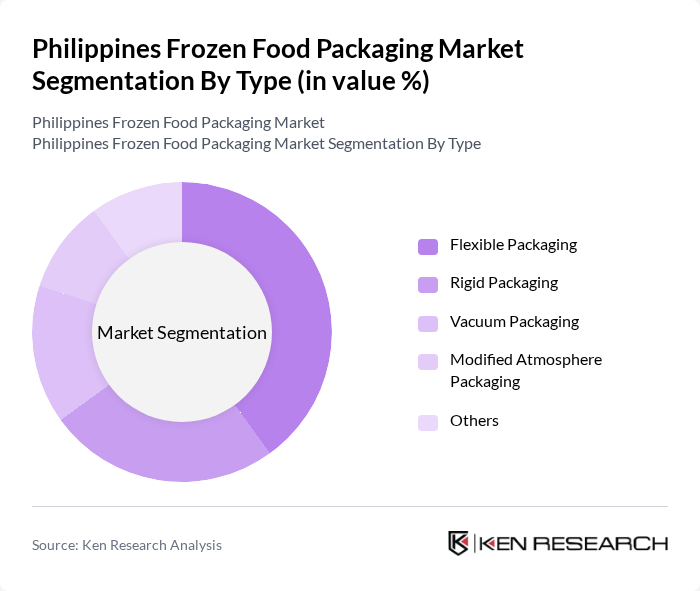

By Type:

The frozen food packaging market can be segmented into various types, including Flexible Packaging, Rigid Packaging, Vacuum Packaging, Modified Atmosphere Packaging, and Others. Among these, Flexible Packaging is the leading sub-segment due to its lightweight, cost-effectiveness, and ability to preserve food quality. The demand for flexible packaging is driven by consumer preferences for convenience, the need for longer shelf life, and the increasing adoption of sustainable and innovative packaging materials by manufacturers .

By End-User:

The end-user segmentation includes Retail, Food Service, Industrial, Government & Utilities, and Others. The Retail segment dominates the market, driven by the increasing availability of frozen food products in supermarkets, convenience stores, and the rapid expansion of online grocery shopping platforms. The trend of digital grocery channels and improved cold-chain logistics has further contributed to the retail segment's expansion, as consumers seek easy access to a wider variety of frozen food options .

The Philippines Frozen Food Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as San Miguel Corporation, Universal Robina Corporation, Purefoods Hormel Company, Del Monte Philippines, Inc., CDO Foodsphere, Inc., Alaska Milk Corporation, Monde Nissin Corporation, Jollibee Foods Corporation, Nestlé Philippines, Inc., Century Pacific Food, Inc., Liwayway Marketing Corporation, Gardenia Bakeries Philippines, Inc., M.Y. San Corporation, Cargill Philippines, Inc., Dole Philippines, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines frozen food packaging market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness rises, there is a growing demand for nutritious frozen meal options, which will likely influence packaging innovations. Additionally, the shift towards sustainable practices will encourage companies to adopt eco-friendly materials, aligning with global trends. The market is expected to adapt to these changes, fostering growth and enhancing product offerings to meet consumer needs effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Packaging Rigid Packaging Vacuum Packaging Modified Atmosphere Packaging Others |

| By End-User | Retail Food Service Industrial Government & Utilities Others |

| By Material | Plastic Paper Metal Glass Others |

| By Application | Frozen Vegetables Frozen Meat Frozen Seafood Frozen Ready Meals Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Convenience Stores Direct Sales Others |

| By Region | Luzon Visayas Mindanao Others |

| By Packaging Technology | Thermoforming Injection Molding Blow Molding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Frozen Food Manufacturers | 60 | Production Managers, Quality Assurance Heads |

| Retail Outlets Selling Frozen Foods | 50 | Store Managers, Category Buyers |

| Logistics Providers for Frozen Food | 40 | Logistics Coordinators, Supply Chain Analysts |

| Consumers of Frozen Food Products | 120 | Household Decision Makers, Health-Conscious Shoppers |

| Packaging Suppliers for Frozen Foods | 40 | Sales Managers, Product Development Specialists |

The Philippines Frozen Food Packaging Market is valued at approximately USD 1.25 billion, reflecting significant growth driven by increasing demand for convenience foods and rising disposable incomes among consumers.