Region:Middle East

Author(s):Shubham

Product Code:KRAB0730

Pages:90

Published On:August 2025

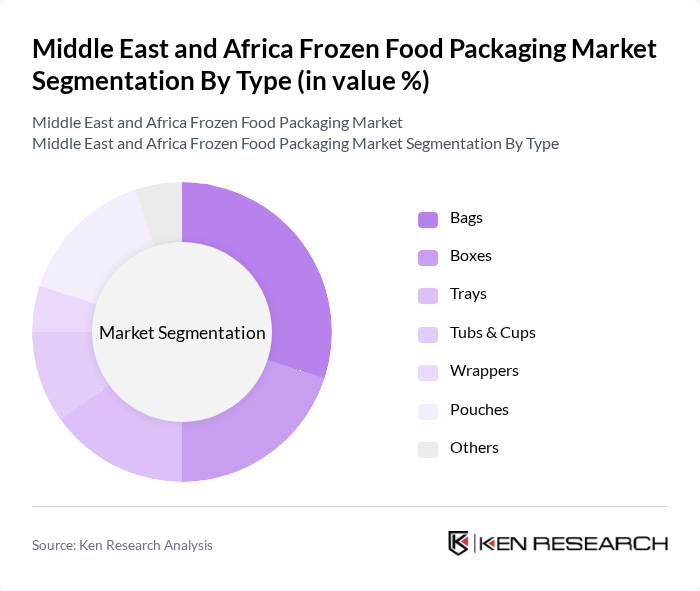

By Type:The frozen food packaging market is segmented into Bags, Boxes, Trays, Tubs & Cups, Wrappers, Pouches, and Others. Each packaging type is tailored for specific product protection, shelf life, and convenience requirements. Bags and Pouches are especially favored for their lightweight, cost-effectiveness, and ease of storage and transport, making them the preferred choice for both manufacturers and end consumers .

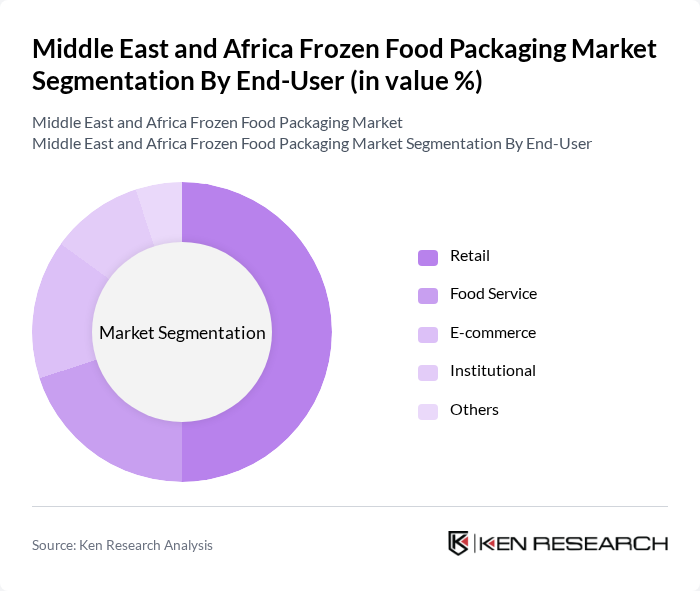

By End-User:The end-user segmentation comprises Retail, Food Service, E-commerce, Institutional, and Others. The retail sector leads due to the increasing consumer preference for frozen foods, driven by convenience and extended shelf life. E-commerce is rapidly gaining share as digital grocery platforms expand, while food service and institutional segments continue to adopt frozen food packaging for efficiency and food safety .

The Middle East and Africa Frozen Food Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Berry Global, Inc., Mondi Group, Sonoco Products Company, Smurfit Kappa Group, Huhtamaki Oyj, Constantia Flexibles, Winpak Ltd., Coveris Holdings S.A., Schur Flexibles Group, Clondalkin Group, ProAmpac LLC, Pactiv Evergreen Inc., Tetra Pak International S.A., Genpak LLC, Graham Packaging Company, and Ball Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the frozen food packaging market in the Middle East and Africa appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness rises, there is a growing demand for packaging that preserves nutritional value while being environmentally friendly. Additionally, the expansion of cold chain logistics is expected to enhance distribution efficiency, ensuring that frozen products reach consumers in optimal condition. These trends will likely shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bags Boxes Trays Tubs & Cups Wrappers Pouches Others |

| By End-User | Retail Food Service E-commerce Institutional Others |

| By Material | Plastic Paper Metal Glass Others |

| By Application | Ready Meals Fruits & Vegetables Meat & Seafood Baked Goods Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Direct Sales Others |

| By Region | GCC Countries North Africa Sub-Saharan Africa Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Frozen Food Manufacturers | 60 | Production Managers, Quality Assurance Leads |

| Packaging Suppliers | 50 | Sales Directors, Product Development Managers |

| Retail Chains | 70 | Category Managers, Supply Chain Coordinators |

| Logistics Providers | 40 | Operations Managers, Distribution Supervisors |

| Consumer Insights | 55 | Market Research Analysts, Consumer Behavior Specialists |

The Middle East and Africa Frozen Food Packaging Market is valued at approximately USD 5.5 billion, reflecting significant growth driven by increasing demand for convenience foods and the expansion of retail and e-commerce sectors.