Region:Global

Author(s):Shubham

Product Code:KRAA2631

Pages:82

Published On:August 2025

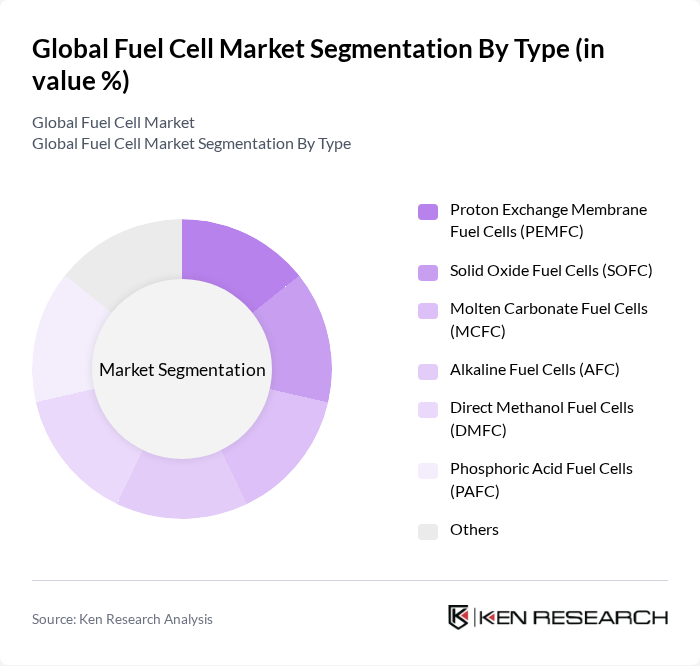

By Type:The fuel cell market is segmented into Proton Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), Molten Carbonate Fuel Cells (MCFC), Alkaline Fuel Cells (AFC), Direct Methanol Fuel Cells (DMFC), Phosphoric Acid Fuel Cells (PAFC), and Others. Each type offers distinct advantages: PEMFCs are widely used in transportation and portable applications due to their quick start-up and low operating temperature; SOFCs are favored for stationary power and industrial use for their high efficiency and fuel flexibility; MCFCs are applied in large-scale power generation; AFCs and DMFCs serve niche and portable markets; PAFCs are used in commercial and industrial stationary power; and other emerging types address specialized needs .

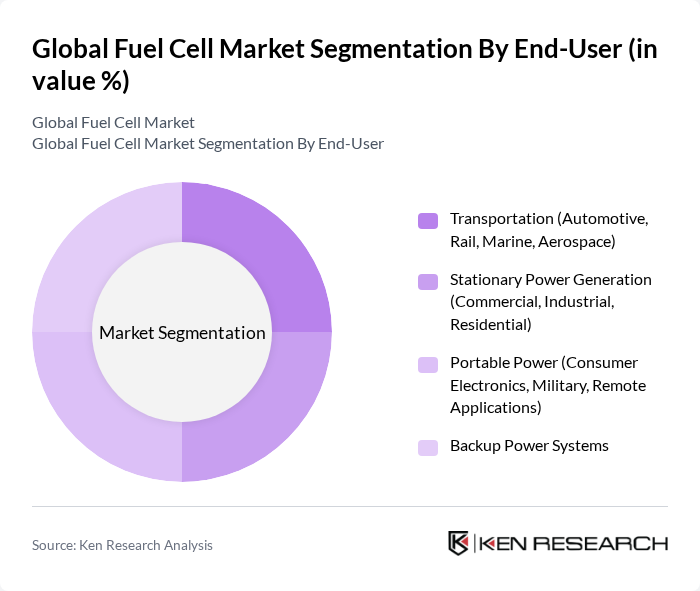

By End-User:The end-user segmentation includes Transportation (Automotive, Rail, Marine, Aerospace), Stationary Power Generation (Commercial, Industrial, Residential), Portable Power (Consumer Electronics, Military, Remote Applications), and Backup Power Systems. Transportation leads due to the rapid adoption of fuel cell electric vehicles (FCEVs) and public transit applications; stationary power generation is driven by demand for distributed energy and backup solutions; portable and backup power segments address specialized and remote energy needs .

The Global Fuel Cell Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ballard Power Systems Inc., Plug Power Inc., FuelCell Energy, Inc., Bloom Energy Corporation, Hydrogenics Corporation (a Cummins Inc. company), Doosan Fuel Cell Co., Ltd., Toshiba Energy Systems & Solutions Corporation, Siemens Energy AG, Cummins Inc., AFC Energy PLC, SFC Energy AG, PowerCell Sweden AB, ITM Power PLC, Nel ASA, Horizon Fuel Cell Technologies Pte Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fuel cell market appears promising, driven by increasing investments in research and development, which reached approximately $2 billion in future. Additionally, the growing adoption of hydrogen as a fuel source is expected to enhance market dynamics, with projections indicating a rise in hydrogen production to over 70 million tons in future. Collaborations among industry players are likely to foster innovation, while a focus on sustainability and carbon neutrality will further propel the market forward, creating a robust ecosystem for fuel cell technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Proton Exchange Membrane Fuel Cells (PEMFC) Solid Oxide Fuel Cells (SOFC) Molten Carbonate Fuel Cells (MCFC) Alkaline Fuel Cells (AFC) Direct Methanol Fuel Cells (DMFC) Phosphoric Acid Fuel Cells (PAFC) Others |

| By End-User | Transportation (Automotive, Rail, Marine, Aerospace) Stationary Power Generation (Commercial, Industrial, Residential) Portable Power (Consumer Electronics, Military, Remote Applications) Backup Power Systems |

| By Application | Automotive Aerospace Industrial Residential Data Centers |

| By Component | Fuel Cell Stack Balance of Plant (BoP) Power Conditioning System Fuel Processor |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies Tax Incentives Renewable Energy Certificates (RECs) |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Transportation Sector Fuel Cells | 100 | Fleet Managers, Automotive Engineers |

| Stationary Power Applications | 80 | Facility Managers, Energy Consultants |

| Portable Power Solutions | 50 | Product Managers, Technology Developers |

| Hydrogen Production and Supply | 60 | Supply Chain Managers, Hydrogen Production Engineers |

| Research and Development in Fuel Cells | 70 | R&D Directors, Innovation Managers |

The Global Fuel Cell Market is valued at approximately USD 10 billion, driven by the increasing demand for clean energy solutions, advancements in fuel cell technology, and supportive government policies promoting hydrogen adoption and decarbonization.