Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8208

Pages:96

Published On:November 2025

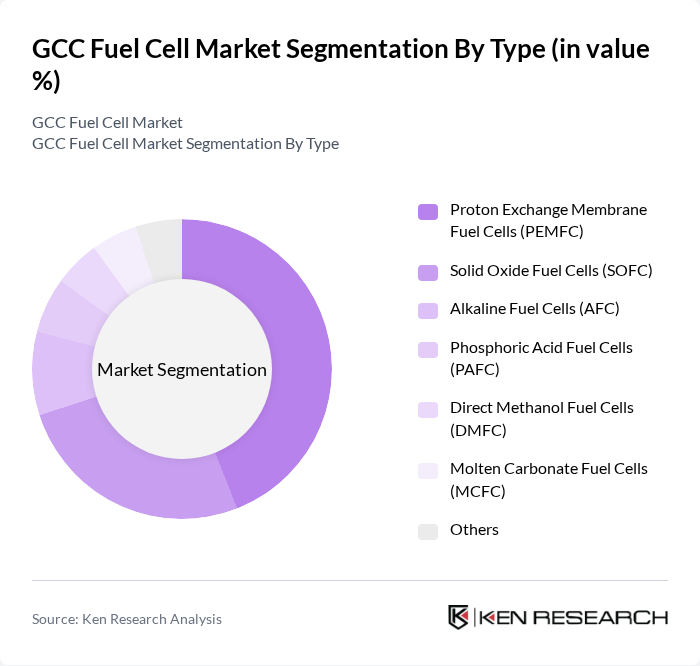

By Type:The fuel cell market can be segmented into various types, including Proton Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), Alkaline Fuel Cells (AFC), Phosphoric Acid Fuel Cells (PAFC), Direct Methanol Fuel Cells (DMFC), Molten Carbonate Fuel Cells (MCFC), and Others. Among these,PEMFCsare leading the market due to their high efficiency and suitability for transportation applications, particularly in vehicles and portable power systems. The growing demand for clean energy solutions in urban areas is further propelling the adoption of PEMFC technology.

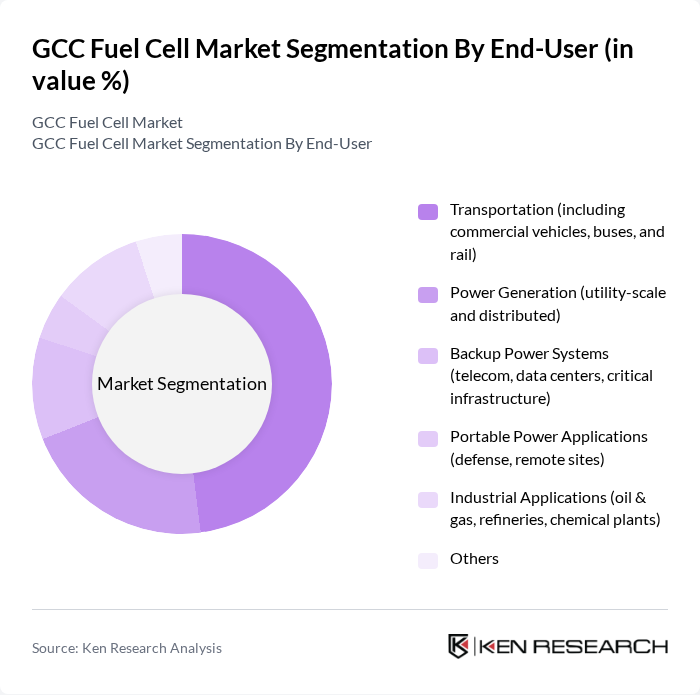

By End-User:The end-user segmentation of the fuel cell market includes Transportation (including commercial vehicles, buses, and rail), Power Generation (utility-scale and distributed), Backup Power Systems (telecom, data centers, critical infrastructure), Portable Power Applications (defense, remote sites), Industrial Applications (oil & gas, refineries, chemical plants), and Others. Thetransportation sectoris currently the dominant end-user, driven by the increasing adoption of fuel cell electric vehicles (FCEVs) and government incentives aimed at reducing emissions from the transport sector.

The GCC Fuel Cell Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ballard Power Systems, Plug Power Inc., FuelCell Energy, Inc., Siemens Energy AG, Toshiba Energy Systems & Solutions Corporation, Hyundai Motor Company, Panasonic Corporation, Bloom Energy Corporation, Ceres Power Holdings plc, AFC Energy PLC, ITM Power PLC, Nel ASA, SFC Energy AG, PowerCell Sweden AB, Hydrogenics Corporation, Saudi Aramco, NEOM Green Hydrogen Company, ACWA Power, Masdar (Abu Dhabi Future Energy Company), Air Products & Chemicals, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC fuel cell market appears promising, driven by increasing investments in clean energy and technological advancements. In future, the region is expected to see a surge in fuel cell applications, particularly in transportation and energy storage. The collaboration between governments and private sectors will likely enhance infrastructure development, facilitating the growth of hydrogen production and distribution networks. As regulatory frameworks evolve, the market is poised for significant expansion, aligning with global sustainability goals and energy transition strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Proton Exchange Membrane Fuel Cells (PEMFC) Solid Oxide Fuel Cells (SOFC) Alkaline Fuel Cells (AFC) Phosphoric Acid Fuel Cells (PAFC) Direct Methanol Fuel Cells (DMFC) Molten Carbonate Fuel Cells (MCFC) Others |

| By End-User | Transportation (including commercial vehicles, buses, and rail) Power Generation (utility-scale and distributed) Backup Power Systems (telecom, data centers, critical infrastructure) Portable Power Applications (defense, remote sites) Industrial Applications (oil & gas, refineries, chemical plants) Others |

| By Application | Automotive (passenger vehicles, commercial fleets) Stationary Power (residential, commercial, industrial) Portable Devices (electronics, field equipment) Industrial Applications (process power, CHP) Marine & Aviation Others |

| By Fuel Source | Hydrogen Natural Gas Methanol Biogas Ammonia Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Investment Source | Private Investments Government Funding International Grants Public-Private Partnerships (PPP) Sovereign Wealth Funds Others |

| By Policy Support | Subsidies Tax Incentives Research Grants Regulatory Support National Hydrogen Strategies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Transportation Sector Fuel Cell Applications | 100 | Fleet Managers, Transportation Planners |

| Stationary Power Generation | 80 | Energy Managers, Facility Operations Directors |

| Portable Power Solutions | 60 | Product Development Engineers, R&D Managers |

| Government Policy and Regulation | 50 | Policy Makers, Regulatory Affairs Specialists |

| Research and Development in Fuel Cell Technology | 70 | Academic Researchers, Industry Analysts |

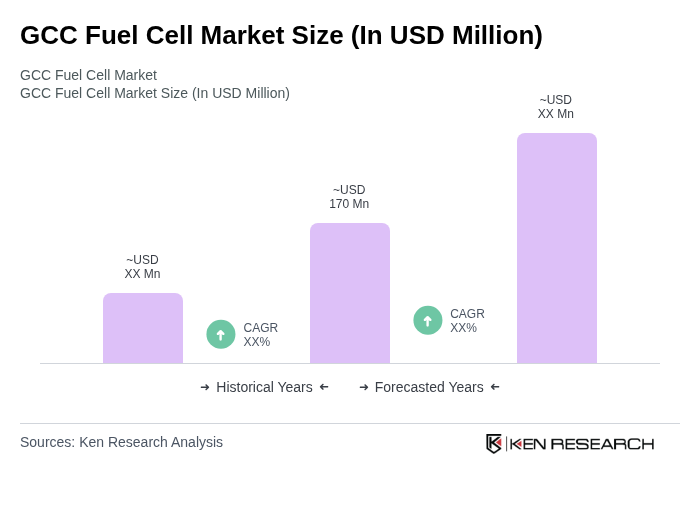

The GCC Fuel Cell Market is valued at approximately USD 170 million, driven by investments in renewable energy, government initiatives for clean technologies, and the rising demand for sustainable energy solutions across various sectors.