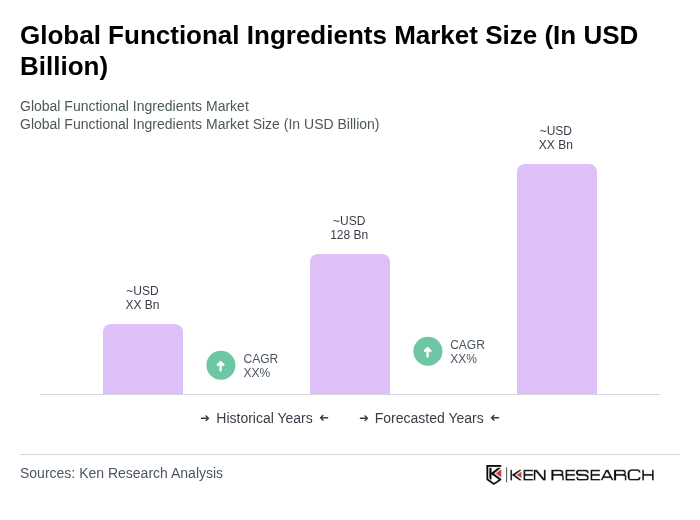

Global Functional Ingredients Market Overview

- The Global Functional Ingredients Market is valued at USD 128 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding health and wellness, a rising demand for fortified foods and dietary supplements, and the proliferation of clean label products that emphasize transparency and natural ingredients. Additional growth drivers include a surge in demand for immunity-boosting and gut-health-supporting ingredients, the adoption of preventative healthcare lifestyles, and ongoing product innovation in the food and beverage sector .

- Key players in this market include the United States, Germany, and China. The United States dominates due to its advanced food processing industry and high consumer spending on health products. Germany is recognized for its innovation and stringent quality standards, while China’s rapidly growing middle class is increasingly investing in health and wellness products. North America remains the largest regional market, with the United States holding the highest revenue share, driven by escalating healthcare expenditure and a strong focus on preventive nutrition .

- The Novel Food Regulation (Regulation (EU) 2015/2283), issued by the European Parliament and Council in 2015, governs the approval and safety assessment of novel food ingredients in the European Union. This regulation requires that any functional ingredient not consumed in the EU before May 1997 undergo a comprehensive safety evaluation by the European Food Safety Authority (EFSA) prior to market entry, ensuring consumer protection and fostering innovation .

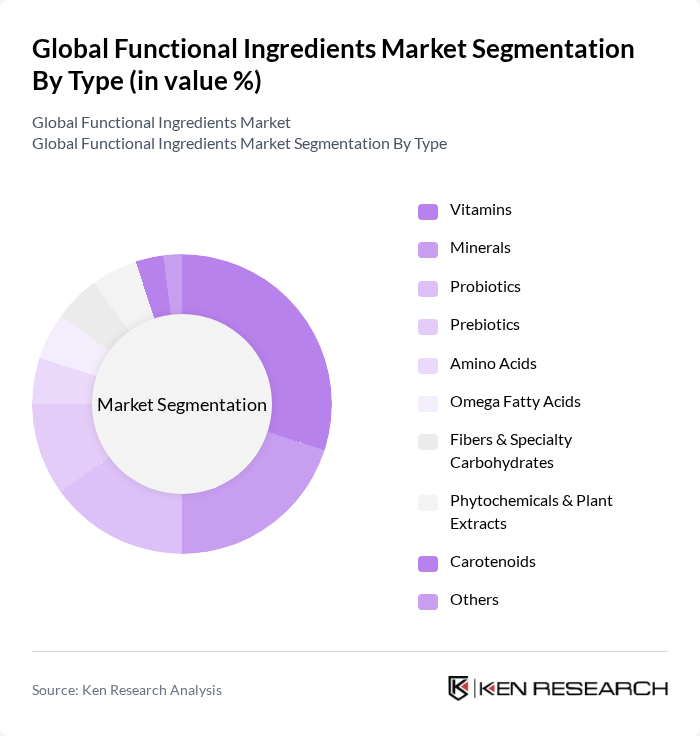

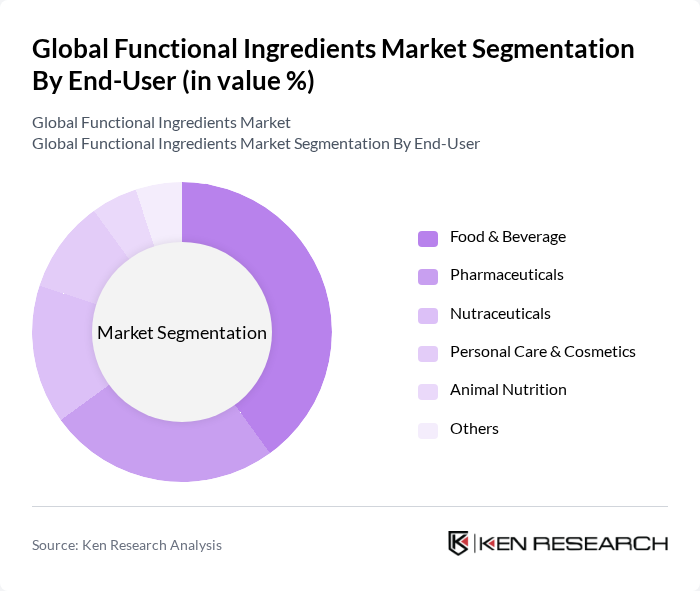

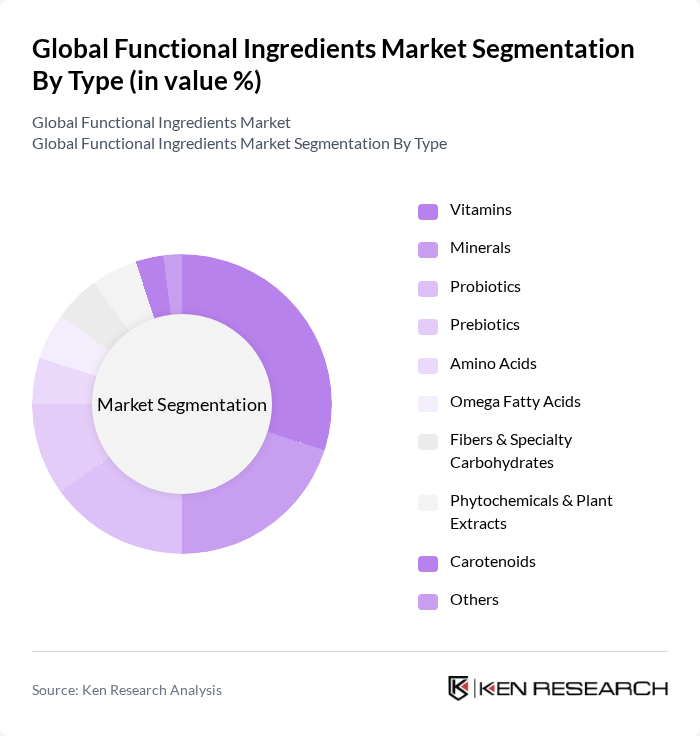

Global Functional Ingredients Market Segmentation

By Type:This segmentation includes various functional ingredients that cater to different health needs and preferences. The subsegments are Vitamins, Minerals, Probiotics, Prebiotics, Amino Acids, Omega Fatty Acids, Fibers & Specialty Carbohydrates, Phytochemicals & Plant Extracts, Carotenoids, and Others. Among these, Vitamins and Probiotics are particularly dominant due to their widespread use in dietary supplements and functional foods, driven by increasing health consciousness and the growing focus on digestive and immune health. Probiotics, in particular, are forecast to account for a significant share of the market, reflecting consumer demand for gut-health-supporting products .

By End-User:This segmentation encompasses various industries that utilize functional ingredients, including Food & Beverage, Pharmaceuticals, Nutraceuticals, Personal Care & Cosmetics, Animal Nutrition, and Others. The Food & Beverage sector is the largest consumer of functional ingredients, driven by the increasing demand for health-oriented products, clean label trends, and the shift toward healthier eating habits. The sector’s dominance is reinforced by ongoing product launches and reformulations targeting digestive health, immunity, and weight management .

Global Functional Ingredients Market Competitive Landscape

The Global Functional Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Kerry Group plc, DSM Nutritional Products, Tate & Lyle PLC, Ginkgo Bioworks, Inc., Chr. Hansen Holding A/S, Naturex S.A. (Givaudan SA), Symrise AG, Emsland Group, BioCare Copenhagen A/S, Fonterra Co-operative Group Limited, Lonza Group Ltd, Novozymes A/S, Ingredion Incorporated, Kerry Group plc, NutriLeads B.V. contribute to innovation, geographic expansion, and service delivery in this space.

Global Functional Ingredients Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The global health and wellness market is projected to reach $4.24 trillion in future, driven by a growing awareness of health issues. In future, the demand for functional ingredients is expected to rise as consumers increasingly seek products that promote health benefits, such as immunity and digestive health. This trend is supported by the World Health Organization's report indicating that 60% of consumers are prioritizing health in their purchasing decisions, leading to a surge in functional ingredient utilization.

- Rising Demand for Natural Ingredients:The global natural food market is anticipated to reach $1 trillion in future, reflecting a significant shift towards clean-label products. According to a recent survey, 70% of consumers prefer products with natural ingredients, which is driving manufacturers to innovate and incorporate functional ingredients derived from natural sources. This trend is further supported by the increasing availability of organic raw materials, with the organic food market growing at a rate of 8% annually, enhancing the appeal of functional ingredients.

- Growth in Functional Foods and Beverages:The functional foods and beverages sector is projected to reach $275 billion in future, fueled by consumer demand for products that offer health benefits beyond basic nutrition. The increasing prevalence of lifestyle diseases, such as obesity and diabetes, has led to a 15% rise in the consumption of functional foods over the past three years. This growth is supported by the International Food Information Council, which reports that 80% of consumers are actively seeking functional food options, driving market expansion.

Market Challenges

- Stringent Regulatory Frameworks:The functional ingredients market faces significant challenges due to stringent regulations imposed by authorities such as the FDA and EFSA. Compliance with food safety standards and labeling requirements can increase operational costs by up to 20%. In future, companies must navigate complex regulatory landscapes, which can hinder innovation and slow down product launches, impacting overall market growth and competitiveness.

- High Production Costs:The production of functional ingredients often involves advanced technologies and high-quality raw materials, leading to elevated costs. In future, production costs are expected to rise by approximately 10% due to inflation and supply chain disruptions. This financial burden can limit the ability of smaller companies to compete, resulting in market consolidation and reduced diversity in product offerings, ultimately affecting consumer choice.

Global Functional Ingredients Market Future Outlook

The future of the functional ingredients market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, companies are likely to invest in research and development to create innovative products that cater to specific health needs. Additionally, the integration of technology in ingredient sourcing and processing will enhance efficiency and sustainability, positioning the market for robust growth in the coming years, particularly in emerging economies where demand is surging.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for functional ingredients. With a combined population of over 4 billion, these regions are witnessing a rapid increase in disposable income, leading to higher spending on health-oriented products. This trend is expected to drive demand for functional ingredients, creating a lucrative market for manufacturers.

- Innovations in Product Development:The ongoing trend towards personalization in food and beverage products offers a unique opportunity for innovation. Companies can leverage advancements in technology to develop tailored functional ingredients that meet specific consumer needs. This approach not only enhances customer satisfaction but also fosters brand loyalty, positioning businesses to capitalize on the growing demand for customized health solutions.