Region:Global

Author(s):Shubham

Product Code:KRAD0610

Pages:90

Published On:August 2025

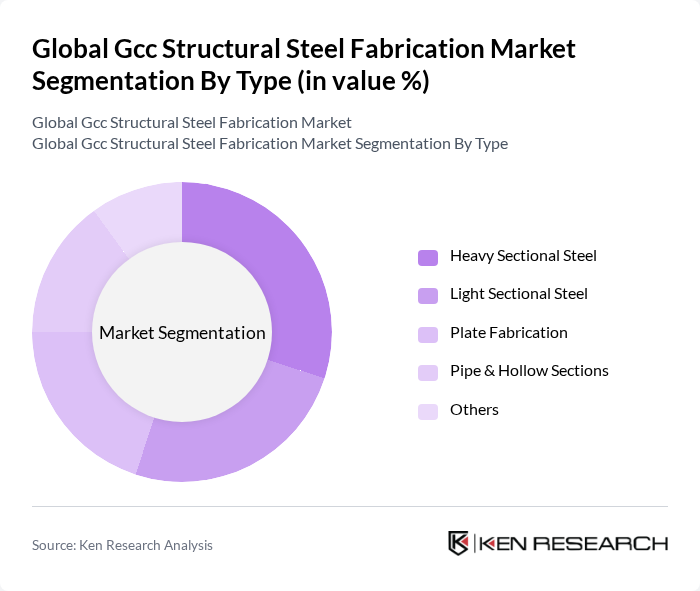

By Type:

The heavy sectional steel segment is currently dominating the market due to its extensive use in large-scale construction projects, including high-rise buildings and industrial facilities. The demand for heavy steel sections is driven by their strength and durability, making them ideal for structural applications. Additionally, the ongoing urbanization and infrastructure development in the GCC region have further propelled the need for heavy sectional steel, as it is essential for supporting significant loads and ensuring structural integrity .

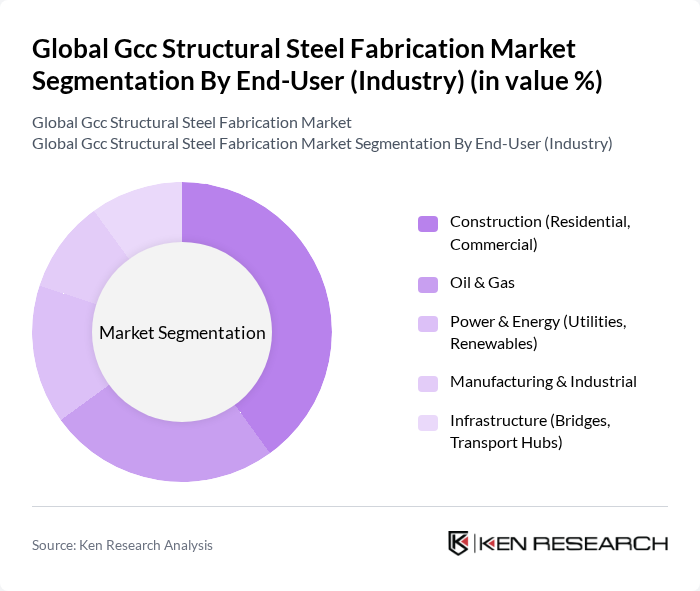

By End-User (Industry):

The construction sector, encompassing both residential and commercial projects, is the leading end-user of structural steel fabrication. This dominance is attributed to the rapid urbanization and population growth in the GCC region, which has led to a surge in construction activities. The demand for high-quality structural steel in building frameworks, facades, and other applications is driving the growth of this segment. Additionally, government initiatives to enhance infrastructure and housing projects further solidify the construction industry's position as the primary consumer of fabricated steel .

The Global GCC Structural Steel Fabrication Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arabian International Company for Steel Structures (AIC Steel), Al Yamamah Steel Industries Co., Zamil Steel, Hidada Ltd. Company, Mabani Steel LLC, Eversendai Engineering LLC (UAE), Rasana Steel (Rasana Steel Fabrication LLC), Al Shahin Company for Metal Industries, Emirates Building Systems Co. LLC, Emirates Steel Arkan, Techno Steel Construction LLC, Standard Steel Fabrication Co. LLC, Intermass Engineering & Contracting Co. LLC, Metal Services & Coating Company (METSCCO), United Iron & Steel Company LLC contribute to innovation, geographic expansion, and service delivery in this space .

Additional validated insights and recent trends:

The future of the structural steel fabrication market in the GCC region appears promising, driven by ongoing infrastructure investments and a shift towards sustainable construction practices. As governments prioritize eco-friendly initiatives, the demand for innovative fabrication solutions is expected to rise. Additionally, advancements in automation and digital technologies will likely enhance operational efficiency, enabling companies to meet the evolving needs of the construction industry. Overall, the market is poised for growth, supported by favorable economic conditions and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy Sectional Steel Light Sectional Steel Plate Fabrication Pipe & Hollow Sections Others |

| By End-User (Industry) | Construction (Residential, Commercial) Oil & Gas Power & Energy (Utilities, Renewables) Manufacturing & Industrial Infrastructure (Bridges, Transport Hubs) |

| By Application | Buildings (Low/Mid/High-Rise) Industrial Plants Offshore & Onshore Structures Transportation Infrastructure (Bridges, Terminals) |

| By Sales Channel | Direct Contracts (EPC/Main Contractors) Distributors/Stockists Online/Tender Portals |

| By Material Type | Carbon Steel Alloy Steel Stainless Steel |

| By Country (GCC) | Saudi Arabia United Arab Emirates Qatar Oman Kuwait Bahrain |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Construction Projects | 140 | Project Managers, Architects |

| Residential Building Fabrication | 100 | Construction Supervisors, Home Builders |

| Industrial Steel Structures | 80 | Operations Managers, Facility Engineers |

| Infrastructure Development | 120 | Government Officials, Urban Planners |

| Steel Supply Chain Management | 90 | Procurement Managers, Supply Chain Analysts |

The Global GCC Structural Steel Fabrication Market is valued at approximately USD 10 billion, driven by significant investments in infrastructure development and urbanization across the GCC region, particularly in Saudi Arabia and the UAE.