Region:Middle East

Author(s):Shubham

Product Code:KRAD0598

Pages:100

Published On:August 2025

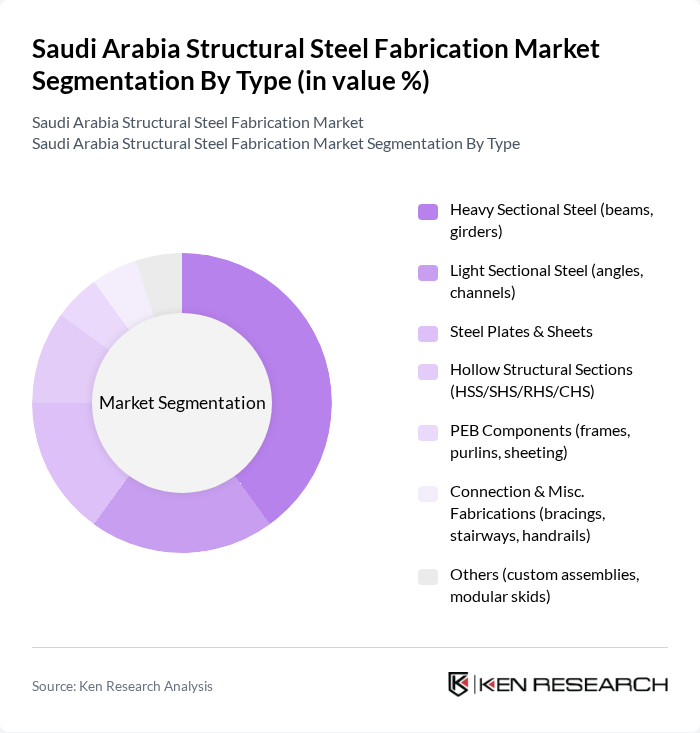

By Type:The market is segmented into various types of structural steel products, including Heavy Sectional Steel, Light Sectional Steel, Steel Plates & Sheets, Hollow Structural Sections, PEB Components, Connection & Misc. Fabrications, and Others. Among these, Heavy Sectional Steel, which includes beams and girders, is the leading sub-segment due to its extensive use in large-scale construction projects such as bridges and high-rise buildings. The demand for Heavy Sectional Steel is driven by its strength and durability, and by its suitability for prefabrication and modular erection methods that are increasingly used on mega-projects.

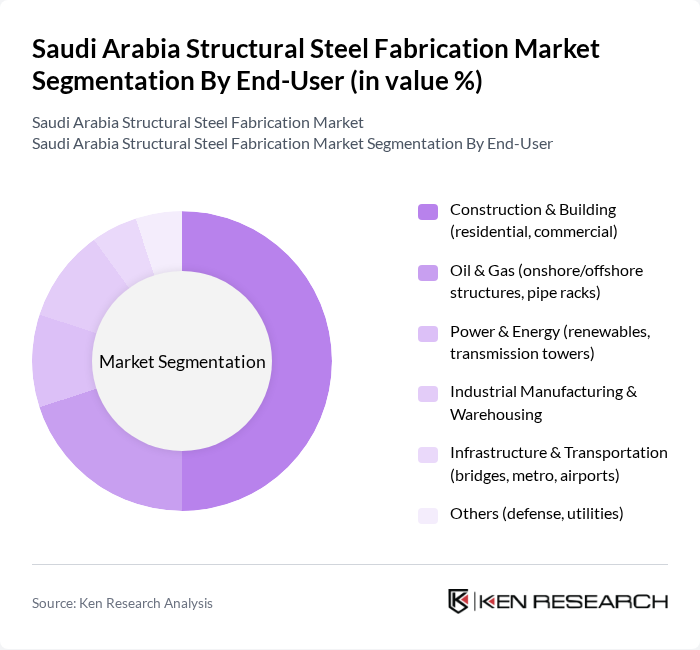

By End-User:The end-user segments include Construction & Building, Oil & Gas, Power & Energy, Industrial Manufacturing & Warehousing, Infrastructure & Transportation, and Others. The Construction & Building sector is the dominant end-user, driven by ongoing urban development and tourism-led projects, housing and commercial demand, and large mixed-use precincts. Expanding transport, utilities, and industrial programs (including energy and logistics platforms under Vision 2030) further bolster structural steel demand.

The Saudi Arabia Structural Steel Fabrication Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zamil Steel (Saudi Arabia), Gulf Specialized Works Co., Attieh Steel (Attieh Steel Company), Al Rajhi Steel, Saudi Steel Pipe Company (Tenaris Saudi Steel Pipes), Arabian International Company for Steel Structures (AIC Steel), Saudi Steel Profile Company (SSP), Al-Jazira Steel Products Co., Al-Babtain Power & Telecommunications Co., Saudi Arabian Saipem Ltd. (fabrication yard operations), National Petroleum Construction Company Saudi (NPCC Saudi), NESMA & Partners – Steel Fabrication (Nesma Group), Rashed Abdul Rahman Al Rashed & Sons – United Gulf Steel (UGS), Al Fanar Steel (Alfanar Company), Al-Osais Group – Zahran Al-Osais Steel Fabrication contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia structural steel fabrication market appears promising, driven by ongoing investments in infrastructure and construction. As the government continues to prioritize mega-projects and urban development, the demand for fabricated steel is expected to rise significantly. Additionally, advancements in technology and automation will likely enhance production efficiency, allowing local fabricators to compete effectively against imports. The market is poised for growth, with a focus on sustainability and innovation shaping its trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy Sectional Steel (beams, girders) Light Sectional Steel (angles, channels) Steel Plates & Sheets Hollow Structural Sections (HSS/SHS/RHS/CHS) PEB Components (frames, purlins, sheeting) Connection & Misc. Fabrications (bracings, stairways, handrails) Others (custom assemblies, modular skids) |

| By End-User | Construction & Building (residential, commercial) Oil & Gas (onshore/offshore structures, pipe racks) Power & Energy (renewables, transmission towers) Industrial Manufacturing & Warehousing Infrastructure & Transportation (bridges, metro, airports) Others (defense, utilities) |

| By Application | Buildings Superstructure (frames, columns, trusses) Pre-Engineered Buildings (PEB) & Steel Sheds Industrial Plants & Process Structures Bridges & Heavy Infrastructure Transmission & Telecom Towers |

| By Distribution Channel | Direct EPC/Developer Contracts Fabricator/System Integrator Partnerships Distributors/Stockists Online/Tender Portals Others |

| By Material Source | Domestic Mills & Service Centers Imported Mill Steel Recycled/Secondary Steel Others |

| By Price Range | Project/Turnkey (EPC) Pricing Fabrication-Only (job work) Pricing Component/Per-Tonne Pricing |

| By Quality Standard | SASO/ISO-Compliant Standard Quality High-Strength/Alloy Grades (e.g., S355, S460) Specialty/Certified (offshore, seismic, fire-rated) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Construction Projects | 100 | Project Managers, Construction Supervisors |

| Residential Building Fabrication | 80 | Architects, Structural Engineers |

| Infrastructure Development | 90 | Government Officials, Urban Planners |

| Industrial Steel Fabrication | 70 | Procurement Managers, Operations Directors |

| Steel Supply Chain Management | 60 | Logistics Coordinators, Supply Chain Analysts |

The Saudi Arabia Structural Steel Fabrication Market is valued at approximately USD 3.4 billion, driven by significant investments in construction and infrastructure projects under Vision 2030, including mega-projects like NEOM and the Red Sea Project.