Global Genomics Data Analysis Market Overview

- The Global Genomics Data Analysis Market is valued at USD 1.3 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in next-generation sequencing technologies, increasing adoption of precision oncology and personalized medicine approaches, and the rising prevalence of genetic disorders requiring sophisticated diagnostic solutions. The demand for genomic data analysis services has surged as healthcare providers, biopharmaceutical companies, and research institutions seek to leverage genomic information through advanced bioinformatics platforms and AI-powered analytical tools for better patient outcomes and innovative treatments. Strategic collaborations between technology organizations, drug developers, and cloud computing companies are expanding analytical capacity and facilitating secure data sharing across the healthcare ecosystem.

- Key players in this market include the United States, Germany, and China, which dominate due to their robust healthcare infrastructure, significant investments in research and development, and a high concentration of leading biotechnology firms. The presence of advanced genomic research facilities and a favorable regulatory environment further enhance their competitive edge in the global market. North America particularly holds substantial market share, driven by extensive funding initiatives such as the National Institutes of Health's USD 5.4 million investment in integrating genomics into learning health systems and increasing adoption of population genomics programs.

- The NIH Genomic Data Sharing Policy, implemented in 2015 and updated periodically through subsequent guidance documents issued by the National Institutes of Health, mandates that genomic data generated from NIH-funded research be shared through designated repositories such as dbGaP (database of Genotypes and Phenotypes). This policy requires investigators to submit an Institutional Certification confirming appropriate consent for data sharing, with specific timelines for data submission (typically within six months of final dataset assembly or publication). The policy covers all large-scale human and non-human genomic data, establishing clear operational requirements for data access committees, data use limitations, and security protocols to balance scientific collaboration with privacy protection, ultimately accelerating genomic discoveries while maintaining ethical standards for participant confidentiality.

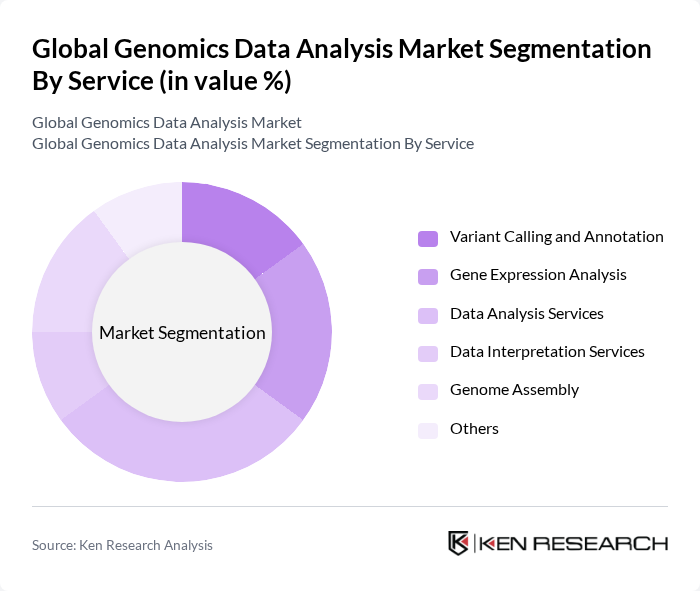

Global Genomics Data Analysis Market Segmentation

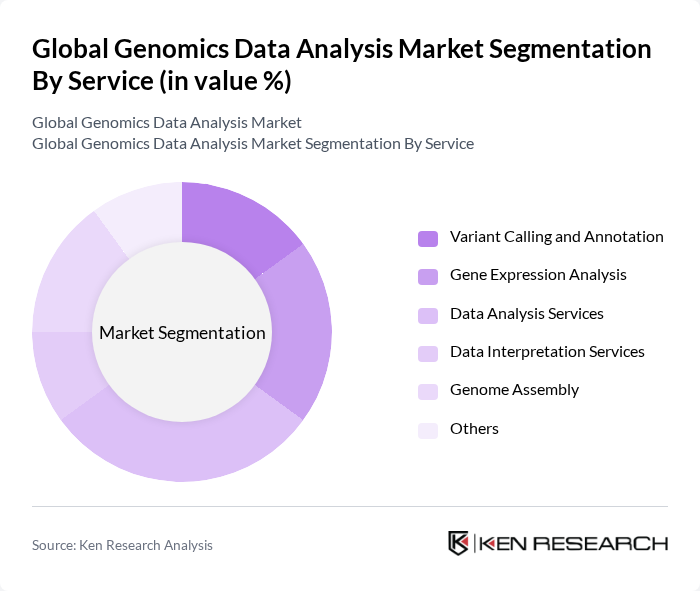

By Service:The service segment includes various offerings such as variant calling and annotation, gene expression analysis, data analysis services, data interpretation services, genome assembly, and others. Among these, data analysis services are currently dominating the market due to the increasing complexity of genomic data and the need for specialized expertise in interpreting results. The demand for these services is driven by the growing number of research projects, clinical applications requiring comprehensive data analysis, and the integration of machine learning algorithms into bioinformatics pipelines to derive meaningful insights from raw sequencing data. Cloud-based analytical workflows are increasingly adopted to handle large-scale datasets efficiently while maintaining regulatory compliance.

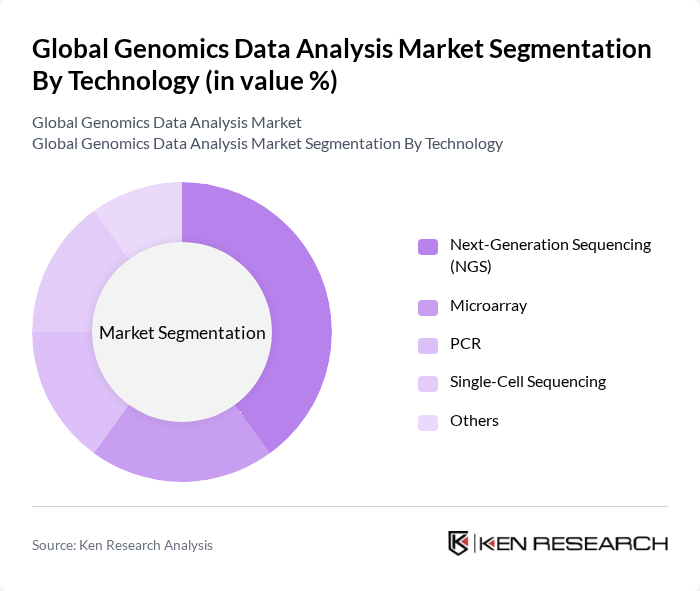

By Technology:The technology segment encompasses various methodologies such as next-generation sequencing (NGS), microarray, PCR, single-cell sequencing, and others. Next-generation sequencing (NGS) is the leading technology in the market, primarily due to its high throughput, cost-effectiveness, and ability to generate vast amounts of data quickly. The increasing adoption of NGS in clinical diagnostics, precision oncology, pharmacogenomics, and rare genetic disorder identification is driving its dominance, as it enables comprehensive genomic profiling and personalized treatment strategies. Continuous innovations in sequencing chemistry, data processing algorithms, and integrated multi-omics analytics further enhance the reliability and efficiency of genomic data interpretation.

Global Genomics Data Analysis Market Competitive Landscape

The Global Genomics Data Analysis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN N.V., BGI Genomics Co., Ltd., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd. (Roche Sequencing Solutions), Bio-Rad Laboratories, Inc., Eurofins Scientific SE (Eurofins Genomics), Oxford Nanopore Technologies Ltd., 10x Genomics, Inc., PerkinElmer, Inc., CD Genomics, Charles River Laboratories International, Inc., Fios Genomics Ltd., Basepair Technologies, Inc., Golden Helix, Inc., CellCarta (Nexcelom Bioscience) contribute to innovation, geographic expansion, and service delivery in this space.

Global Genomics Data Analysis Market Industry Analysis

Growth Drivers

- Increasing Demand for Personalized Medicine:The global personalized medicine market is projected to reach $2.4 trillion in future, driven by advancements in genomics. This surge is fueled by the growing recognition of tailored therapies that improve patient outcomes. In future, the U.S. spent approximately $4.3 trillion on healthcare, with a significant portion allocated to genomic research and personalized treatments, highlighting the increasing demand for genomic data analysis in developing customized healthcare solutions.

- Advancements in Sequencing Technologies:The cost of whole-genome sequencing has plummeted from around $100 million in 2001 to approximately $1,000 in future. This dramatic reduction has made genomic analysis more accessible, leading to a surge in research and clinical applications. In future, the global market for sequencing technologies is expected to exceed $10.5 billion, reflecting the critical role of these advancements in driving the demand for genomics data analysis services across various sectors.

- Rising Prevalence of Genetic Disorders:The World Health Organization reported that genetic disorders affect approximately 1 in 17 individuals globally, translating to over 580 million people. This rising prevalence has intensified the need for genomic data analysis to identify, diagnose, and treat these conditions effectively. In future, healthcare systems are expected to allocate an estimated $50 billion towards genetic disorder management, further propelling the demand for genomic analysis services and technologies.

Market Challenges

- High Costs of Genomic Data Analysis:The initial investment for genomic data analysis infrastructure can exceed $1 million, posing a significant barrier for many institutions. Additionally, ongoing operational costs, including data storage and processing, can reach up to $500,000 annually. These financial constraints hinder the ability of smaller organizations to adopt advanced genomic technologies, limiting overall market growth and accessibility to genomic insights.

- Data Privacy and Security Concerns:With the increasing volume of genomic data, concerns regarding data privacy and security have escalated. In future, over 60% of healthcare organizations reported data breaches, leading to significant financial losses averaging $4.4 million per incident. Regulatory compliance, such as GDPR, adds complexity and costs, making it challenging for companies to navigate the legal landscape while ensuring the protection of sensitive genomic information.

Global Genomics Data Analysis Market Future Outlook

The future of the genomics data analysis market appears promising, driven by technological advancements and increasing integration with artificial intelligence. As organizations continue to invest in genomic research, the demand for sophisticated data analysis tools will rise. Furthermore, the collaboration between academic institutions and industry players is expected to foster innovation, leading to new applications in personalized medicine and agriculture, ultimately enhancing the overall efficiency and effectiveness of genomic data utilization.

Market Opportunities

- Expansion of Cloud-Based Genomic Services:The global cloud computing market is projected to reach $1.6 trillion in future, providing a significant opportunity for genomic data analysis services. Cloud-based solutions offer scalable storage and processing capabilities, enabling researchers to analyze vast datasets efficiently. This shift is expected to enhance collaboration and accessibility, driving innovation in genomic research and applications.

- Development of AI-Driven Analytics Tools:The AI analytics market is anticipated to grow to $190 billion in future, presenting a substantial opportunity for integrating AI with genomic data analysis. AI-driven tools can enhance data interpretation, leading to faster and more accurate insights. This technological synergy is expected to revolutionize personalized medicine and genetic research, making genomic analysis more efficient and impactful.