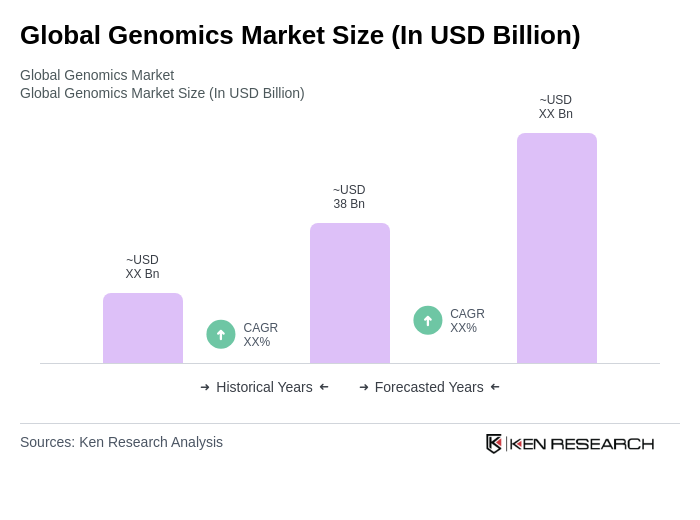

Global Genomics Market Overview

- The Global Genomics Market is valued at USD 38 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in sequencing technologies, declining sequencing costs, increased funding for genomic research, and the rising prevalence of chronic and genetic disorders. The integration of genomics in personalized medicine, drug development, and diagnostics has further accelerated market expansion, as healthcare providers increasingly adopt genomic solutions for improved patient outcomes. Recent trends also highlight the growing impact of consumer genomics and the expansion of applications in oncology and rare disease research .

- Key players in this market includethe United States, Germany, and China, which dominate due to their robust healthcare infrastructure, significant investments in research and development, and a high concentration of leading genomics companies. The presence of advanced laboratories, major pharmaceutical firms, and research institutions in these countries fosters innovation and accelerates the adoption of genomic technologies. North America holds the largest market share, supported by strong government and private sector funding, while Europe and Asia Pacific are witnessing rapid growth driven by expanding research capabilities and increasing healthcare spending .

- In 2023, the U.S. government implemented theGenomic Data Sharing Policy(National Institutes of Health, 2023), which mandates that all genomic data generated from federally funded research must be shared publicly. This regulation, issued by the National Institutes of Health, aims to enhance collaboration among researchers, improve data accessibility, and accelerate advancements in genomics, ultimately benefiting public health and scientific discovery. The policy covers data sharing requirements, compliance thresholds, and operational standards for research institutions receiving federal funding .

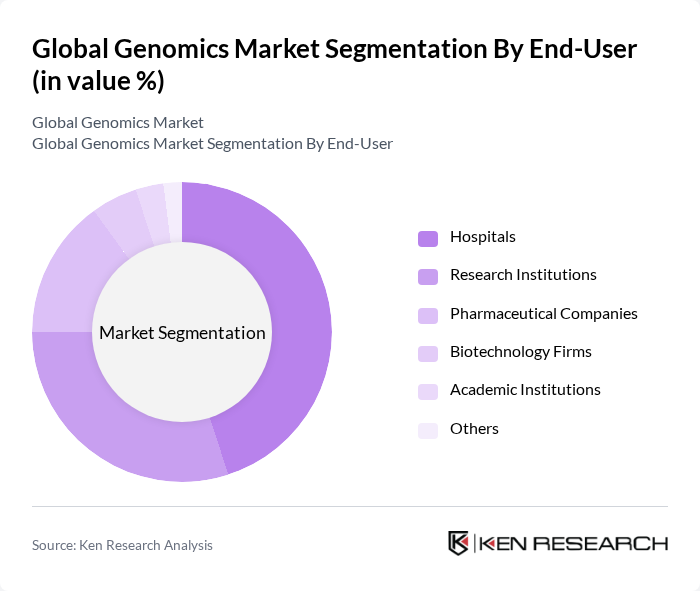

Global Genomics Market Segmentation

By Type:The market is segmented into various types, including DNA Sequencing, RNA Sequencing, Whole Genome Sequencing, Targeted Sequencing, Epigenomics, Genotyping, and Others. Among these,DNA Sequencingremains the most dominant segment due to its widespread application in research, clinical diagnostics, and personalized medicine. The increasing demand for precision therapies, rapid advancements in next-generation sequencing (NGS) platforms, and the utility of DNA sequencing in oncology and rare disease diagnostics have significantly contributed to the growth of this segment.RNA Sequencingis also gaining traction, particularly in transcriptomics and gene expression analysis, as researchers seek to understand cellular mechanisms and disease pathways .

By End-User:The end-user segmentation includes Hospitals, Research Institutions, Pharmaceutical Companies, Biotechnology Firms, Academic Institutions, and Others.Hospitalsare the leading end-user segment, driven by the increasing adoption of genomic testing for diagnostics, personalized treatment plans, and integration into routine clinical workflows. Research institutions also play a significant role, as they are at the forefront of genomic research, technology development, and innovation, contributing to advancements in disease understanding and therapeutic discovery. Pharmaceutical and biotechnology companies are expanding their use of genomics in drug development and biomarker discovery .

Global Genomics Market Competitive Landscape

The Global Genomics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., BGI Genomics Co., Ltd., Roche Holding AG, Agilent Technologies, Inc., QIAGEN N.V., Pacific Biosciences of California, Inc., Bio-Rad Laboratories, Inc., PerkinElmer, Inc., 10x Genomics, Inc., Genomatix Software GmbH, Oxford Nanopore Technologies Ltd., Myriad Genetics, Inc., Eppendorf AG, Zymo Research Corporation, Eurofins Scientific SE, Danaher Corporation, GE Healthcare, Macrogen, Inc., NVIDIA Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Global Genomics Market Industry Analysis

Growth Drivers

- Increasing Demand for Personalized Medicine:The global personalized medicine market is projected to reach $2.4 trillion, driven by advancements in genomics. This surge is fueled by the growing recognition of tailored therapies that improve patient outcomes. In future, approximately 70% of new drug approvals were linked to genomic data, highlighting the critical role of genomics in developing targeted treatments. The increasing prevalence of chronic diseases further propels this demand, as personalized approaches are essential for effective management.

- Advancements in Sequencing Technologies:The cost of whole-genome sequencing has plummeted from $100 million in the early 2000s to approximately $1,000, making genomic analysis more accessible. This dramatic reduction has led to a significant increase in sequencing capacity over the past five years. Enhanced technologies, such as next-generation sequencing (NGS), are enabling rapid and accurate genomic analysis, which is crucial for research and clinical applications. As a result, the adoption of these technologies is expected to continue growing significantly in future.

- Rising Investments in Genomic Research:Global investments in genomic research reached approximately $20 billion, reflecting a notable increase from previous periods. This growth is driven by both public and private sectors, with notable funding from initiatives like the National Institutes of Health (NIH) and various biotech firms. The focus on genomics is further supported by the increasing number of clinical trials utilizing genomic data, which rose to over 5,000, indicating a robust commitment to advancing genomic science and its applications.

Market Challenges

- High Costs of Genomic Testing:Despite advancements, the average cost of comprehensive genomic testing remains around $1,500 to $2,000, which can be prohibitive for many patients. This financial barrier limits access to essential genomic services, particularly in low-income populations. Additionally, insurance coverage for genomic testing varies significantly, with only about 50% of plans offering comprehensive coverage. This inconsistency creates disparities in access to genomic healthcare, hindering overall market growth and patient outcomes.

- Data Privacy Concerns:The increasing volume of genomic data raises significant privacy issues, with a substantial proportion of consumers expressing concerns about how their genetic information is used. Regulatory frameworks like GDPR impose strict guidelines on data handling, complicating compliance for genomic companies. In future, over 30% of genomic firms reported challenges in meeting these regulations, which can lead to costly penalties and loss of consumer trust. Addressing these concerns is crucial for fostering a secure environment for genomic data utilization.

Global Genomics Market Future Outlook

The future of the genomics market is poised for transformative growth, driven by technological advancements and increasing integration of artificial intelligence in genomic analysis. As healthcare systems worldwide prioritize personalized medicine, the demand for genomic services is expected to rise significantly. Furthermore, collaborations between academia and industry will enhance research capabilities, leading to innovative solutions. The focus on ethical guidelines and regulatory compliance will also shape the landscape, ensuring responsible use of genomic data while fostering public trust in genomic technologies.

Market Opportunities

- Expansion of Genomic Services in Emerging Markets:Emerging markets are witnessing a surge in demand for genomic services, with investments projected to exceed $5 billion. This growth is driven by increasing healthcare access and rising awareness of genetic disorders. Companies that establish a presence in these regions can capitalize on untapped markets, providing essential genomic testing and personalized medicine solutions to a broader population.

- Integration of AI in Genomic Data Analysis:The integration of artificial intelligence in genomic data analysis is expected to revolutionize the field, with AI-driven solutions projected to enhance data interpretation accuracy by 40%. This technological advancement will facilitate faster and more precise genomic insights, enabling healthcare providers to deliver personalized treatments more effectively. Companies investing in AI capabilities will likely gain a competitive edge in the rapidly evolving genomics landscape.