Region:Asia

Author(s):Geetanshi

Product Code:KRAAA0027

Pages:100

Published On:November 2025

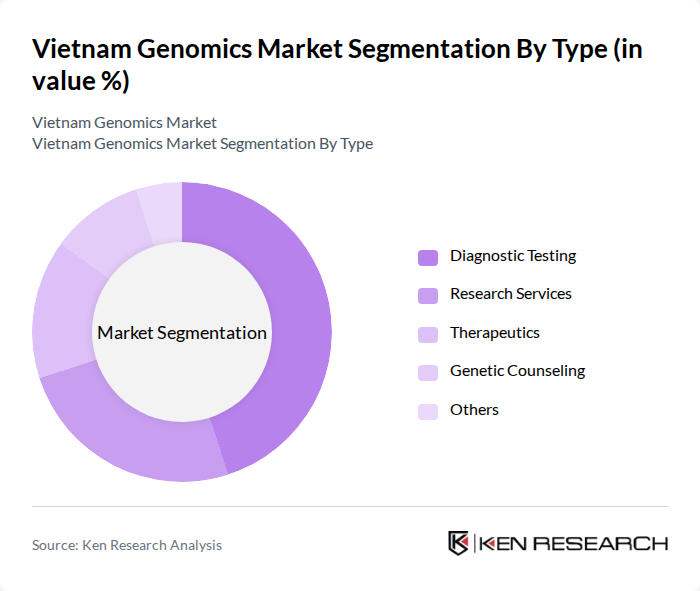

By Type:The Vietnam Genomics Market can be segmented into various types, including Diagnostic Testing, Research Services, Therapeutics, Genetic Counseling, and Others. Among these, Diagnostic Testing is the leading subsegment, driven by the increasing prevalence of genetic disorders and the growing demand for early disease detection. Research Services also play a significant role, as they support the development of new genomic technologies and therapies.

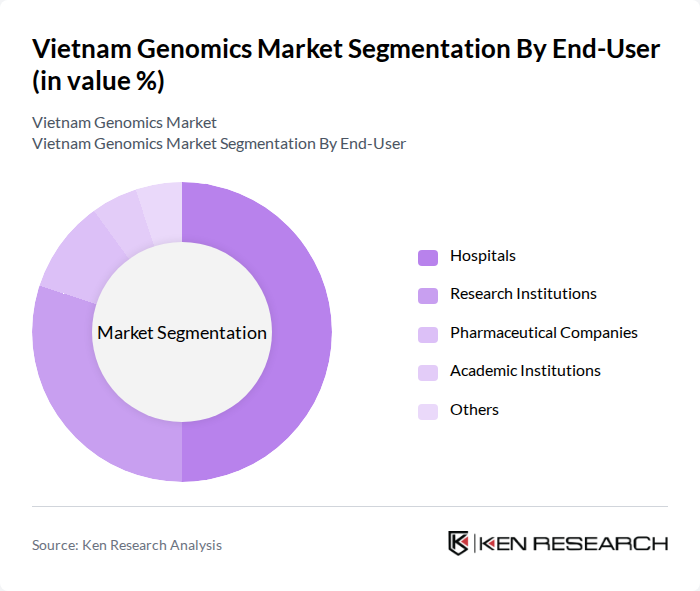

By End-User:The end-user segmentation of the Vietnam Genomics Market includes Hospitals, Research Institutions, Pharmaceutical Companies, Academic Institutions, and Others. Hospitals are the dominant end-user segment, as they increasingly adopt genomic testing for patient diagnosis and treatment planning. Research Institutions also contribute significantly, focusing on advancing genomic research and technology development.

The Vietnam Genomics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vinmec Healthcare System, Genome Vietnam, FPT Corporation, Medlatec, VietGen, Ho Chi Minh City University of Medicine and Pharmacy, Hanoi Medical University, National Institute of Hematology and Blood Transfusion, VinGroup, Biomedic, Gene Solutions, HanoGen, Genetica, Medigen, Genomics Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam genomics market is poised for significant growth, driven by increasing investments in healthcare infrastructure and technological advancements. As the government prioritizes biotechnology, the integration of AI in genomic data analysis is expected to enhance diagnostic accuracy and efficiency. Furthermore, the expansion of telemedicine services will facilitate access to genomic testing, particularly in underserved regions. These trends indicate a promising future for the genomics sector, with potential for improved health outcomes and increased patient engagement in personalized medicine.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Testing Research Services Therapeutics Genetic Counseling Others |

| By End-User | Hospitals Research Institutions Pharmaceutical Companies Academic Institutions Others |

| By Application | Oncology Rare Diseases Cardiovascular Diseases Neurological Disorders Others |

| By Technology | Next-Generation Sequencing Polymerase Chain Reaction (PCR) Microarray Technology Sanger Sequencing Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| By Investment Source | Government Funding Private Investments International Grants Venture Capital Others |

| By Policy Support | Tax Incentives Research Grants Regulatory Support Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Genomics Services | 100 | Geneticists, Laboratory Directors |

| Biotechnology Research Institutions | 80 | Research Scientists, Lab Managers |

| Healthcare Providers Offering Genetic Testing | 70 | Healthcare Administrators, Medical Directors |

| Pharmaceutical Companies Involved in Genomics | 60 | R&D Managers, Product Development Leads |

| Government Health Agencies | 50 | Policy Makers, Health Program Coordinators |

The Vietnam Genomics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by advancements in biotechnology, increased healthcare spending, and a rising demand for personalized medicine.