Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7997

Pages:99

Published On:December 2025

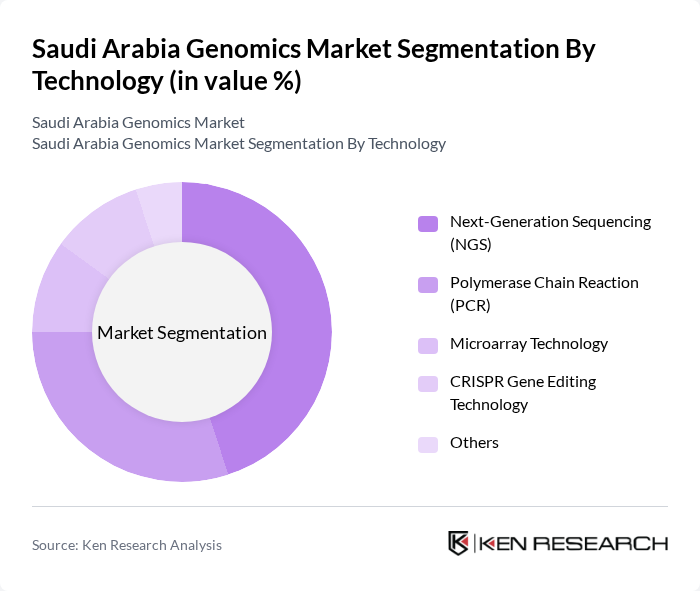

By Technology:The technology segment of the Saudi Arabia Genomics Market includes various advanced methodologies that are pivotal in genomic research and diagnostics. The leading technologies are Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR), which are widely adopted due to their efficiency and accuracy in genetic analysis. NGS is particularly favored for its ability to sequence large amounts of DNA quickly, making it essential for research and clinical applications.

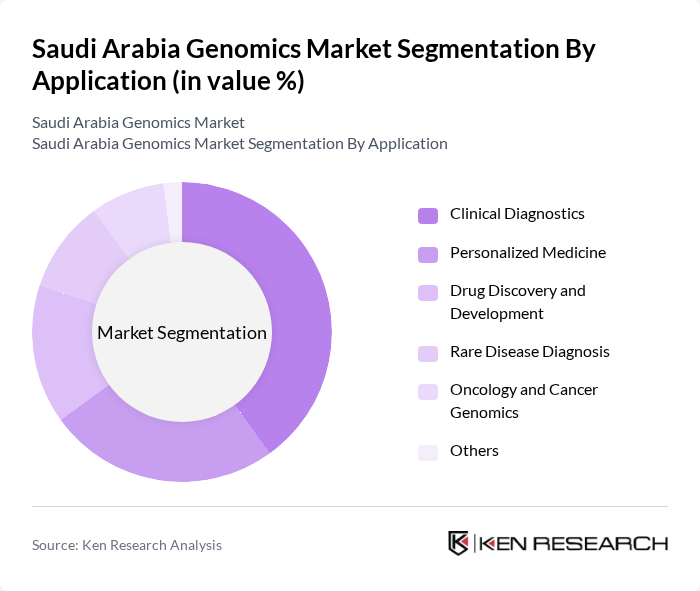

By Application:The application segment encompasses various fields where genomics plays a crucial role, including clinical diagnostics, personalized medicine, and oncology. Clinical diagnostics is the dominant application, driven by the increasing prevalence of genetic disorders and the need for accurate diagnostic tools. Personalized medicine is gaining traction as healthcare providers seek tailored treatment plans based on individual genetic profiles, enhancing patient outcomes.

The Saudi Arabia Genomics Market is characterized by a dynamic mix of regional and international players. Leading participants such as King Faisal Specialist Hospital & Research Centre, Saudi Human Genome Program, Saudi Advanced Medical Lab (SAML), NoorDx, Al Farabi Labs, Novo Genomics, Anwa Labs, Saudi-German Genomic Centre, Illumina, Inc., Thermo Fisher Scientific, QIAGEN, Roche Diagnostics, BGI Genomics, Agilent Technologies, PerkinElmer contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia genomics market appears promising, driven by ongoing government initiatives and technological advancements. As public awareness increases, more individuals are likely to seek genomic testing, leading to higher demand for personalized medicine. Additionally, the integration of artificial intelligence in genomic analysis is expected to enhance diagnostic accuracy and efficiency. These trends will likely foster a more robust genomics ecosystem, positioning Saudi Arabia as a key player in the global genomics landscape.

| Segment | Sub-Segments |

|---|---|

| By Technology | Next-Generation Sequencing (NGS) Polymerase Chain Reaction (PCR) Microarray Technology CRISPR Gene Editing Technology Others |

| By Application | Clinical Diagnostics Personalized Medicine Drug Discovery and Development Rare Disease Diagnosis Oncology and Cancer Genomics Others |

| By Product Type | Kits and Consumables Instruments and Equipment Software and Bioinformatics Solutions Services |

| By End-User | Hospitals and Healthcare Providers Research Institutions and Universities Pharmaceutical and Biotechnology Companies Clinical Laboratories Others |

| By Service Type | Laboratory Testing Services Genetic Counseling Services Data Analysis and Bioinformatics Services Research and Development Services |

| By Region | Riyadh (Central Region) Eastern Province Western Region (Jeddah/Mecca) Southern Region Rural and Underserved Areas |

| By Funding Source | Government Funding and Vision 2030 Initiatives Private Sector Investments International Grants and Collaborations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Genomics Services | 100 | Geneticists, Laboratory Directors |

| Biotechnology Research Institutions | 80 | Research Scientists, Lab Managers |

| Healthcare Providers Utilizing Genomics | 100 | Oncologists, General Practitioners |

| Pharmaceutical Companies Involved in Genomics | 90 | Product Managers, R&D Directors |

| Government Health Agencies | 70 | Policy Makers, Health Program Coordinators |

The Saudi Arabia Genomics Market is valued at approximately USD 215 million, driven by advancements in genomic technologies, increased healthcare investments, and a rising demand for personalized medicine, particularly in response to the prevalence of genetic disorders.