Region:Global

Author(s):Dev

Product Code:KRAA3049

Pages:90

Published On:August 2025

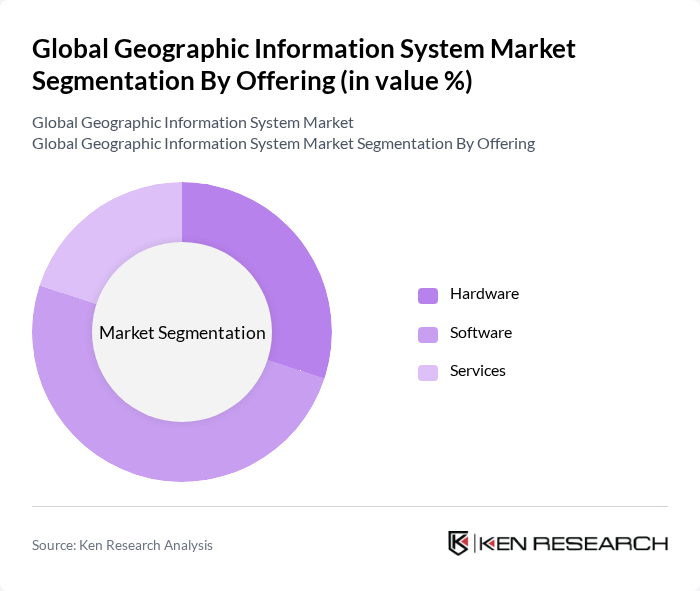

By Offering:This segmentation includes Hardware, Software, and Services. The hardware segment encompasses GIS collectors, imaging sensors, LiDAR, total stations, and GNSS/GPS antennas. The software segment consists of desktop GIS, server GIS, developer GIS, mobile GIS, and remote sensing software. The services segment includes consulting, system integration, and training services .

The software segment is currently dominating the market due to the increasing reliance on GIS applications for data analysis and visualization across various sectors. Organizations are investing in advanced GIS software solutions to enhance operational efficiency and decision-making capabilities. The rise of cloud-based GIS solutions has also contributed to the growth of this segment, as it allows for easier access and collaboration among users. As businesses continue to recognize the value of spatial data, the software segment is expected to maintain its leadership position .

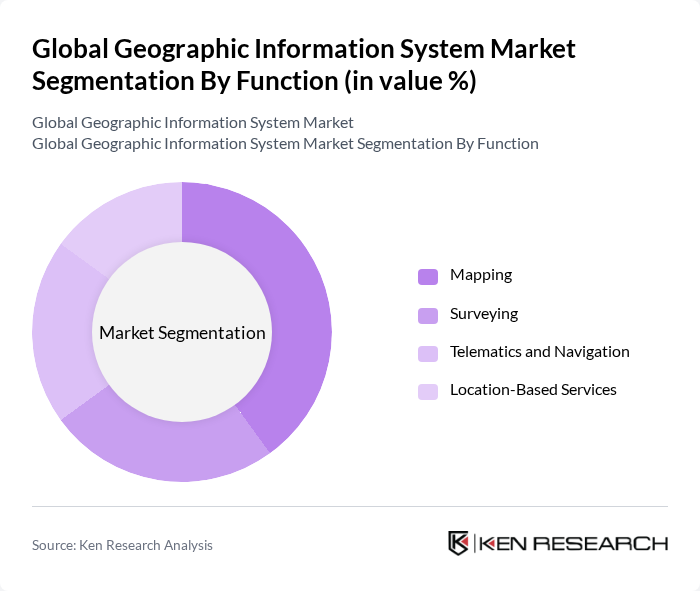

By Function:This segmentation includes Mapping, Surveying, Telematics and Navigation, and Location-Based Services. Mapping involves the creation of visual representations of geographic data, while surveying focuses on measuring and analyzing land and property. Telematics and navigation provide real-time location tracking and route optimization, and location-based services offer personalized information based on user location .

The mapping function is the leading segment, driven by the increasing need for visual data representation in urban planning, disaster management, and environmental monitoring. Organizations are leveraging mapping tools to enhance their decision-making processes and improve communication with stakeholders. The growing adoption of GIS technologies in various sectors, including government and transportation, further solidifies the mapping segment's dominance in the market .

The Global Geographic Information System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Esri, Hexagon AB, Autodesk, Inc., Bentley Systems, Incorporated, Trimble Inc., Pitney Bowes Inc., HERE Technologies, GeoIQ, Mapbox, QGIS Project, OpenStreetMap Foundation, Safe Software Inc., SuperMap Software Co., Ltd., CARTO, Spatial Data Science Institute contribute to innovation, geographic expansion, and service delivery in this space .

The future of the GIS market appears promising, driven by technological advancements and increasing integration with emerging technologies. The rise of AI and machine learning is expected to enhance data analysis capabilities, making GIS more efficient and user-friendly. Additionally, the growing emphasis on sustainability and environmental monitoring will likely lead to increased investments in GIS solutions, particularly in urban planning and resource management, fostering innovation and expansion in the sector.

| Segment | Sub-Segments |

|---|---|

| By Offering | Hardware (GIS collectors, Imaging sensors, LiDAR, Total stations, GNSS/GPS antennas) Software (Desktop GIS, Server GIS, Developer GIS, Mobile GIS, Remote sensing software) Services |

| By Function | Mapping Surveying Telematics and Navigation Location-Based Services |

| By End-User Industry | Government Agriculture Oil & Gas Architecture, Engineering, and Construction Transportation and Logistics Utilities Mining Healthcare Retail Others (Marine, Education, Forestry) |

| By Deployment Mode | On-premise Cloud |

| By Geography | North America (US, Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, Rest of APAC) Rest of the World (South America, Middle East, Africa) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Planning Applications | 60 | City Planners, Urban Development Officers |

| Environmental Monitoring | 50 | Environmental Scientists, Policy Makers |

| Transportation Management | 45 | Logistics Coordinators, Transportation Analysts |

| Utility Management Solutions | 40 | Utility Managers, GIS Technicians |

| Geospatial Data Services | 55 | Data Analysts, IT Managers |

The Global Geographic Information System Market is valued at approximately USD 14 billion, driven by the increasing demand for spatial data analytics across various industries, including urban planning, environmental monitoring, and transportation.