Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2364

Pages:94

Published On:October 2025

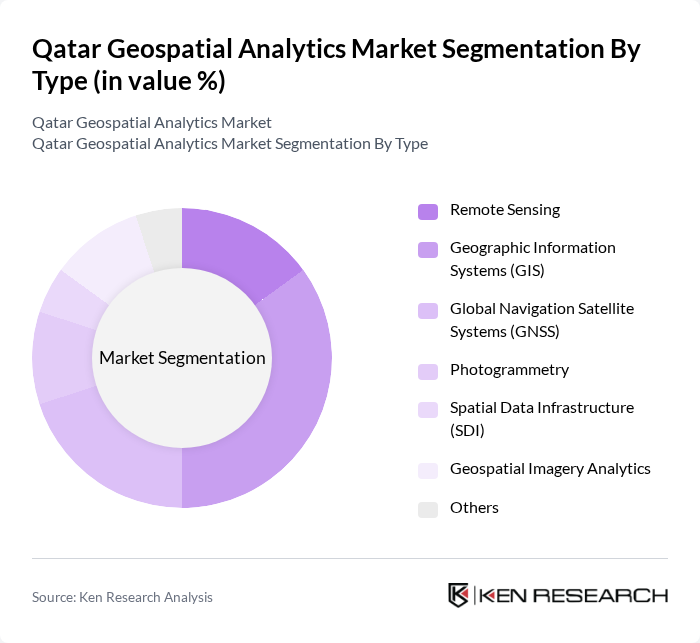

By Type:The geospatial analytics market is segmented into Remote Sensing, Geographic Information Systems (GIS), Global Navigation Satellite Systems (GNSS), Photogrammetry, Spatial Data Infrastructure (SDI), Geospatial Imagery Analytics, and Others. Among these, Geographic Information Systems (GIS) is the leading sub-segment due to its extensive applications in urban planning, resource management, and environmental monitoring. The increasing adoption of GIS technology by government and private sectors for data visualization and analysis is driving its dominance in the market. Recent trends indicate a growing preference for cloud-based GIS platforms and integration with AI for predictive analytics .

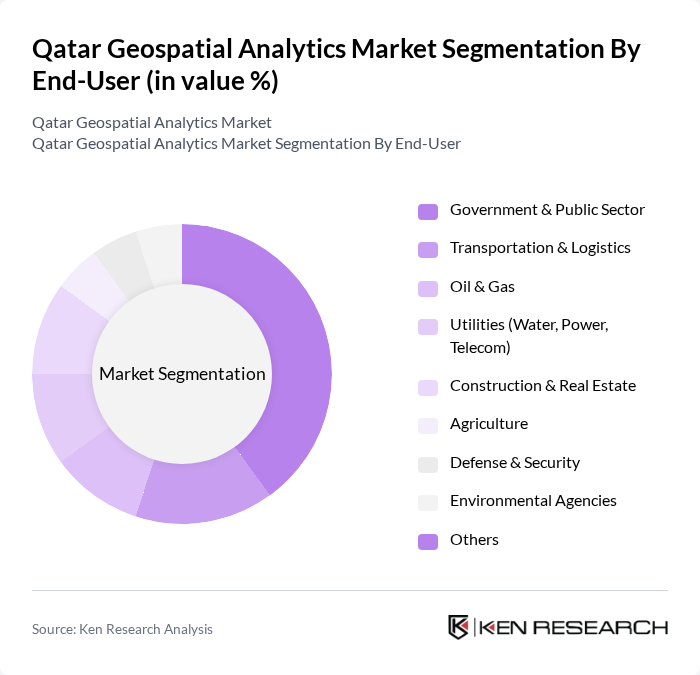

By End-User:The end-user segmentation of the geospatial analytics market includes Government & Public Sector, Transportation & Logistics, Oil & Gas, Utilities (Water, Power, Telecom), Construction & Real Estate, Agriculture, Defense & Security, Environmental Agencies, and Others. The Government & Public Sector is the dominant segment, driven by the increasing need for efficient urban planning, disaster management, and environmental monitoring. The government's focus on smart city initiatives, digital infrastructure, and sustainable development further enhances the demand for geospatial analytics in this sector. Other sectors such as utilities and transportation are also experiencing rapid adoption due to the need for optimized asset management and logistics .

The Qatar Geospatial Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Esri, Hexagon AB, Trimble Inc., Autodesk Inc., Bentley Systems, Incorporated, HERE Technologies, GDi, Carto, QGIS Association, Mapbox, Maxar Technologies, GIS/Transport Engineering Consultants (Qatar), Spatial Data Science Qatar, OpenStreetMap Foundation, Planet Labs PBC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar geospatial analytics market appears promising, driven by technological advancements and increasing government support. The integration of artificial intelligence and machine learning into geospatial analytics is expected to enhance data processing capabilities, leading to more informed decision-making. Additionally, the shift towards cloud-based solutions will facilitate greater accessibility and collaboration among stakeholders, fostering innovation and efficiency in various sectors, including urban planning and environmental monitoring.

| Segment | Sub-Segments |

|---|---|

| By Type | Remote Sensing Geographic Information Systems (GIS) Global Navigation Satellite Systems (GNSS) Photogrammetry Spatial Data Infrastructure (SDI) Geospatial Imagery Analytics Others |

| By End-User | Government & Public Sector Transportation & Logistics Oil & Gas Utilities (Water, Power, Telecom) Construction & Real Estate Agriculture Defense & Security Environmental Agencies Others |

| By Application | Urban Planning & Smart Cities Environmental Monitoring & Management Disaster Management & Emergency Response Asset & Infrastructure Management Land Use & Land Cover Analysis Resource Exploration (Oil, Gas, Minerals) Agriculture & Crop Monitoring Others |

| By Distribution Mode | Direct Sales Online Sales Distributors/Channel Partners System Integrators Others |

| By Investment Source | Government Funding Private Investments International Aid & Multilateral Agencies Public-Private Partnerships (PPP) Others |

| By Policy Support | Subsidies Tax Incentives Grants Regulatory Mandates Others |

| By Technology | Cloud-based Solutions On-Premise Solutions Hybrid Solutions AI & Machine Learning Enabled Analytics IoT-Integrated Geospatial Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Urban Planning Departments | 60 | Urban Planners, Policy Makers |

| Real Estate Development Firms | 50 | Project Managers, Land Surveyors |

| Environmental Monitoring Agencies | 40 | Environmental Scientists, Data Analysts |

| Transportation and Logistics Companies | 45 | Logistics Coordinators, Operations Managers |

| Geospatial Technology Providers | 40 | Product Managers, Technical Leads |

The Qatar Geospatial Analytics Market is valued at approximately USD 350 million, reflecting significant growth driven by the demand for location-based services, urban planning, and infrastructure development, alongside advancements in technologies like AI and IoT.