Region:Global

Author(s):Rebecca

Product Code:KRAA2912

Pages:98

Published On:August 2025

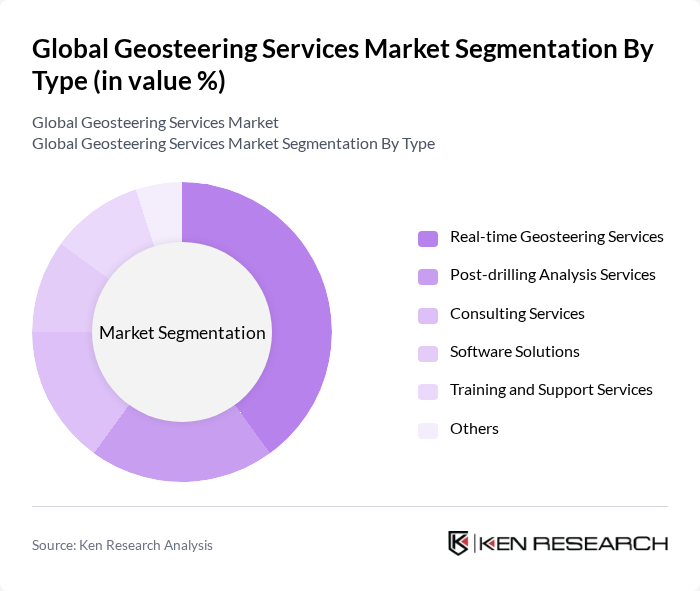

By Type:The market is segmented into various types of services that cater to different aspects of geosteering. The primary subsegments include Real-time Geosteering Services, Post-drilling Analysis Services, Consulting Services, Software Solutions, Training and Support Services, and Others. Among these, Real-time Geosteering Services is the most dominant segment, driven by the increasing need for immediate data analysis and decision-making during drilling operations. Companies are increasingly investing in real-time technologies to enhance drilling accuracy and reduce costs, with software solutions and advanced analytics gaining prominence for optimizing well placement and reducing non-productive time .

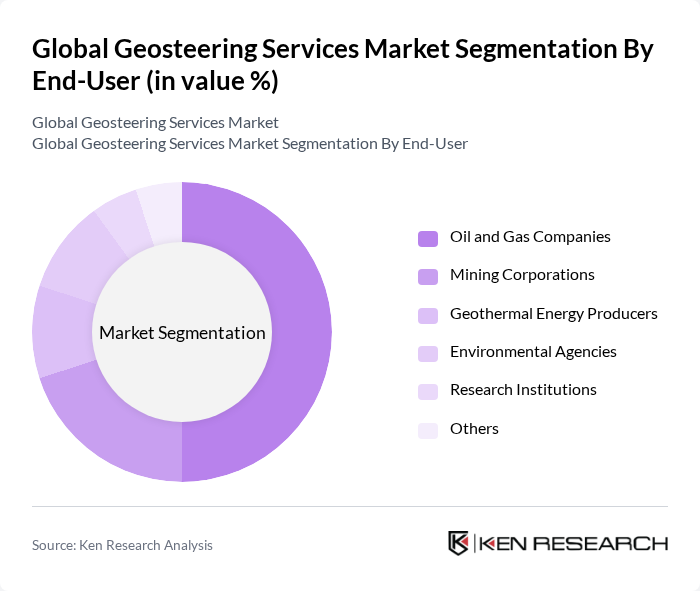

By End-User:The end-user segmentation includes Oil and Gas Companies, Mining Corporations, Geothermal Energy Producers, Environmental Agencies, Research Institutions, and Others. Oil and Gas Companies represent the largest segment, as they are the primary users of geosteering services to enhance drilling efficiency and optimize resource extraction. The increasing complexity of oil and gas reservoirs, especially in unconventional plays, necessitates advanced geosteering solutions, making this segment crucial for market growth .

The Global Geosteering Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halliburton Company, Schlumberger Limited, Baker Hughes Company, Weatherford International plc, National Oilwell Varco, Inc., Geoservices S.A., Paradigm Geophysical, Katalyst Data Management, RPS Group plc, Aker Solutions ASA, PGS ASA, CGG S.A., TGS-NOPEC Geophysical Company ASA, Fugro N.V., ION Geophysical Corporation, GeoSteering Technologies, Inc., H&P Technologies (Helmerich & Payne), Emerson Paradigm Holding LLC, Geolog International BV, Petrolern LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of geosteering services is poised for significant transformation, driven by technological advancements and evolving industry demands. As companies increasingly adopt digital solutions, the integration of AI and machine learning will enhance data analytics capabilities, leading to more informed decision-making. Furthermore, the emphasis on sustainability will push the industry towards eco-friendly practices, ensuring compliance with environmental regulations while optimizing resource extraction. This dynamic landscape presents opportunities for innovation and growth in the geosteering sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Real-time Geosteering Services Post-drilling Analysis Services Consulting Services Software Solutions Training and Support Services Others |

| By End-User | Oil and Gas Companies Mining Corporations Geothermal Energy Producers Environmental Agencies Research Institutions Others |

| By Application | Onshore Drilling Offshore Drilling Horizontal Drilling Vertical Drilling Unconventional Resource Extraction Others |

| By Service Model | Managed Services Project-based Services Subscription-based Services Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-based Pricing Others |

| By Customer Type | Large Enterprises Medium Enterprises Small Enterprises Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Geosteering Services | 100 | Geosteering Engineers, Drilling Supervisors |

| Offshore Geosteering Technologies | 80 | Project Managers, Marine Geologists |

| Software Solutions for Geosteering | 60 | Software Engineers, IT Managers in Energy |

| Training and Consultancy Services | 50 | Training Coordinators, Technical Consultants |

| Market Trends and Innovations | 70 | Industry Analysts, Research Scientists |

The Global Geosteering Services Market is valued at approximately USD 11.5 billion, reflecting a significant growth trend driven by advancements in drilling technologies and the increasing demand for precision in resource extraction.