Region:Global

Author(s):Dev

Product Code:KRAC2705

Pages:90

Published On:October 2025

By Type:The downhole tools market is segmented into various types, including drilling tools, completion tools, intervention tools, measurement tools, production tools, flow & pressure control tools, handling tools, impurity control tools, downhole control tools, and others. Among these, drilling tools are the most widely used due to their essential role in the initial stages of oil and gas extraction. The increasing complexity of drilling operations and the need for efficient resource extraction have led to a higher demand for advanced drilling tools, which are designed to enhance performance and reduce operational risks .

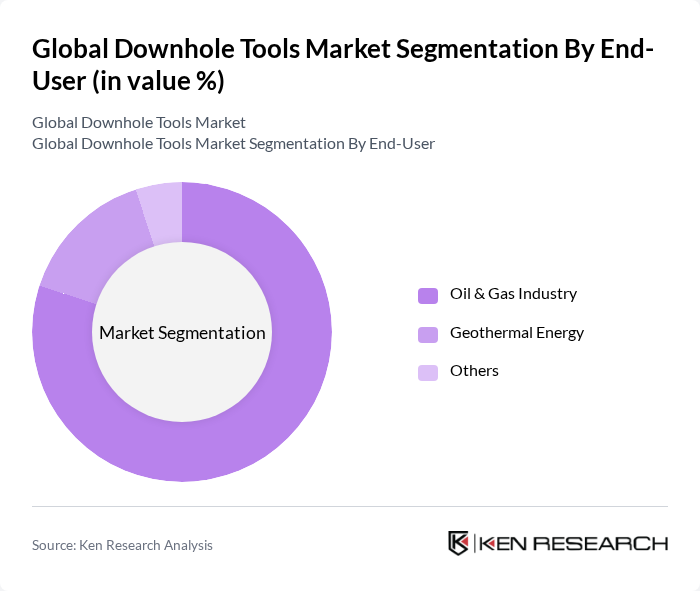

By End-User:The end-user segmentation includes the oil & gas industry, geothermal energy, and others. The oil & gas industry is the dominant segment, driven by the continuous need for exploration and production activities. The increasing global energy demand and the push for efficient extraction methods have led to significant investments in downhole tools tailored for oil and gas applications. This segment's growth is further supported by technological advancements that enhance the efficiency and safety of drilling operations .

The Global Downhole Tools Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger Limited, Halliburton Company, Baker Hughes Company, NOV Inc. (formerly National Oilwell Varco, Inc.), Weatherford International plc, TechnipFMC plc, Aker Solutions ASA, Nabors Industries Ltd., Superior Energy Services, Inc., Oil States International, Inc., Tenaris S.A., Vallourec S.A., Core Laboratories N.V., Schoeller-Bleckmann Oilfield Equipment AG, TETRA Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the downhole tools market appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt automation and digitalization, the demand for smart downhole tools is expected to rise significantly. Furthermore, the expansion into emerging markets, particularly in Asia and Africa, will provide new growth avenues. The industry's focus on eco-friendly solutions will also shape product development, ensuring that downhole tools meet evolving environmental standards while enhancing operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Drilling Tools Completion Tools Intervention Tools Measurement Tools Production Tools Flow & Pressure Control Tools Handling Tools Impurity Control Tools Downhole Control Tools Others |

| By End-User | Oil & Gas Industry Geothermal Energy Others |

| By Application | Well Drilling Well Completion Well Intervention Formation & Evaluation Oil & Gas Production Onshore Drilling Offshore Drilling Others |

| By Component | Downhole Motors Drill Bits Packers Liner Hangers Fishing Tools Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Domestic Distribution International Distribution Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oilfield Services Providers | 100 | Operations Managers, Technical Directors |

| Drilling Equipment Manufacturers | 60 | Product Development Managers, Sales Executives |

| Energy Sector Consultants | 40 | Industry Analysts, Market Researchers |

| Regulatory Bodies and Compliance Officers | 40 | Policy Makers, Compliance Managers |

| End-users in Oil and Gas Exploration | 50 | Field Engineers, Project Managers |

The Global Downhole Tools Market is valued at approximately USD 4.8 billion, driven by increasing demand for oil and gas exploration and advancements in drilling technologies. This valuation is based on a comprehensive five-year historical analysis.