Region:Global

Author(s):Dev

Product Code:KRAD5286

Pages:92

Published On:December 2025

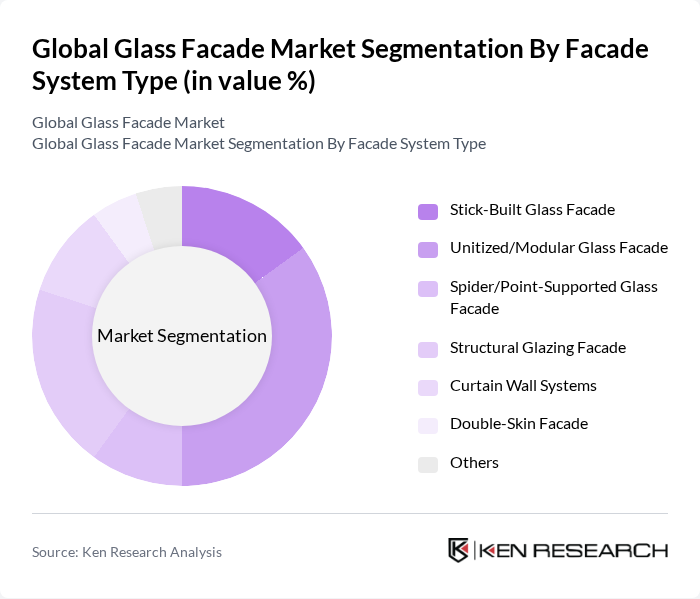

By Facade System Type:The facade system type segment includes various sub-segments such as Stick-Built Glass Facade, Unitized/Modular Glass Facade, Spider/Point-Supported Glass Facade, Structural Glazing Facade, Curtain Wall Systems, Double-Skin Facade, and Others. Among these, the Unitized/Modular Glass Facade is currently dominating the market due to its ease of installation and reduced labor costs. This system allows for faster construction timelines and is increasingly preferred in large-scale commercial projects, aligning with the industry's shift towards efficiency and sustainability.

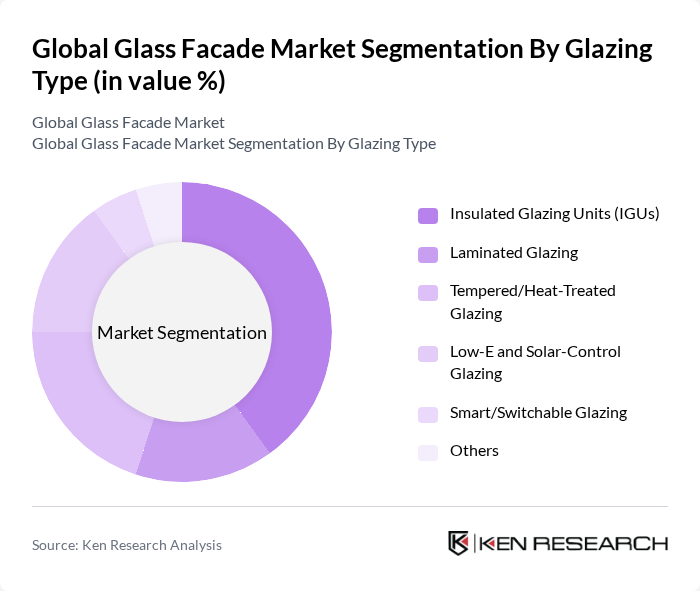

By Glazing Type:The glazing type segment encompasses Insulated Glazing Units (IGUs), Laminated Glazing, Tempered/Heat-Treated Glazing, Low-E and Solar-Control Glazing, Smart/Switchable Glazing, and Others. Insulated Glazing Units (IGUs) are leading this segment due to their superior thermal performance and energy efficiency, making them a preferred choice for both residential and commercial buildings. The growing emphasis on energy conservation and sustainability in construction is driving the demand for IGUs, which help in reducing heating and cooling costs.

The Global Glass Facade Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain, AGC Inc. (Asahi Glass Company), Guardian Glass, Nippon Sheet Glass Co., Ltd. (NSG Group / Pilkington), Schüco International KG, Kawneer Company, Inc. (an Arconic company), Yuanda China Holdings Limited, Permasteelisa Group, Oldcastle BuildingEnvelope (OBE), Apogee Enterprises, Inc. (incl. Viracon), Alcoa Corporation, Sika AG, Eastman Chemical Company, 3M Company, Jangho Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the glass facade market appears promising, driven by a growing emphasis on sustainability and technological integration. As urbanization continues to rise, the demand for aesthetically pleasing and energy-efficient buildings will likely increase. Furthermore, the integration of smart technologies and IoT in building designs is expected to enhance functionality and user experience. These trends indicate a robust market evolution, with significant opportunities for innovation and collaboration among industry stakeholders in the None region.

| Segment | Sub-Segments |

|---|---|

| By Facade System Type | Stick-Built Glass Facade Unitized/Modular Glass Facade Spider/Point-Supported Glass Facade Structural Glazing Facade Curtain Wall Systems Double-Skin Facade Others |

| By Glazing Type | Insulated Glazing Units (IGUs) Laminated Glazing Tempered/Heat-Treated Glazing Low?E and Solar-Control Glazing Smart/Switchable Glazing Others |

| By End-User | Residential Commercial (Offices, Hospitality, Retail) Industrial & Logistics Facilities Institutional & Public Buildings Others |

| By Application | New-Build Facade Retrofit & Refurbishment Facade Skylights & Atriums Shopfronts & Storefront Systems Others |

| By Installation Type | On?Site (Stick) Installation Off?Site Prefabricated/Unitized Installation Hybrid Installation Others |

| By Performance Characteristics | Thermal Insulation & Energy Efficiency Acoustic Insulation Solar & Glare Control Safety, Security & Impact Resistance Fire-Resistant & Smoke Control Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Projects | 120 | Architects, Project Managers |

| Residential Glass Facade Installations | 90 | Home Builders, Contractors |

| Public Infrastructure Developments | 60 | Government Officials, Urban Planners |

| Green Building Initiatives | 50 | Sustainability Consultants, Environmental Engineers |

| Retail and Commercial Spaces | 80 | Facility Managers, Retail Developers |

The Global Glass Facade Market is valued at approximately USD 80 billion, driven by the increasing demand for energy-efficient buildings, urbanization, and advancements in glass technology. This market has shown significant growth over the past five years.