Region:Middle East

Author(s):Dev

Product Code:KRAA8315

Pages:89

Published On:November 2025

By Type:The market is segmented into various types of smart glass, including Electrochromic Glass, Photochromic Glass, Thermochromic Glass, Suspended Particle Device (SPD) Glass, Liquid Crystal Glass, and Others. Among these, Electrochromic Glass leads due to its widespread application in energy-efficient buildings and automotive sectors, driven by consumer preferences for dynamic light control, sustainability, and energy savings. Photochromic and Thermochromic Glass are also gaining traction as innovative solutions for adaptive building envelopes and comfort .

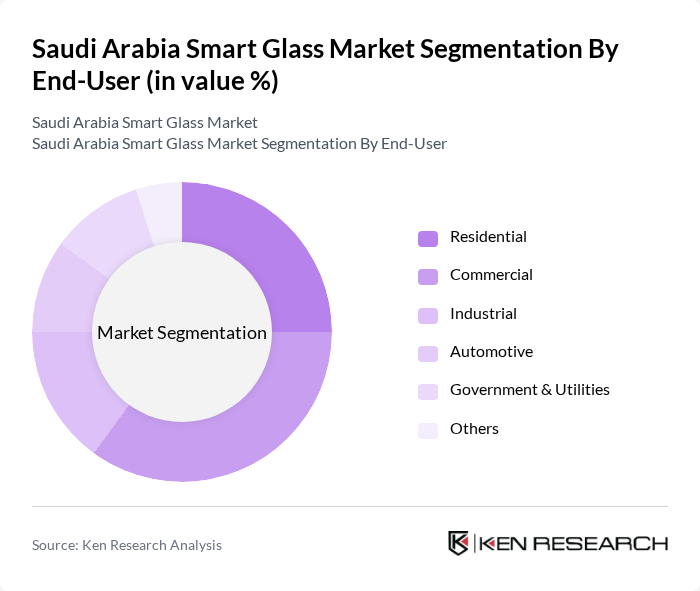

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Automotive, Government & Utilities, and Others. The Commercial sector is currently the dominant segment, driven by the increasing adoption of smart glass in office buildings, retail spaces, and hospitality projects, where aesthetics, energy efficiency, and occupant comfort are critical for attracting customers and reducing operational costs. The Residential sector is also expanding as homeowners seek modern solutions for privacy, energy savings, and smart home integration .

The Saudi Arabia Smart Glass Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain, AGC Inc., NSG Group (Nippon Sheet Glass Co., Ltd.), Guardian Glass, SCHOTT AG, View, Inc., Research Frontiers Inc., SageGlass (Saint-Gobain Subsidiary), PPG Industries, Xinyi Glass Holdings Limited, Halio, Inc., EControl-Glas GmbH & Co. KG, Glass Apps, LLC, Smart Glass Technologies LLC, Polytronix, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia smart glass market appears promising, driven by increasing urbanization and a strong governmental push towards sustainable building practices. As the construction sector continues to expand, the integration of smart glass in residential and commercial projects is expected to rise significantly. Additionally, advancements in manufacturing technologies will likely reduce costs, making smart glass more accessible to a broader audience, thus enhancing its market penetration in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrochromic Glass Photochromic Glass Thermochromic Glass Suspended Particle Device (SPD) Glass Liquid Crystal Glass Others |

| By End-User | Residential Commercial Industrial Automotive Government & Utilities Others |

| By Application | Architectural (Building & Construction) Automotive Aerospace Consumer Electronics Power Generation Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Smart Tint Technology Smart Film Technology Electrochromic Technology SPD Technology Thermochromic Technology Liquid Crystal Technology Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Projects | 100 | Project Managers, Architects |

| Residential Developments | 80 | Home Builders, Interior Designers |

| Automotive Industry Applications | 60 | Automotive Engineers, Product Managers |

| Smart Glass Suppliers | 50 | Sales Managers, Product Development Leads |

| Energy Efficiency Consultants | 40 | Sustainability Consultants, Energy Auditors |

The Saudi Arabia Smart Glass Market is valued at approximately USD 1.2 billion, driven by the increasing demand for energy-efficient building materials and a focus on sustainability in construction practices.