Region:Global

Author(s):Dev

Product Code:KRAA3091

Pages:88

Published On:August 2025

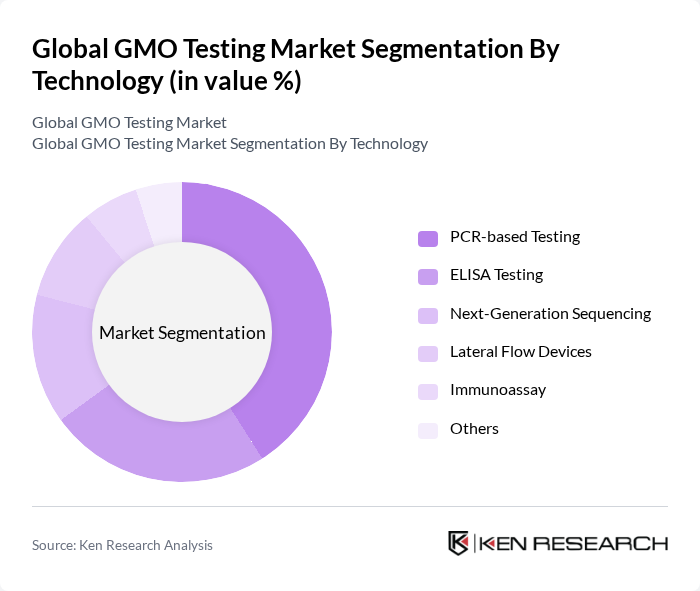

By Technology:The technology segment encompasses various methodologies used for GMO testing, including PCR-based Testing, ELISA Testing, Next-Generation Sequencing, Lateral Flow Devices, Immunoassay, and Others. Among these, PCR-based Testing remains the most widely adopted due to its high sensitivity and specificity, making it the preferred choice for detecting GMO content in food and agricultural products. The growing need for accurate, rapid, and cost-effective testing solutions continues to drive the expansion of this segment .

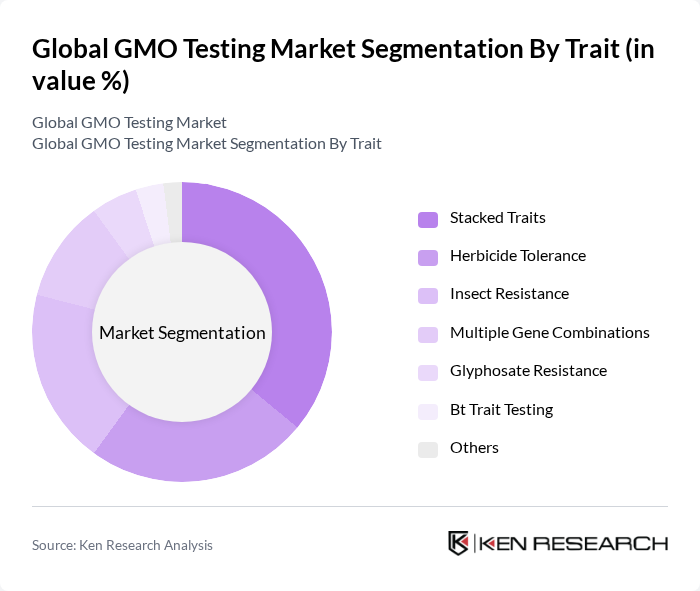

By Trait:The trait segment includes various genetic modifications such as Stacked Traits, Herbicide Tolerance, Insect Resistance, Multiple Gene Combinations, Glyphosate Resistance, Bt Trait Testing, and Others. Stacked Traits continue to lead the market due to their ability to confer multiple agronomic benefits, including enhanced pest resistance and improved yield. The trend is supported by the increasing adoption of multi-trait crops by producers aiming to maximize productivity and reduce reliance on chemical crop protection .

The Global GMO Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eurofins Scientific, SGS S.A., Intertek Group plc, Bureau Veritas S.A., ALS Limited, Neogen Corporation, Genetic ID NA Inc., FoodChain ID Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Merck KGaA, 3M Company, AsureQuality Limited, EnviroLogix Inc., Symbio Laboratories Pty Ltd., Geneius Laboratories Ltd., Primoris Services Corporation, Qiagen N.V., Silliker Inc., Genetic ID Europe AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GMO testing market appears promising, driven by increasing consumer demand for transparency and safety in food products. As regulations tighten globally, companies will likely invest more in testing technologies to ensure compliance. Additionally, advancements in rapid testing methods will enhance efficiency and reduce costs, making testing more accessible. The integration of digital platforms for testing services will further streamline processes, allowing for quicker results and improved consumer trust in food safety.

| Segment | Sub-Segments |

|---|---|

| By Technology | PCR-based Testing ELISA Testing Next-Generation Sequencing Lateral Flow Devices Immunoassay Others |

| By Trait | Stacked Traits Herbicide Tolerance Insect Resistance Multiple Gene Combinations Glyphosate Resistance Bt Trait Testing Others |

| By Crop Type | Corn Soybean Rapeseed/Canola Potato Tomato Sugar Beet Rice Others |

| By Food Type | Bakery & Confectionery Meat & Meat Products Breakfast Cereals & Snacks Food Additives Dairy Products Infant Food Processed Beverages Others |

| By Application | Food Testing Seed Testing Environmental Testing Feed Testing |

| By End-User | Food Manufacturers Agricultural Producers Research Institutions Regulatory Bodies Testing Laboratories |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Distribution Channel | Direct Sales Online Sales Distributors |

| By Testing Method | Qualitative Testing Quantitative Testing |

| By Certification Type | Non-GMO Project Verified USDA Organic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Safety Testing | 100 | Quality Control Managers, Food Safety Officers |

| Agricultural Biotechnology Firms | 60 | Research Scientists, Product Development Managers |

| Regulatory Compliance Testing | 50 | Regulatory Affairs Specialists, Compliance Managers |

| Environmental Impact Assessments | 40 | Environmental Scientists, Sustainability Managers |

| Consumer Awareness Studies | 50 | Market Researchers, Consumer Insights Analysts |

The Global GMO Testing Market is valued at approximately USD 4.8 billion, reflecting a significant increase driven by consumer demand for transparency in food labeling and stringent regulatory frameworks across major markets.