Region:Asia

Author(s):Shubham

Product Code:KRAD6673

Pages:86

Published On:December 2025

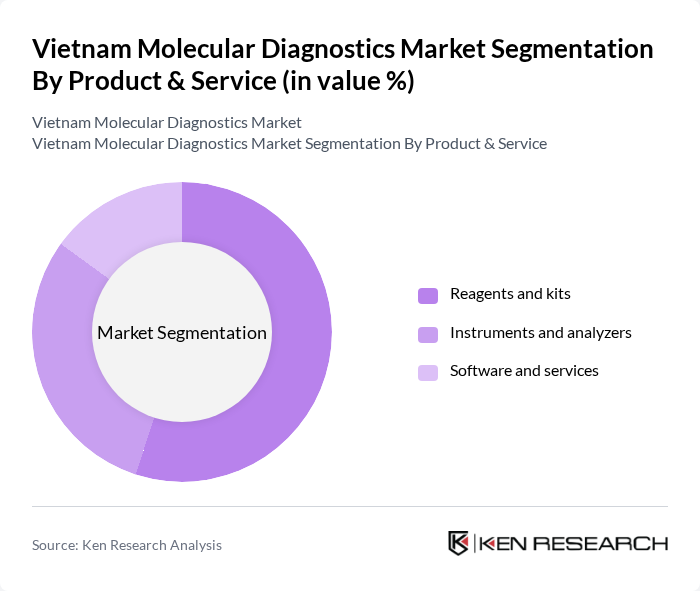

By Product & Service:The product and service segment of the market includes reagents and kits, instruments and analyzers, and software and services, in line with leading market assessments. Among these, reagents and kits are the most significant contributors to market growth due to their essential, recurring role in molecular testing and their dominant share of molecular diagnostics revenue in Vietnam. The increasing demand for accurate diagnostic results, particularly for infectious disease testing, oncology panels, and genetic screening, has led to a surge in the use of these products, especially in public health laboratories, hospital laboratories, and large private diagnostic chains.

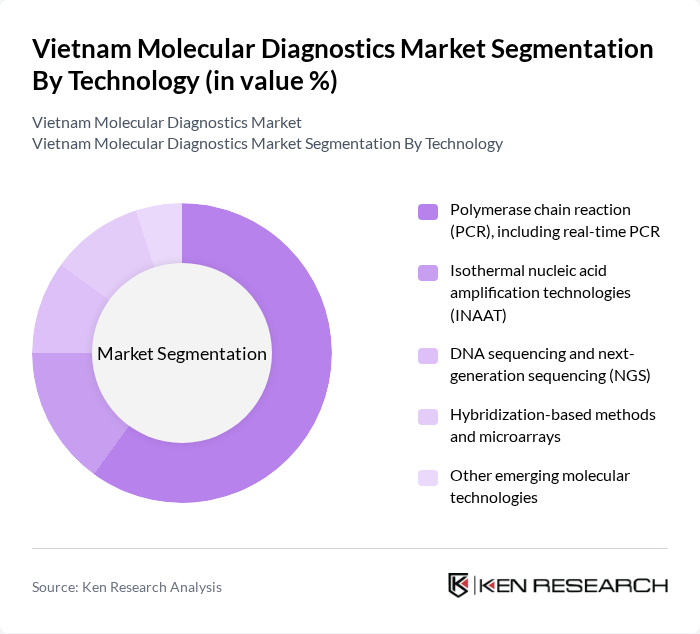

By Technology:This segment encompasses various technologies used in molecular diagnostics, including polymerase chain reaction (PCR), isothermal nucleic acid amplification technologies (INAAT), DNA sequencing and next-generation sequencing (NGS), hybridization-based methods, and other emerging molecular technologies, consistent with the technology splits used in leading Vietnam market studies. PCR technology, particularly real-time PCR, dominates this segment due to its widespread application in infectious disease testing, viral load monitoring (e.g., HIV and hepatitis), and respiratory pathogen panels, along with its ability to provide rapid and highly sensitive results.

The Vietnam Molecular Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche Diagnostics Vietnam Co., Ltd., Abbott Laboratories (Abbott Diagnostics Vietnam), Siemens Healthineers Vietnam, Thermo Fisher Scientific, Bio-Rad Laboratories, QIAGEN, Becton, Dickinson and Company (BD), BGI Genomics (BGI Genomics Vietnam / BGI Genomics Co., Ltd.), Cepheid (a Danaher company), Illumina, Sysmex Corporation (Sysmex Vietnam Co., Ltd.), PerkinElmer (Revvity), Hologic, Danaher Corporation (molecular diagnostics portfolio), Medicon Company Limited (Vietnam) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam molecular diagnostics market appears promising, driven by ongoing technological advancements and increasing healthcare investments. The government’s commitment to enhancing healthcare infrastructure, particularly in rural areas, is expected to facilitate greater access to molecular diagnostics. Additionally, the integration of artificial intelligence in diagnostic processes is anticipated to improve accuracy and efficiency, further propelling market growth. As awareness among healthcare providers increases, the adoption of these technologies is likely to expand, fostering a more robust healthcare ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Product & Service | Reagents and kits Instruments and analyzers Software and services |

| By Technology | Polymerase chain reaction (PCR), including real-time PCR Isothermal nucleic acid amplification technologies (INAAT) DNA sequencing and next-generation sequencing (NGS) Hybridization-based methods and microarrays Other emerging molecular technologies |

| By Application | Infectious diseases (e.g., TB, HIV, hepatitis, respiratory viruses) Oncology (solid tumors and hematologic malignancies) Genetic and hereditary disease testing Blood screening and transfusion safety Other applications (e.g., transplant diagnostics, pharmacogenomics) |

| By End-User | Public hospitals and medical centers Private hospitals and clinics Independent diagnostic laboratories Research and academic institutes Other healthcare settings |

| By Test Setting | Centralized laboratory testing Point-of-care and near-patient testing |

| By Sample Type | Blood and plasma Tissue and biopsy samples Respiratory samples (e.g., swabs, sputum) Urine and other body fluids Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 120 | Laboratory Managers, Technical Directors |

| Healthcare Providers | 100 | Physicians, Medical Directors |

| Diagnostic Equipment Suppliers | 80 | Sales Managers, Product Specialists |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

| Research Institutions | 60 | Research Scientists, Lab Technicians |

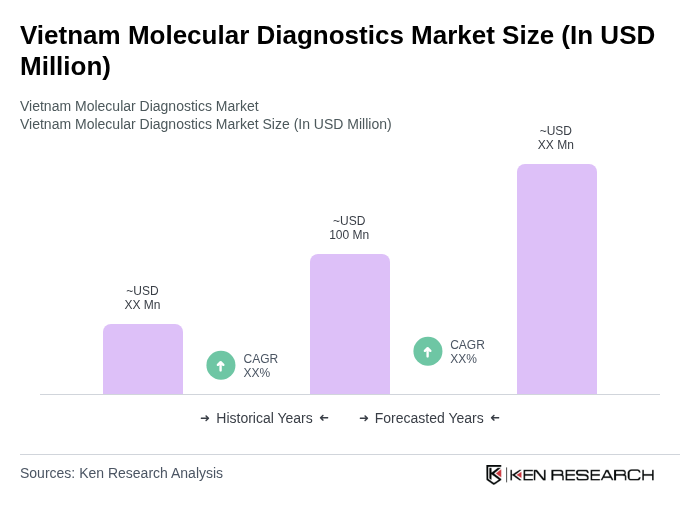

The Vietnam Molecular Diagnostics Market is valued at approximately USD 100 million, reflecting a five-year historical analysis. This growth is driven by the rising prevalence of infectious diseases, advancements in molecular technologies, and increased healthcare expenditure.