Region:Global

Author(s):Dev

Product Code:KRAB0319

Pages:80

Published On:August 2025

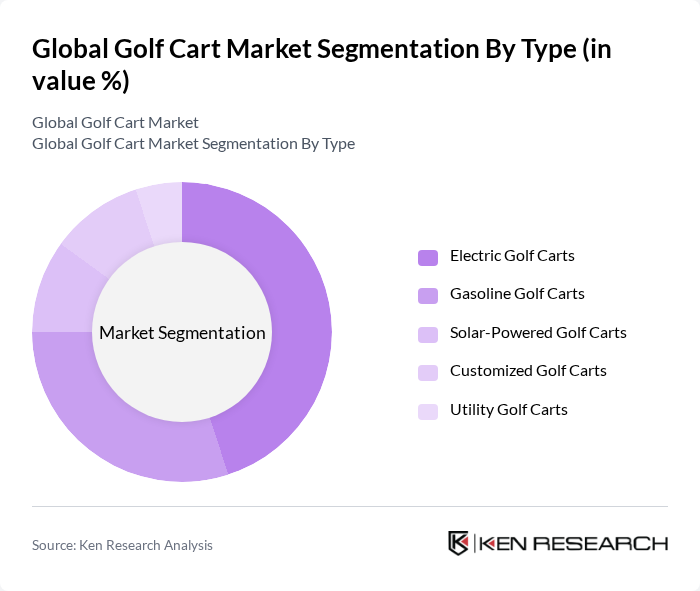

By Type:The market is segmented into Electric Golf Carts, Gasoline Golf Carts, Solar-Powered Golf Carts, Customized Golf Carts, and Utility Golf Carts. Among these, Electric Golf Carts lead the market, supported by their eco-friendliness, lower operational costs, and compliance with emission regulations. The adoption of lithium-ion batteries and smart features further enhances their appeal. Gasoline Golf Carts remain prevalent in regions with limited charging infrastructure, while solar-powered models are gaining traction due to renewable energy initiatives. Customized and utility carts are increasingly used for personal and commercial applications beyond golf courses.

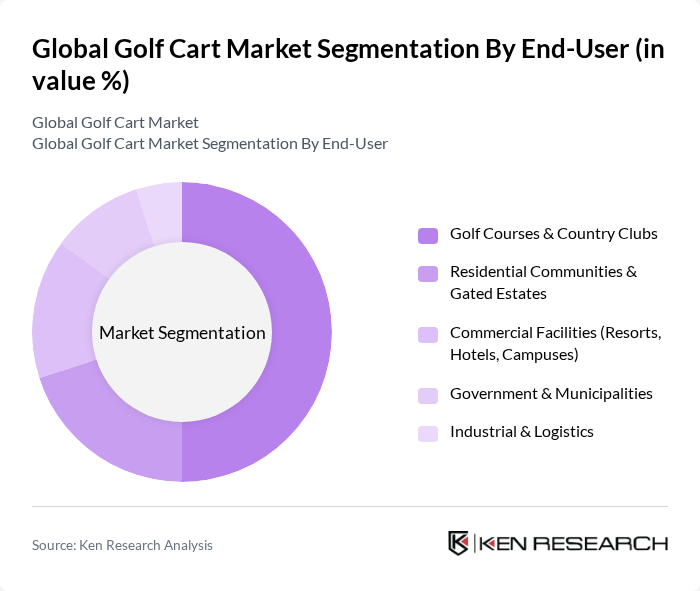

By End-User:The end-user segmentation includes Golf Courses & Country Clubs, Residential Communities & Gated Estates, Commercial Facilities (Resorts, Hotels, Campuses), Government & Municipalities, and Industrial & Logistics. Golf Courses & Country Clubs remain the dominant segment, driven by the need for efficient transportation across large properties and the expansion of golf tourism. Residential communities and gated estates increasingly utilize golf carts for local mobility, while commercial facilities and government sectors adopt them for logistics, maintenance, and passenger transport.

The Global Golf Cart Market is characterized by a dynamic mix of regional and international players. Leading participants such as Club Car, E-Z-GO (Textron Specialized Vehicles), Yamaha Golf-Car Company, Polaris Industries Inc., Garia A/S, Cushman, STAR EV, Advanced EV, Tomberlin, Bintelli Electric Vehicles, Evolution Electric Vehicles, Marshell Electric Vehicle, JH Global Services, Inc. (Star EV), HDK Electric Vehicle, Columbia Vehicle Group Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the golf cart market appears promising, driven by increasing environmental awareness and technological advancements. As electric vehicle adoption continues to rise, golf carts are likely to see enhanced features, including smart technology integration. Additionally, the expansion of golf courses and recreational facilities will create new opportunities for growth. The market is expected to adapt to changing consumer preferences, focusing on sustainability and innovative designs, ensuring its relevance in the evolving transportation landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Golf Carts Gasoline Golf Carts Solar-Powered Golf Carts Customized Golf Carts Utility Golf Carts |

| By End-User | Golf Courses & Country Clubs Residential Communities & Gated Estates Commercial Facilities (Resorts, Hotels, Campuses) Government & Municipalities Industrial & Logistics |

| By Application | Golfing Resort & Hospitality Transportation Industrial & Utility Use Event & Venue Transportation Airport & Railway Station Mobility |

| By Distribution Channel | Direct Sales Online Retail Dealerships Rental & Leasing Services |

| By Price Range | Budget Golf Carts Mid-Range Golf Carts Premium Golf Carts |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Battery Technology (Lead Acid, Lithium-Ion, AGM) Charging Technology (Standard, Fast, Wireless) Navigation & Connectivity (GPS, Bluetooth, IoT) Safety & Automation Features |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Golf Course Operators | 100 | Golf Course Managers, Facility Directors |

| Golf Cart Manufacturers | 60 | Product Development Managers, Sales Executives |

| Rental Service Providers | 50 | Operations Managers, Business Owners |

| Retailers of Golf Carts | 40 | Store Managers, Sales Representatives |

| End-Users (Golf Enthusiasts) | 80 | Golf Players, Club Members |

The Global Golf Cart Market is valued at approximately USD 1.9 billion, reflecting a significant growth trend driven by the increasing popularity of golf, demand for eco-friendly transportation, and advancements in battery technology.