Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3035

Pages:81

Published On:October 2025

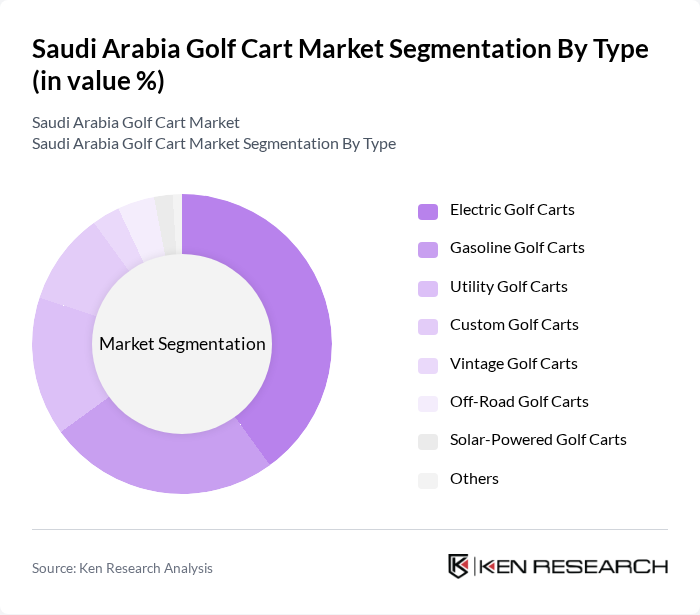

By Type:The market is segmented into various types of golf carts, including Electric Golf Carts, Gasoline Golf Carts, Utility Golf Carts, Custom Golf Carts, Vintage Golf Carts, Off-Road Golf Carts, Solar-Powered Golf Carts, and Others. Among these, Electric Golf Carts are gaining significant traction due to their eco-friendliness, lower operational costs, and alignment with national sustainability goals. Increasing awareness of environmental sustainability and government incentives for electric vehicles are further propelling the demand for electric models. Gasoline Golf Carts remain popular for their power and range, especially where charging infrastructure is limited. The overall trend is shifting towards electric options as consumers and operators prioritize environmental impact and operational efficiency.

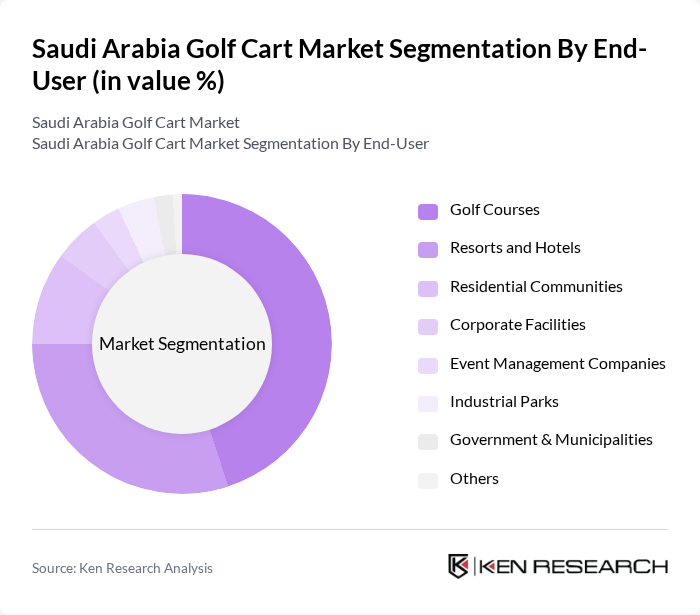

By End-User:The end-user segmentation includes Golf Courses, Resorts and Hotels, Residential Communities, Corporate Facilities, Event Management Companies, Industrial Parks, Government & Municipalities, and Others. Golf Courses are the leading end-users, requiring golf carts for transporting players and equipment across expansive courses. Resorts and Hotels also contribute significantly, utilizing golf carts for guest transportation and enhancing the overall guest experience. The integration of golf carts into residential communities for convenience and leisure is a growing trend, reflecting a shift in consumer preferences towards sustainable and efficient mobility solutions.

The Saudi Arabia Golf Cart Market is characterized by a dynamic mix of regional and international players. Leading participants such as Club Car, E-Z-GO (Textron Specialized Vehicles Inc.), Yamaha Golf-Car Company, Polaris Industries, Garia, Cushman, Star EV Corporation, Advanced EV, Bintelli Electric Vehicles, Tomberlin, Evolution Electric Vehicles, Marshell Electric Vehicle Co., Ltd., Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd., HDK Electric Vehicle, Al-Jazirah Vehicles Agencies Co. (Saudi Distributor), Al-Futtaim Motors (Regional Distributor), Green Carts, Skyy Rider Electric contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia golf cart market appears promising, driven by increasing investments in tourism and leisure activities. As the government continues to promote golf as a key component of its Vision 2030 initiative, the demand for golf carts is expected to rise. Additionally, the integration of smart technologies and eco-friendly solutions will likely attract a broader consumer base, enhancing market dynamics and encouraging innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Golf Carts Gasoline Golf Carts Utility Golf Carts Custom Golf Carts Vintage Golf Carts Off-Road Golf Carts Solar-Powered Golf Carts Others |

| By End-User | Golf Courses Resorts and Hotels Residential Communities Corporate Facilities Event Management Companies Industrial Parks Government & Municipalities Others |

| By Application | Recreational Use Commercial Use Industrial Use Government Use Tourism & Hospitality Others |

| By Distribution Channel | Direct Sales Online Sales Dealerships Rental Services Fleet Management Companies Others |

| By Price Range | Budget Golf Carts Mid-Range Golf Carts Premium Golf Carts Luxury Golf Carts Others |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Al Khobar) Western Region (Jeddah, Makkah) Southern Region (Abha) Northern Region (Tabuk) Others |

| By User Demographics | Age Group Income Level Lifestyle Preferences Nationality (Saudi, Expat) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Golf Course Operators | 60 | Golf Course Managers, Facility Directors |

| Recreational Facility Managers | 50 | Operations Managers, Event Coordinators |

| Golf Cart Retailers | 40 | Sales Managers, Product Specialists |

| Tourism Sector Stakeholders | 45 | Tour Operators, Hotel Managers |

| End Consumers (Golf Enthusiasts) | 55 | Golf Players, Club Members |

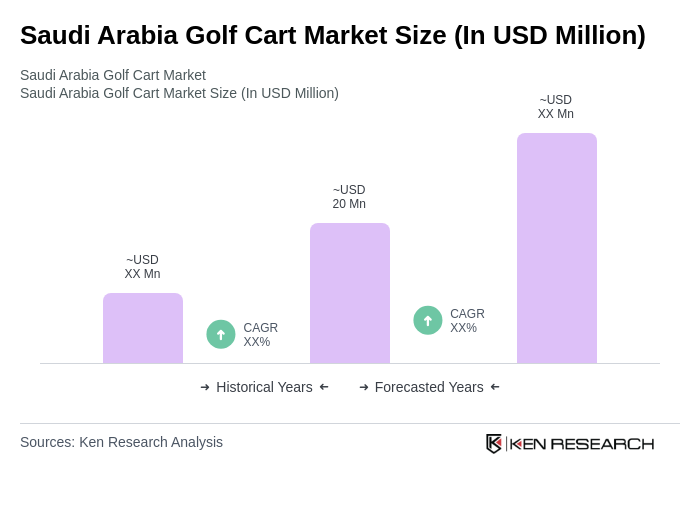

The Saudi Arabia Golf Cart Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This growth is driven by the increasing popularity of golf, eco-friendly transportation demand, and the expansion of luxury resorts incorporating golf carts.