Region:Global

Author(s):Rebecca

Product Code:KRAC0185

Pages:80

Published On:August 2025

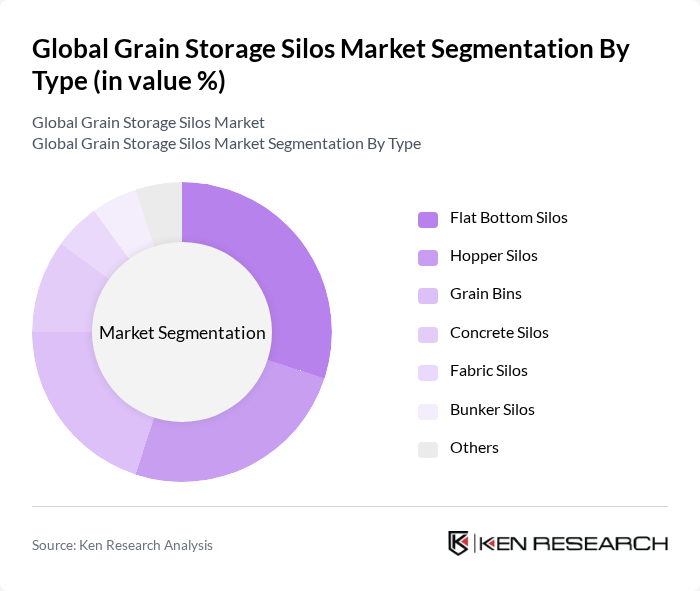

By Type:The market is segmented into various types of silos, each serving different storage needs and capacities. The primary types include Flat Bottom Silos, Hopper Silos, Grain Bins, Concrete Silos, Fabric Silos, Bunker Silos, and Others. Flat Bottom Silos are widely used for long-term bulk storage of grains due to their large capacity and ease of unloading. Hopper Silos are preferred for short-term storage and frequent unloading operations. Grain Bins, often cylindrical and made of steel, are common in North America for on-farm storage. Concrete Silos offer durability for high-capacity, long-term storage, while Fabric and Bunker Silos are used for temporary or specialty storage needs .

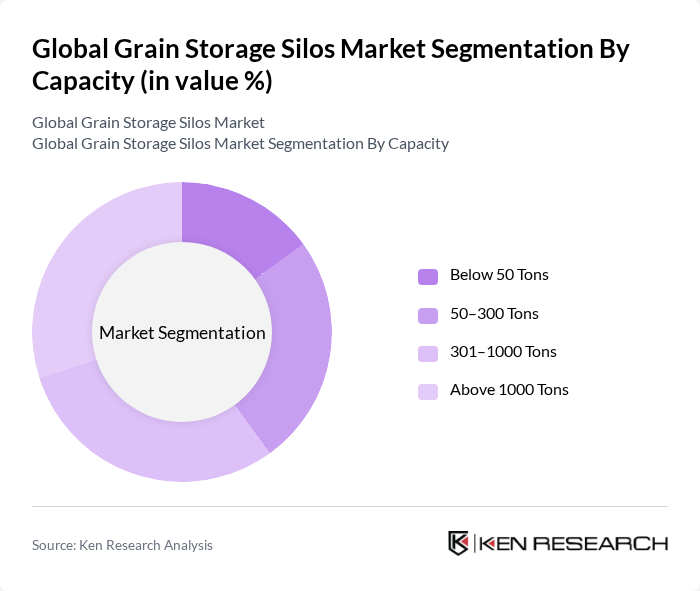

By Capacity:The market is also segmented based on the storage capacity of silos, which includes Below 50 Tons, 50–300 Tons, 301–1000 Tons, and Above 1000 Tons. This segmentation reflects the diverse requirements of end-users, with large commercial farms and grain traders favoring high-capacity silos for bulk storage, while small and medium-sized farms often opt for lower-capacity options for operational flexibility .

The Global Grain Storage Silos Market is characterized by a dynamic mix of regional and international players. Leading participants such as AGI (Ag Growth International), GSI (Grain Systems, Inc.), Sukup Manufacturing Co., Behlen Manufacturing Company, Brock Grain Systems, Meridian Manufacturing Inc., Superior Silo LLC, Silos Córdoba, Symaga, Sioux Steel Company, TSC Silos, Ahrens Agri, Westeel, Stomaha Silo, VG Engineers Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the grain storage silos market appears promising, driven by technological advancements and increasing food production demands. As agricultural practices evolve, the integration of smart technologies will enhance operational efficiency and reduce waste. Additionally, the focus on sustainability will encourage investments in eco-friendly storage solutions. With emerging markets expanding their agricultural infrastructure, the demand for innovative storage systems is expected to rise, creating a dynamic landscape for industry players in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Flat Bottom Silos Hopper Silos Grain Bins Concrete Silos Fabric Silos Bunker Silos Others |

| By Capacity | Below 50 Tons –300 Tons –1000 Tons Above 1000 Tons |

| By Commodity Type | Rice Maize Wheat Soybean Sunflower Others |

| By End-User | Farmers Agricultural Cooperatives Food Processing Companies Grain Traders Government Agencies |

| By Application | Grain Storage Feed Storage Seed Storage Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Grain Storage Facilities | 80 | Facility Managers, Operations Directors |

| Agricultural Producers | 70 | Farm Owners, Crop Managers |

| Grain Traders and Distributors | 60 | Supply Chain Managers, Logistics Coordinators |

| Government Agricultural Agencies | 40 | Policy Makers, Agricultural Analysts |

| Technology Providers for Grain Storage | 50 | Product Managers, Sales Executives |

The Global Grain Storage Silos Market is valued at approximately USD 1.9 billion, reflecting a significant demand for efficient grain storage solutions driven by rising agricultural production and the need for food security.