Region:North America

Author(s):Rebecca

Product Code:KRAA2106

Pages:84

Published On:August 2025

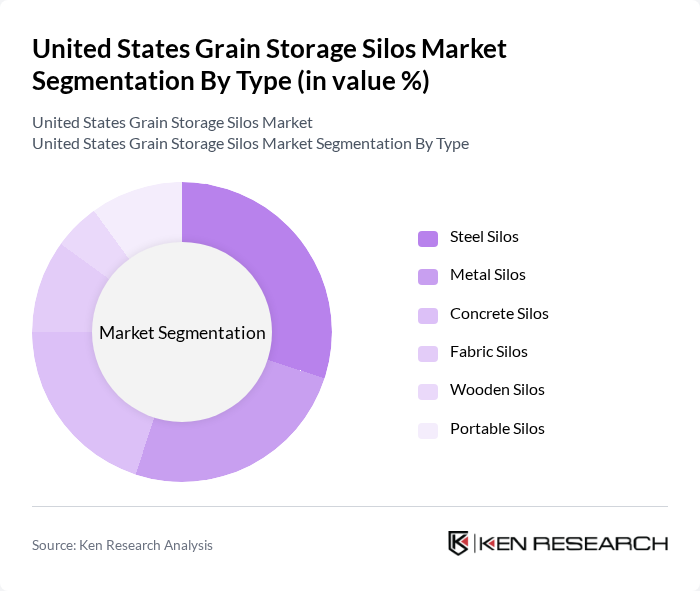

By Type:This segmentation includes various types of silos used for grain storage, each catering to different needs and preferences in the agricultural sector.

The steel silos segment is currently dominating the market due to their durability, cost-effectiveness, and ability to store large quantities of grain. Steel silos are preferred by commercial grain handlers and large-scale farmers for their long lifespan and resistance to environmental factors. The trend towards mechanization and digitalization in agriculture has further increased the demand for steel silos, as they can be easily integrated with modern grain handling systems and smart monitoring technologies .

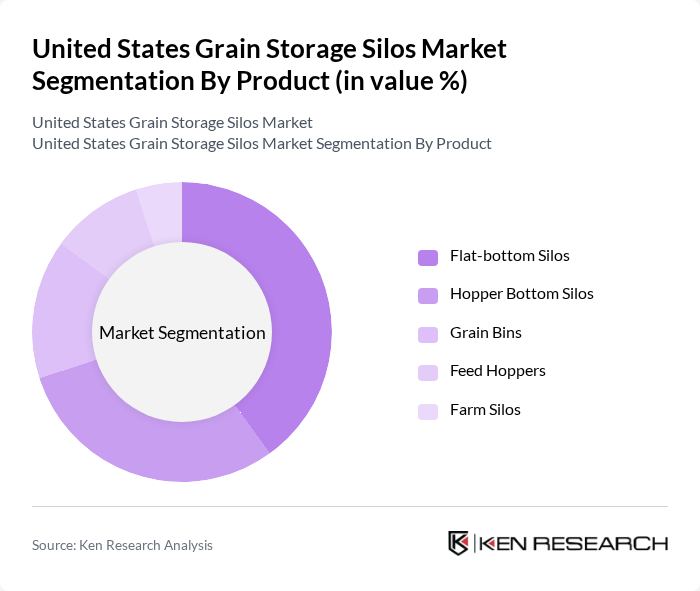

By Product:This segmentation categorizes the market based on the types of products stored in silos, reflecting the diverse needs of the agricultural sector.

The flat-bottom silos segment leads the market due to their versatility and efficiency in storing various types of grains. They are widely used by farmers and commercial grain handlers for bulk storage, allowing for easy loading and unloading. The increasing trend of large-scale farming operations and the need for integrated storage and handling systems have further propelled the demand for flat-bottom silos, as they can accommodate significant quantities of grain while minimizing spoilage .

The United States Grain Storage Silos Market is characterized by a dynamic mix of regional and international players. Leading participants such as AGI (Ag Growth International Inc.), GSI (Grain Systems, Inc. – a brand of AGCO Corporation), Sukup Manufacturing Co., Brock Grain Systems (CTB, Inc.), Meridian Manufacturing Inc., Behlen Manufacturing Company, Chief Industries, Inc., Westeel (a division of AGI), Superior Grain Equipment, SCAFCO Grain Systems Co., Sioux Steel Company, MFS/York/Stormor (a division of Global Industries, Inc.), Symaga S.A., TSC Silos, Trelleborg Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the grain storage silos market in the United States appears promising, driven by technological advancements and increasing agricultural output. As farmers seek to optimize storage efficiency, the adoption of smart technologies and modular systems is expected to rise. Additionally, sustainability initiatives will likely shape the market, encouraging the development of eco-friendly storage solutions. These trends indicate a dynamic shift towards more efficient and sustainable grain storage practices, positioning the industry for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Steel Silos Metal Silos Concrete Silos Fabric Silos Wooden Silos Portable Silos |

| By Product | Flat-bottom Silos Hopper Bottom Silos Grain Bins Feed Hoppers Farm Silos |

| By Capacity | Below 50 Tons 300 Tons 1000 Tons Above 1000 Tons |

| By Commodity Stored | Corn Wheat Soybeans Rice Sunflower Other Grains |

| By End-User | Farmers Commercial Grain Handlers Agricultural Cooperatives Food Processing Companies Exporters Others |

| By Application | Grain Storage Feed Storage Seed Storage Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Midwest South West Northeast |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Grain Storage Facilities | 120 | Facility Managers, Operations Directors |

| Agricultural Cooperatives | 90 | Cooperative Managers, Board Members |

| Grain Exporters | 60 | Export Managers, Logistics Coordinators |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Analysts |

| Technology Providers for Grain Storage | 50 | Product Managers, Sales Executives |

The United States Grain Storage Silos Market is valued at approximately USD 285 million, reflecting a five-year historical analysis. This growth is driven by increasing agricultural production and the demand for efficient grain storage solutions.