Region:Middle East

Author(s):Rebecca

Product Code:KRAC4722

Pages:89

Published On:October 2025

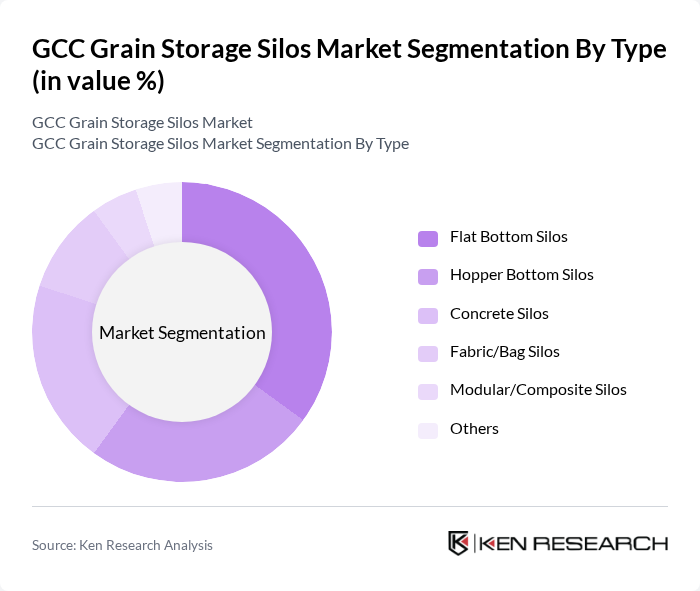

By Type:The market is segmented into various types of silos, including Flat Bottom Silos, Hopper Bottom Silos, Concrete Silos, Fabric/Bag Silos, Modular/Composite Silos, and Others. Each type serves specific storage needs and is designed to accommodate different grain types and capacities. The demand for these silos is influenced by factors such as storage efficiency, cost-effectiveness, and technological advancements. The adoption of IoT-enabled sensors, automation, and modular construction is accelerating, with a shift from traditional warehousing to vertical and prefabricated silos for better land utilization and operational efficiency .

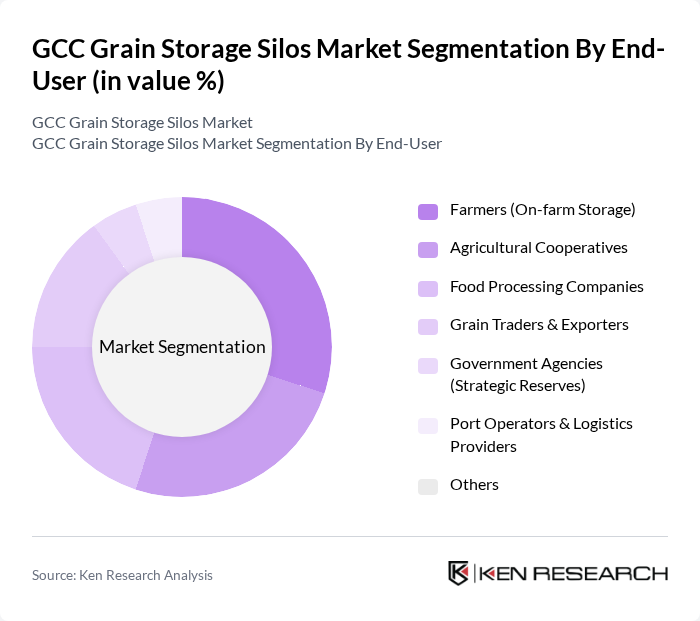

By End-User:The end-user segmentation includes Farmers (On-farm Storage), Agricultural Cooperatives, Food Processing Companies, Grain Traders & Exporters, Government Agencies (Strategic Reserves), Port Operators & Logistics Providers, and Others. Each end-user category has distinct requirements for grain storage, influencing the type and capacity of silos utilized. Farmers and cooperatives are increasingly adopting on-farm and shared storage solutions to improve price arbitrage and reduce spoilage, while government agencies focus on strategic reserves and compliance with food security mandates .

The GCC Grain Storage Silos Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Hazaa Investment Group, AGI (Ag Growth International Inc.), Silos Córdoba, GSI (Grain Systems, Inc.), Bühler Group, Omas Industries, Symaga, Mulmix S.r.l., Tornum AB, PETKUS Technologie GmbH, Sukup Manufacturing Co., Bentall Rowlands Storage Systems Ltd., Mysilo (Altunta? Group), SCAFCO Grain Systems Co., CST Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC grain storage silos market appears promising, driven by increasing government support and technological innovations. As countries in the region strive to enhance food security, investments in modern storage solutions are expected to rise. The integration of smart technologies and sustainable practices will likely become standard, improving efficiency and reducing waste. Furthermore, collaboration with international organizations may facilitate knowledge transfer and investment, further bolstering the market's growth trajectory in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Flat Bottom Silos Hopper Bottom Silos Concrete Silos Fabric/Bag Silos Modular/Composite Silos Others |

| By End-User | Farmers (On-farm Storage) Agricultural Cooperatives Food Processing Companies Grain Traders & Exporters Government Agencies (Strategic Reserves) Port Operators & Logistics Providers Others |

| By Capacity | Small Capacity (up to 100 tons) Medium Capacity (100–1,000 tons) Large Capacity (1,000–5,000 tons) Extra Large Capacity (over 5,000 tons) |

| By Application | Grain Storage Feed Storage Seed Storage Commodity Buffer/Strategic Reserve Others |

| By Distribution Channel | Direct Sales Distributors/Dealers EPC Contractors Online Sales Others |

| By Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Oman Bahrain |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grain Storage Facility Operators | 100 | Facility Managers, Operations Directors |

| Agricultural Cooperatives | 60 | Cooperative Leaders, Procurement Managers |

| Grain Traders and Distributors | 50 | Supply Chain Managers, Sales Directors |

| Government Agricultural Departments | 40 | Policy Makers, Agricultural Analysts |

| Technology Providers for Grain Storage | 50 | Product Managers, Technical Sales Representatives |

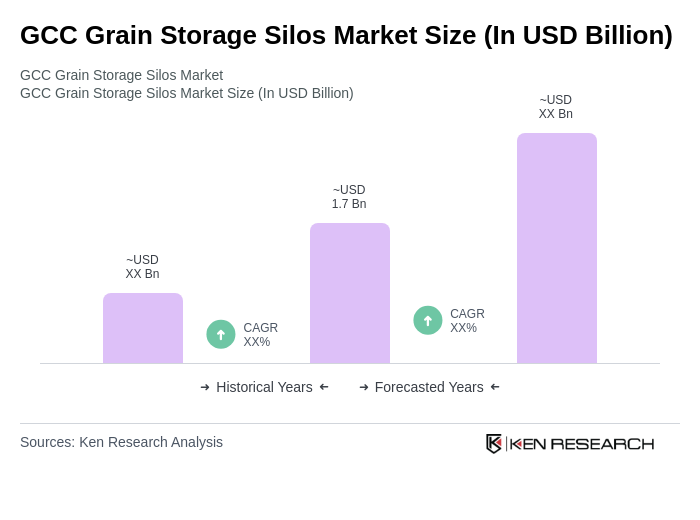

The GCC Grain Storage Silos Market is valued at approximately USD 1.7 billion, reflecting a significant growth driven by increasing agricultural production and the need for efficient grain storage solutions in the region.