Region:Global

Author(s):Shubham

Product Code:KRAA3125

Pages:95

Published On:August 2025

By Grade:The heptanoic acid market is segmented into Pharmaceutical Grade, Industrial Grade, Food Grade, and Others. Each grade serves distinct applications: pharmaceutical grade is crucial for drug formulation and synthesis of active pharmaceutical ingredients; industrial grade is widely used in manufacturing processes, lubricants, and corrosion inhibitors; food grade heptanoic acid is essential for flavoring and food preservation; and other grades address specialty and research applications.

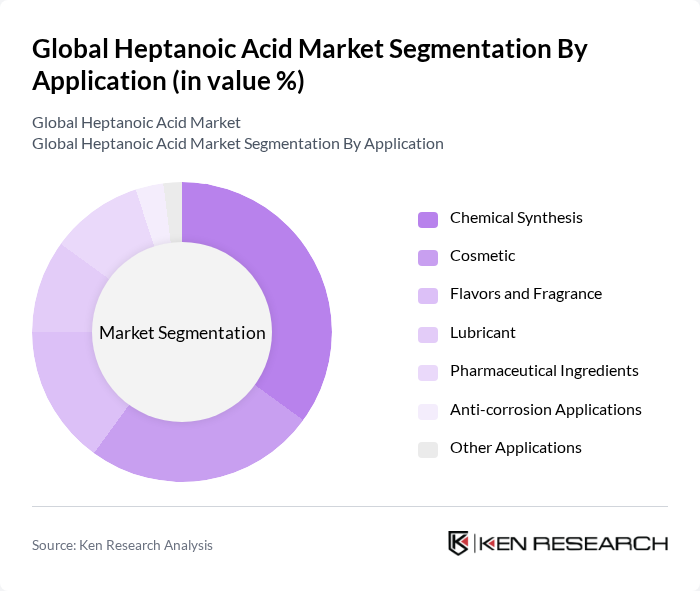

By Application:The applications of heptanoic acid include Chemical Synthesis, Cosmetic, Flavors and Fragrance, Lubricant, Pharmaceutical Ingredients, Anti-corrosion Applications, and Other Applications. Heptanoic acid's versatility is demonstrated by its use as a chemical intermediate, emollient in cosmetics, flavoring agent, lubricant base, and anti-corrosion additive. Chemical synthesis and pharmaceutical ingredients remain the leading applications, driven by the compound's essential role in specialty chemical and drug manufacturing.

The Global Heptanoic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Merck KGaA, Eastman Chemical Company, Croda International Plc, Oxea GmbH, Arkema S.A., Acme Synthetic Chemicals, Mitsubishi Chemical Corporation, Evonik Industries AG, Solvay S.A., AAK AB, Stepan Company, P&G Chemicals, Univar Solutions Inc., Huntsman Corporation, KAO Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the heptanoic acid market appears promising, driven by increasing demand across various sectors, including food, pharmaceuticals, and personal care. Innovations in production technologies are expected to enhance efficiency and reduce costs, while the shift towards sustainable and eco-friendly products will likely create new market segments. As consumer preferences evolve, companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities, particularly in developing regions where market penetration is still growing.

| Segment | Sub-Segments |

|---|---|

| By Grade | Pharmaceutical Grade Industrial Grade Food Grade Others |

| By Application | Chemical Synthesis Cosmetic Flavors and Fragrance Lubricant Pharmaceutical Ingredients Anti-corrosion Applications Other Applications |

| By End-User | Automotive Aerospace Food and Beverage Cosmetics and Personal Care Pharmaceuticals Chemicals Other End-Users |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America (US, Canada) Europe (Germany, France, UK, Spain, Italy, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Australia, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA) |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Applications | 100 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Sector Utilization | 80 | Regulatory Affairs Managers, R&D Scientists |

| Cosmetics and Personal Care Products | 70 | Formulation Chemists, Brand Managers |

| Industrial Chemical Manufacturing | 90 | Operations Managers, Supply Chain Analysts |

| Research Institutions and Academia | 40 | Research Directors, Chemical Engineering Professors |

The Global Heptanoic Acid Market is valued at approximately USD 3.3 billion, reflecting a robust growth trajectory driven by increasing demand across various sectors, including pharmaceuticals, cosmetics, lubricants, and food industries.