Region:Middle East

Author(s):Dev

Product Code:KRAA8223

Pages:96

Published On:November 2025

By Type:The fatty acids market can be segmented into saturated fatty acids, unsaturated fatty acids, essential fatty acids, medium-chain fatty acids, long-chain fatty acids, and others. Among these, unsaturated fatty acids are gaining significant traction due to their health benefits and increasing incorporation in food products. The demand for essential fatty acids is also on the rise, driven by consumer awareness regarding nutrition and wellness. The market is witnessing a shift towards healthier options, with consumers preferring products rich in unsaturated and essential fatty acids .

By End-User:The end-user segmentation includes food and beverage, personal care and cosmetics, pharmaceuticals, animal feed, industrial applications, and others. The food and beverage sector is the largest consumer of fatty acids, driven by the growing trend of health-conscious eating and the incorporation of fatty acids in functional foods. The personal care and cosmetics industry is also expanding its use of fatty acids for their moisturizing and emulsifying properties, contributing to market growth .

The Oman Fatty Acids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oleon N.V., BASF SE, Cargill, Incorporated, Wilmar International Limited, IOI Group, Croda International Plc, Emery Oleochemicals, Musim Mas Group, AAK AB, Bunge Limited, KAO Corporation, Cargill Bioindustrial, Green Biologics, and Ecogreen Oleochemicals contribute to innovation, geographic expansion, and service delivery in this space.

The Oman fatty acids market is poised for significant growth, driven by increasing consumer demand for sustainable and health-oriented products. As the government continues to support renewable energy initiatives, the biofuels sector will likely expand, creating new opportunities for fatty acid applications. Additionally, the rising trend of natural ingredients in personal care and food products will further enhance market dynamics. Companies that innovate and adapt to these trends will be well-positioned to capitalize on emerging opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Saturated Fatty Acids Unsaturated Fatty Acids Essential Fatty Acids Medium-Chain Fatty Acids Long-Chain Fatty Acids Others |

| By End-User | Food and Beverage Personal Care and Cosmetics Pharmaceuticals Animal Feed Industrial Applications Others |

| By Source | Plant-Based Sources Animal-Based Sources Synthetic Sources Others |

| By Application | Food Additives Emulsifiers Stabilizers Surfactants Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Wholesalers Supermarkets and Hypermarkets Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Product Form | Liquid Fatty Acids Solid Fatty Acids Powdered Fatty Acids Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Applications | 45 | Food Technologists, Product Development Managers |

| Cosmetics and Personal Care | 38 | Brand Managers, R&D Specialists |

| Pharmaceutical Sector Usage | 42 | Quality Assurance Managers, Regulatory Affairs Officers |

| Industrial Applications | 35 | Procurement Managers, Operations Directors |

| Research and Development Insights | 40 | Research Scientists, Innovation Managers |

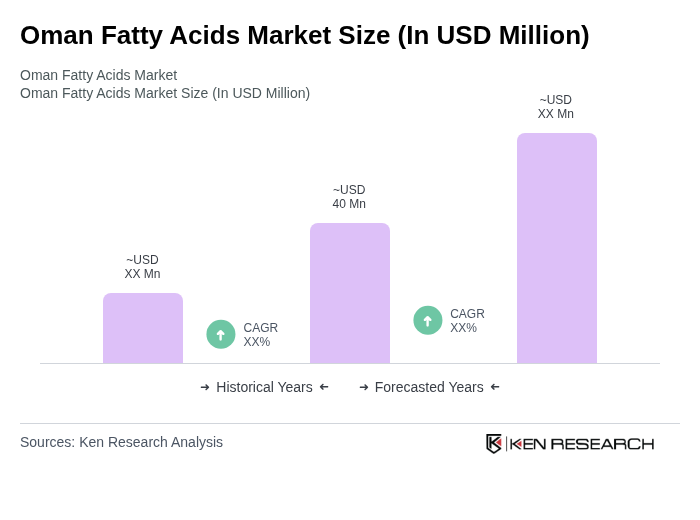

The Oman Fatty Acids Market is valued at approximately USD 40 million, reflecting a five-year historical analysis. This valuation highlights the market's growth driven by increasing demand across various sectors, including food, personal care, and pharmaceuticals.