Region:Global

Author(s):Rebecca

Product Code:KRAA2471

Pages:89

Published On:August 2025

Market.png)

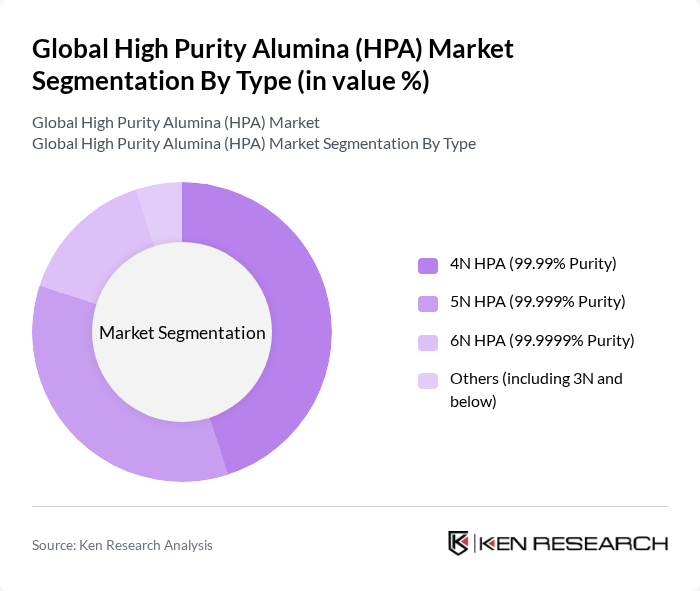

By Type:The market is segmented into four main types: 4N HPA (99.99% purity), 5N HPA (99.999% purity), 6N HPA (99.9999% purity), and others (including 3N and below). Among these, 4N HPA is the most widely used due to its balance of purity and cost-effectiveness, making it suitable for applications such as LED lighting and semiconductor substrates. The demand for 5N and 6N HPA is increasing, particularly in high-tech industries where superior purity is essential for advanced ceramics, lithium-ion battery separators, and optical components .

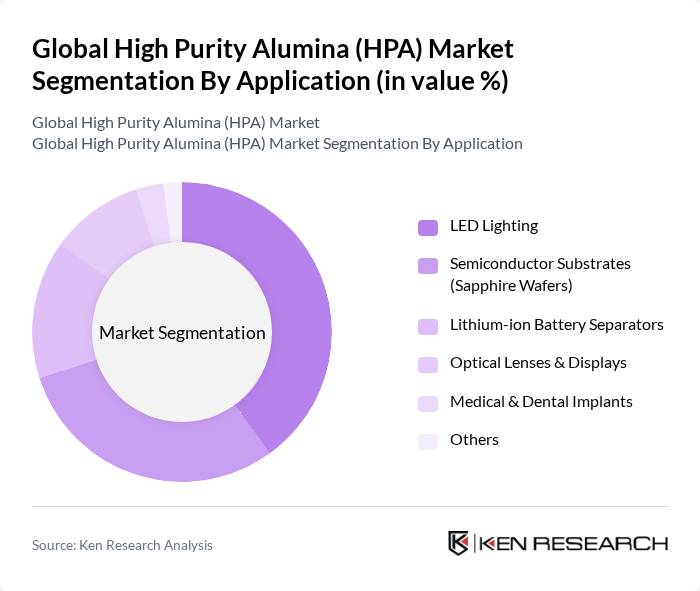

By Application:The applications of high purity alumina include LED lighting, semiconductor substrates (sapphire wafers), lithium-ion battery separators, optical lenses & displays, medical & dental implants, and others. The LED lighting segment represents the largest application area, driven by the global shift towards energy-efficient lighting solutions and regulatory support for sustainable technologies. The semiconductor industry is also a significant consumer, as the demand for high-quality substrates continues to rise. Lithium-ion battery separators are another fast-growing segment, propelled by the expansion of electric vehicles and portable electronics. Advanced ceramics and optical components are increasingly utilizing HPA for its superior thermal stability and corrosion resistance .

The Global High Purity Alumina (HPA) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Altech Chemicals Limited, Sumitomo Chemical Co., Ltd., Nippon Light Metal Company, Ltd., Sasol Limited, Orbite Technologies Inc., FYI Resources Ltd, Baikowski SAS, Hebei Pengda Advanced Materials Technology Co., Ltd., Xuancheng Jingrui New Material Co., Ltd., Honghe Chemical Co., Ltd., Zibo Honghe Chemical Co., Ltd., Alpha HPA Limited, Alcoa Corporation, CHALCO (Aluminum Corporation of China Limited), and Sasol Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the high purity alumina market appears promising, driven by technological advancements and increasing regulatory support for clean technologies. As industries shift towards sustainable practices, the demand for HPA is expected to rise significantly. Innovations in production methods will enhance efficiency, while the growing focus on recycling will create new avenues for HPA applications. Furthermore, strategic partnerships among key players will facilitate market expansion, particularly in emerging economies, fostering a robust growth environment.

| Segment | Sub-Segments |

|---|---|

| By Type | N HPA (99.99% Purity) N HPA (99.999% Purity) N HPA (99.9999% Purity) Others (including 3N and below) |

| By Application | LED Lighting Semiconductor Substrates (Sapphire Wafers) Lithium-ion Battery Separators Optical Lenses & Displays Medical & Dental Implants Others |

| By End-User | Electronics & Electrical Automotive & Transportation Industrial Manufacturing Healthcare Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Rest of APAC) Middle East & Africa Latin America |

| By Price Range | Premium Mid-Range Economy |

| By Product Form | Powder Granules Pellets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| LED Manufacturing Sector | 100 | Product Managers, Supply Chain Analysts |

| Battery Production Industry | 80 | Operations Managers, R&D Directors |

| Ceramics and Coatings Applications | 60 | Technical Sales Representatives, Product Development Managers |

| Pharmaceuticals and Healthcare | 50 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Research Institutions and Academia | 40 | Research Scientists, Professors in Material Science |

The Global High Purity Alumina (HPA) Market is valued at approximately USD 3.8 billion, driven by increasing demand in sectors such as electronics, automotive, and healthcare, particularly for applications like LED lighting and semiconductor technologies.