Global Human Respiratory Syncytial Virus Treatment Market Overview

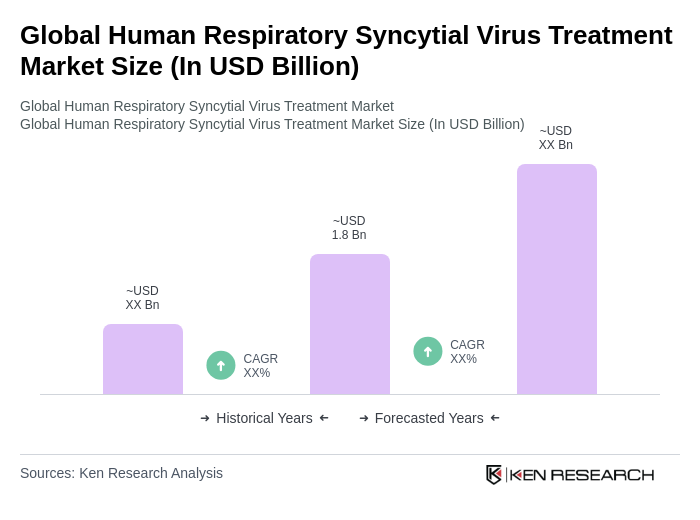

- The Global Human Respiratory Syncytial Virus Treatment Market is valued at USD 1.8 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of RSV infections, particularly among infants and the elderly, alongside advancements in treatment options such as monoclonal antibodies and antiviral drugs. The rising awareness of RSV's impact on public health, coupled with the introduction of new vaccines and combination therapies, has also contributed to the market's expansion. Notably, the surge in global adoption of long-acting monoclonal antibody prophylaxis and rising hospitalizations among adults aged 60 and above have accelerated vaccine uptake and broadened the therapeutic pipeline .

- Key players in this market are predominantly located in North America and Europe, with the United States and Germany leading due to their robust healthcare infrastructure, significant investment in research and development, and high rates of RSV infection. These regions benefit from advanced medical technologies and a strong regulatory framework that supports the development and approval of new treatments. The United States alone accounts for a substantial share of RSV-related hospitalizations, with approximately 58,000 hospitalizations annually in children under five years old .

- In 2023, the U.S. government implemented new regulations aimed at enhancing the accessibility of RSV treatments for high-risk populations. The Inflation Reduction Act, 2022 issued by the United States Congress, includes provisions for expanding access to critical therapies, such as monoclonal antibodies, for infants and elderly patients. This regulatory framework mandates coverage for approved RSV treatments under federal health programs, subsidizes costs for vulnerable groups, and establishes compliance requirements for manufacturers regarding pricing transparency and distribution. These measures ensure timely and effective care for at-risk populations, improving health outcomes and reducing hospitalizations .

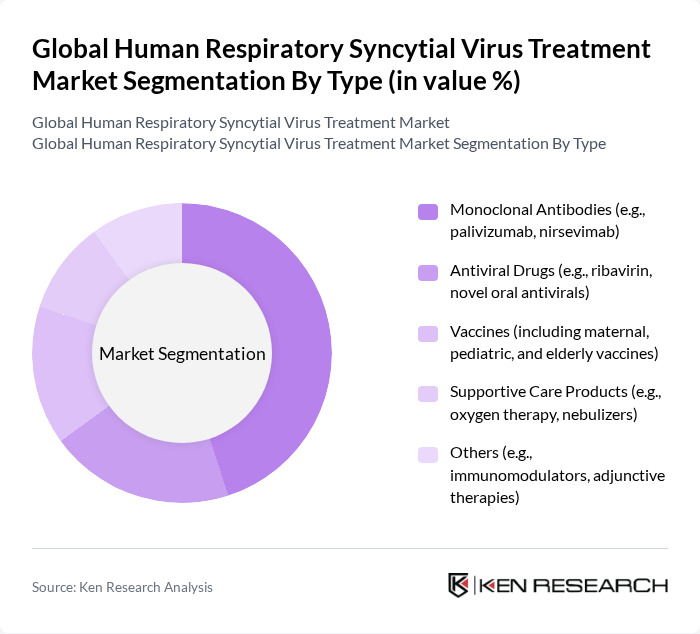

Global Human Respiratory Syncytial Virus Treatment Market Segmentation

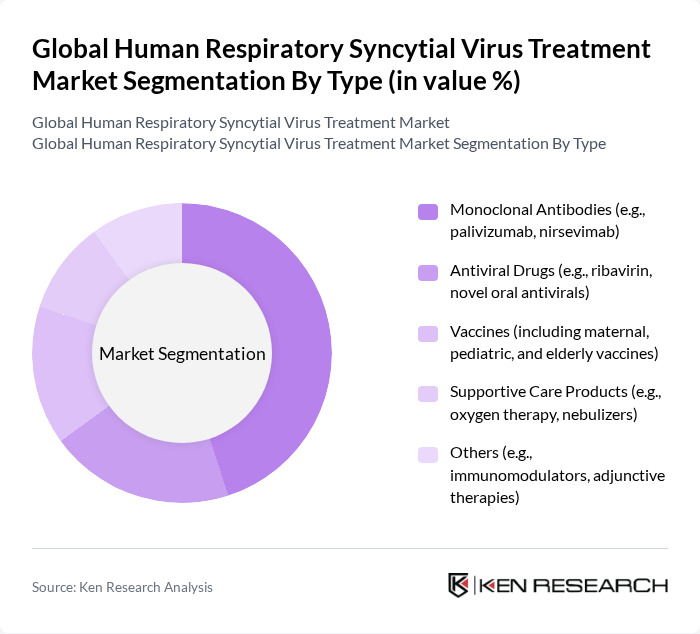

By Type:The market is segmented into various types of treatments, including monoclonal antibodies, antiviral drugs, vaccines, supportive care products, and others. Among these, monoclonal antibodies are currently the leading subsegment due to their effectiveness in preventing severe RSV infections in high-risk infants and elderly adults. The increasing adoption of these therapies, driven by strong clinical efficacy, favorable safety profiles, and recent regulatory approvals for long-acting agents such as nirsevimab, has solidified their dominance in the market. The arrival of new RSV vaccines and combination vaccine strategies is also shaping the competitive landscape, with maternal, pediatric, and elderly vaccines gaining traction .

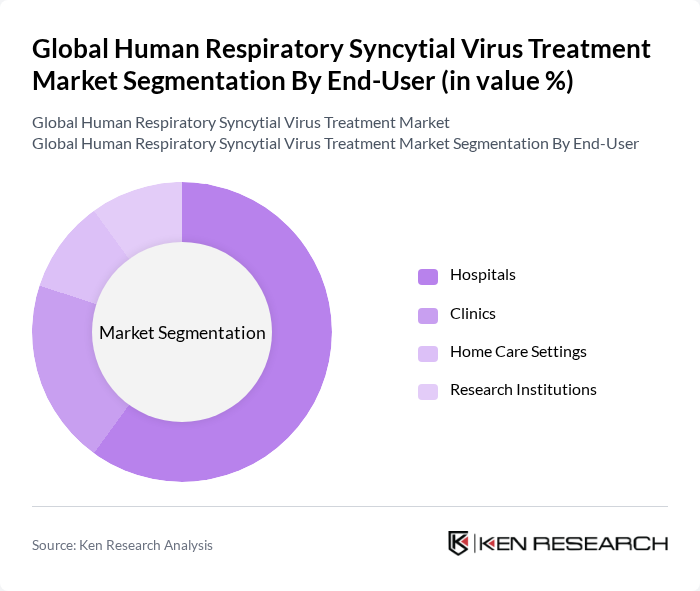

By End-User:The market is categorized based on end-users, including hospitals, clinics, home care settings, and research institutions. Hospitals are the dominant end-user segment, primarily due to the high volume of RSV cases requiring hospitalization, especially among infants and the elderly. The increasing number of hospital admissions for severe RSV infections has led to a greater demand for effective treatment options within these facilities. Clinics and home care settings are also experiencing growth, supported by expanded access to outpatient therapies and point-of-care diagnostics .

Global Human Respiratory Syncytial Virus Treatment Market Competitive Landscape

The Global Human Respiratory Syncytial Virus Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as AbbVie Inc., AstraZeneca PLC, GSK plc, Sanofi S.A., Pfizer Inc., Merck & Co., Inc., Novavax, Inc., Regeneron Pharmaceuticals, Inc., Johnson & Johnson, Roche Holding AG, Takeda Pharmaceutical Company Limited, Vaxart, Inc., MedImmune LLC, Emergent BioSolutions Inc., Bavarian Nordic A/S contribute to innovation, geographic expansion, and service delivery in this space.

Global Human Respiratory Syncytial Virus Treatment Market Industry Analysis

Growth Drivers

- Increasing Prevalence of RSV Infections:The global incidence of respiratory syncytial virus (RSV) infections is significant, with approximately 33 million cases reported annually, particularly among infants and the elderly. According to the World Health Organization, RSV is responsible for around 3.2 million hospitalizations each year. This rising prevalence drives demand for effective treatment options, as healthcare systems seek to manage the increasing burden of RSV-related illnesses, particularly in regions with limited healthcare resources.

- Advancements in Treatment Options:Recent innovations in RSV treatment have led to the development of monoclonal antibodies and antiviral therapies, significantly improving patient outcomes. For instance, the FDA approved palivizumab, which has shown efficacy in reducing RSV hospitalizations by approximately 55% in high-risk infants. The global market for these advanced therapies is projected to reach $1.8 billion in future, reflecting the growing investment in research and development aimed at enhancing treatment efficacy and accessibility.

- Rising Awareness and Diagnosis Rates:Increased awareness of RSV and its implications has led to improved diagnosis rates, particularly in pediatric populations. The Centers for Disease Control and Prevention reported a 25% increase in RSV testing in the last two years, correlating with heightened public health campaigns. This surge in awareness not only facilitates early intervention but also drives the demand for effective treatment solutions, thereby expanding the market for RSV therapies significantly.

Market Challenges

- High Cost of Treatment:The financial burden associated with RSV treatment remains a significant challenge, particularly for families in low-income regions. The average cost of a single dose of palivizumab can exceed $1,200, making it unaffordable for many. According to the American Academy of Pediatrics, the total annual cost of RSV-related hospitalizations in the U.S. is estimated at $1.9 billion, highlighting the economic strain on healthcare systems and families alike.

- Limited Access in Developing Regions:Access to effective RSV treatments is severely restricted in developing regions, where healthcare infrastructure is often inadequate. The World Bank estimates that only 35% of children in low-income countries receive necessary vaccinations, including those for RSV. This disparity not only exacerbates health outcomes but also limits market growth potential in these regions, as healthcare providers struggle to deliver essential services to vulnerable populations.

Global Human Respiratory Syncytial Virus Treatment Market Future Outlook

The future of the RSV treatment market is poised for significant transformation, driven by ongoing advancements in therapeutic options and increased public health initiatives. As research continues to unveil novel treatment modalities, the integration of personalized medicine is expected to enhance patient outcomes. Furthermore, the expansion of telemedicine services will facilitate better management of RSV cases, particularly in underserved areas, ensuring that more patients receive timely and effective care, ultimately improving overall health outcomes.

Market Opportunities

- Development of Novel Therapeutics:The ongoing research into new antiviral agents presents a significant opportunity for market growth. With an estimated $600 million allocated for RSV research in future, pharmaceutical companies are increasingly focused on developing innovative treatments that can address unmet medical needs, potentially transforming the therapeutic landscape for RSV.

- Expansion into Emerging Markets:Emerging markets represent a substantial opportunity for RSV treatment providers. With a projected increase in healthcare spending in regions like Southeast Asia, where spending is expected to reach $1.2 trillion in future, companies can capitalize on the growing demand for effective RSV therapies, thereby enhancing their market presence and profitability.