Region:Global

Author(s):Dev

Product Code:KRAD0458

Pages:94

Published On:August 2025

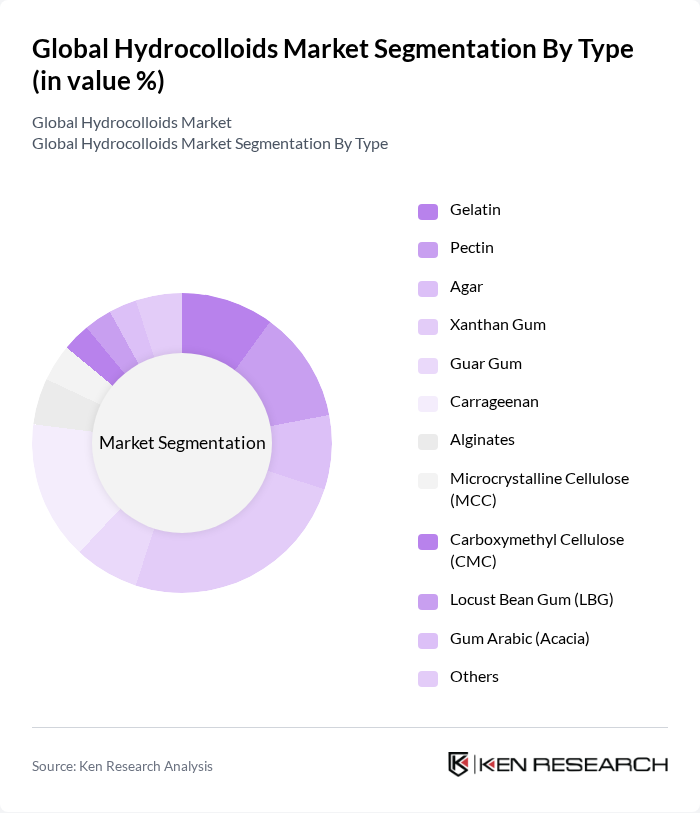

By Type:The hydrocolloids market is segmented into various types, including Gelatin, Pectin, Agar, Xanthan Gum, Guar Gum, Carrageenan, Alginates, Microcrystalline Cellulose (MCC), Carboxymethyl Cellulose (CMC), Locust Bean Gum (LBG), Gum Arabic (Acacia), and Others. Among these, Xanthan Gum is currently the leading subsegment due to its widespread use in food and beverage applications, particularly in gluten-free products and sauces; recent industry analyses highlight xanthan gum’s role as a versatile thickener/stabilizer across food, cosmetics, pharma, and oilfield applications, supported by clean-label and gluten-free trends .

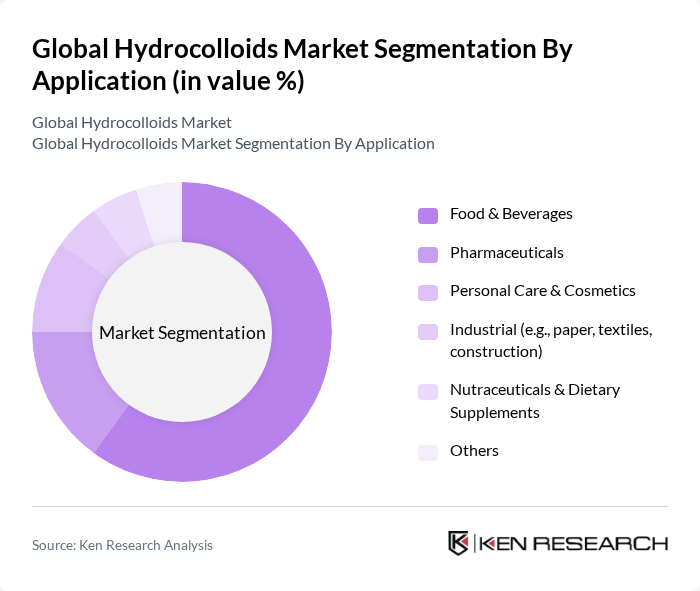

By Application:The applications of hydrocolloids span across various sectors, including Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Industrial (e.g., paper, textiles, construction), Nutraceuticals & Dietary Supplements, and Others. The Food & Beverages segment is the largest application area, driven by the increasing demand for processed foods and the need for texture and stability in food products; industry reports point to expanding use in dairy, bakery, beverages, and plant-based alternatives aligning with clean-label and functionality requirements .

The Global Hydrocolloids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ingredion Incorporated, Cargill, Incorporated, CP Kelco U.S., Inc. (J.M. Huber Corporation), DuPont Nutrition & Biosciences (IFF Health & Biosciences), Tate & Lyle PLC, Kerry Group plc, Nexira, Fufeng Group Company Limited, Gelita AG, PB Leiner (part of Tessenderlo Group), Darling Ingredients (Rousselot), W Hydrocolloids, Inc., Givaudan S.A. (Naturex), Ashland Inc., Symrise AG (Diana Food), Roquette Frères, Jungbunzlauer Suisse AG, FMC Corporation (Alginate business legacy), LBG Sicilia S.r.l., AEP Colloids contribute to innovation, geographic expansion, and service delivery in this space .

The future of the hydrocolloids market appears promising, driven by increasing consumer demand for natural and functional food products. Innovations in hydrocolloid applications, particularly in plant-based and clean label products, are expected to enhance market growth. Additionally, the expansion into emerging economies, where rising disposable incomes and changing dietary preferences are evident, will provide new avenues for market players. Companies that adapt to these trends will likely gain a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Gelatin Pectin Agar Xanthan Gum Guar Gum Carrageenan Alginates Microcrystalline Cellulose (MCC) Carboxymethyl Cellulose (CMC) Locust Bean Gum (LBG) Gum Arabic (Acacia) Others |

| By Application | Food & Beverages Pharmaceuticals Personal Care & Cosmetics Industrial (e.g., paper, textiles, construction) Nutraceuticals & Dietary Supplements Others |

| By End-User | Food Manufacturers (bakery, dairy, confectionery, meats, sauces) Beverage Producers Pharmaceutical Companies Personal Care & Cosmetic Manufacturers Industrial Formulators Others |

| By Distribution Channel | Direct Sales (Key Accounts) Distributors & Traders Online B2B Marketplaces Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Source | Plant-derived Seaweed-derived Microbial-derived Animal-derived Synthetic/Modified |

| By Function | Thickening Gelling Stabilizing Emulsifying Coating/Film-forming Water Binding/Retention |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Applications | 150 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical and Nutraceutical Uses | 120 | Regulatory Affairs Managers, R&D Scientists |

| Cosmetic and Personal Care Products | 80 | Formulation Chemists, Brand Managers |

| Industrial Applications | 70 | Process Engineers, Supply Chain Managers |

| Emerging Markets Insights | 90 | Market Analysts, Business Development Executives |

The Global Hydrocolloids Market is valued at approximately USD 12.3 billion, with estimates ranging from USD 12.3 billion to USD 12.5 billion, reflecting strong demand across various sectors, including food, pharmaceuticals, and personal care.