Region:Global

Author(s):Rebecca

Product Code:KRAC0248

Pages:100

Published On:August 2025

By Type:The ice cream market is segmented into various types, including Dairy-Based Ice Cream, Non-Dairy/Vegan Ice Cream, Low-Fat/Reduced Fat Ice Cream, Gelato, Sorbet, Frozen Yogurt, Artisanal/Ice Cream Bars & Pops, and Others. Dairy-Based Ice Cream remains the dominant segment due to its traditional appeal and widespread consumer acceptance. The increasing trend towards healthier options has also led to a rise in Non-Dairy/Vegan Ice Cream, catering to lactose-intolerant consumers and those seeking plant-based alternatives. Single-serve products such as ice cream bars, cups, cones, and tubs are gaining traction among busy consumers seeking convenience.

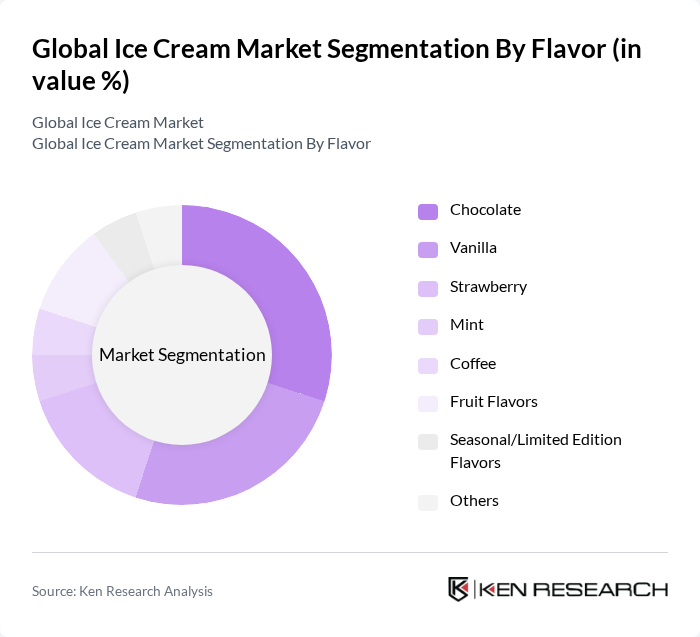

By Flavor:The flavor segmentation of the ice cream market includes Chocolate, Vanilla, Strawberry, Mint, Coffee, Fruit Flavors, Seasonal/Limited Edition Flavors, and Others. Chocolate and Vanilla are the leading flavors, favored for their classic appeal and versatility. The growing trend of unique and exotic flavors has also contributed to the rise of Fruit Flavors and Seasonal/Limited Edition Flavors, attracting adventurous consumers looking for new experiences. Chocolate holds the highest market share globally, followed by vanilla and fruit flavors.

The Global Ice Cream Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever PLC, Nestlé S.A., General Mills, Inc. (Häagen-Dazs), The Kraft Heinz Company, Mars, Incorporated, Blue Bell Creameries LP, Froneri Ltd., Ben & Jerry's, Dairy Farmers of America Inc., Lotte Confectionery (Lotte Corp.), Baskin-Robbins (Inspire Brands Inc.), Amul (Gujarat Cooperative Milk Marketing Federation Ltd.), Talenti Gelato (Unilever), Danone S.A., Jeni's Splendid Ice Creams LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ice cream market in None appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to shape purchasing decisions, brands that prioritize organic and natural ingredients are likely to thrive. Additionally, the rise of subscription-based services and online sales channels will further enhance market accessibility, allowing consumers to explore diverse flavors and brands conveniently. Companies that adapt to these trends will be well-positioned for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dairy-Based Ice Cream Non-Dairy/Vegan Ice Cream Low-Fat/Reduced Fat Ice Cream Gelato Sorbet Frozen Yogurt Artisanal/Ice Cream Bars & Pops Others |

| By Flavor | Chocolate Vanilla Strawberry Mint Coffee Fruit Flavors Seasonal/Limited Edition Flavors Others |

| By Packaging Type | Cups Cones Tubs Pints Bars Cartons Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Food Service/Ice Cream Parlors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Premium Mid-Range Economy |

| By End-User | Individual Consumers Restaurants Cafes Retailers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Ice Cream Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 120 | Ice Cream Consumers, Age 18-45 |

| Food Service Sector Insights | 80 | Restaurant Owners, Food Service Managers |

| Market Trends Analysis | 60 | Market Analysts, Industry Experts |

| Flavor Innovation Feedback | 50 | Product Developers, R&D Managers |

The Global Ice Cream Market is valued at approximately USD 78 billion, reflecting a robust growth driven by consumer demand for innovative flavors and health-conscious options, alongside the expansion of distribution channels.