Region:Global

Author(s):Rebecca

Product Code:KRAD5063

Pages:90

Published On:December 2025

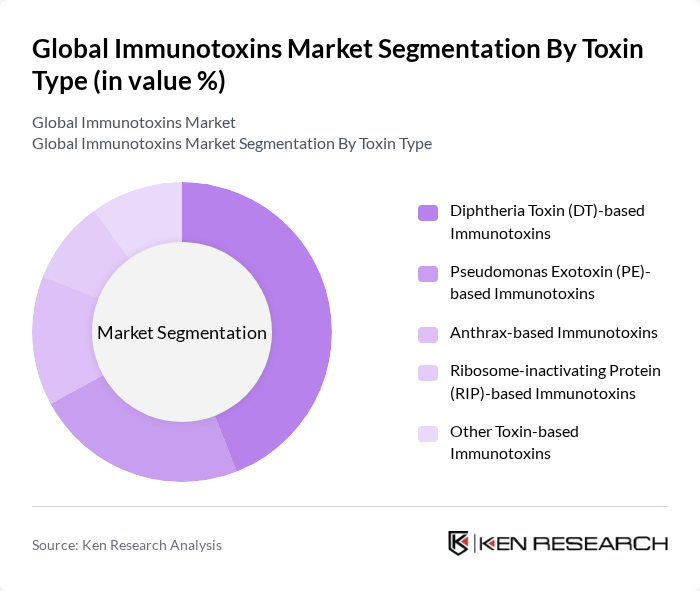

By Toxin Type:The immunotoxins market can be segmented based on the type of toxin used. The primary subsegments include Diphtheria Toxin (DT)-based Immunotoxins, Pseudomonas Exotoxin (PE)-based Immunotoxins, Anthrax-based Immunotoxins, Ribosome-inactivating Protein (RIP)-based Immunotoxins, and Other Toxin-based Immunotoxins. Among these, Diphtheria Toxin-based Immunotoxins are leading due to their demonstrated clinical efficacy in oncology indications and established use in marketed or advanced-stage recombinant fusion toxins, which are designed to selectively target cancer cells while minimizing off?target toxicity to healthy tissues.

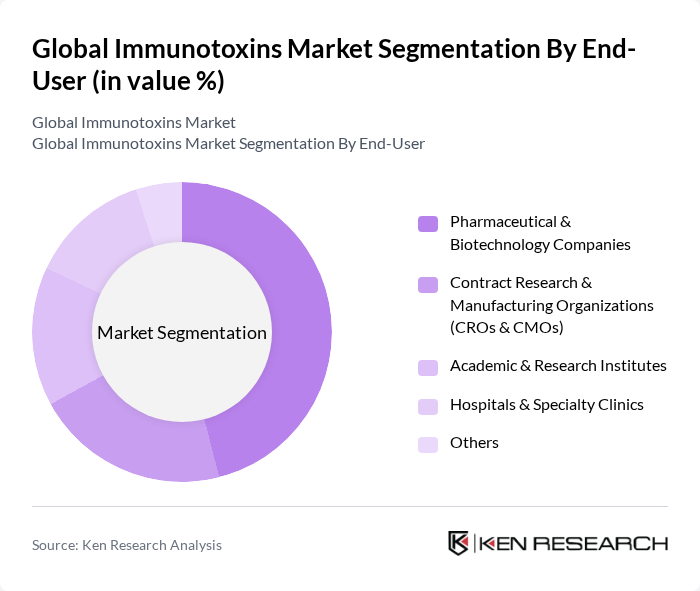

By End-User:The market can also be segmented by end-user categories, which include Pharmaceutical & Biotechnology Companies, Contract Research & Manufacturing Organizations (CROs & CMOs), Academic & Research Institutes, Hospitals & Specialty Clinics, and Others. Pharmaceutical & Biotechnology Companies dominate this segment due to their extensive resources and focus on developing innovative therapies, with this end-use group accounting for the largest share of immunotoxins demand driven by intensive R&D investment, oncology pipelines, and commercialization capabilities.

The Global Immunotoxins Market is characterized by a dynamic mix of regional and international players. Leading participants such as AstraZeneca plc (including MedImmune legacy immunotoxin programs), Takeda Pharmaceutical Company Limited, Sanofi S.A., Bayer AG, Novartis AG, Merck & Co., Inc., F. Hoffmann-La Roche Ltd, ImmunoGen, Inc., Seattle Genetics, Inc. (Seagen Inc.), Molecular Partners AG, NBE-Therapeutics AG, Sorrento Therapeutics, Inc., Mersana Therapeutics, Inc., ADC Therapeutics SA, EndoTAG Immunotherapeutics GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the immunotoxins market appears promising, driven by ongoing advancements in biotechnology and a growing emphasis on personalized medicine. As the healthcare landscape evolves, the integration of immunotoxins into combination therapies is expected to enhance treatment efficacy. Furthermore, the increasing focus on patient-centric approaches will likely lead to the development of more tailored therapies, improving patient outcomes and satisfaction in the long term.

| Segment | Sub-Segments |

|---|---|

| By Toxin Type | Diphtheria Toxin (DT)-based Immunotoxins Pseudomonas Exotoxin (PE)-based Immunotoxins Anthrax-based Immunotoxins Ribosome-inactivating Protein (RIP)-based Immunotoxins Other Toxin-based Immunotoxins |

| By End-User | Pharmaceutical & Biotechnology Companies Contract Research & Manufacturing Organizations (CROs & CMOs) Academic & Research Institutes Hospitals & Specialty Clinics Others |

| By Application | Cancer Therapy Autoimmune Disease Research & Therapy Infectious Disease Research & Therapy Biomedical Research (Target Validation, Cell Depletion, etc.) Others |

| By Route of Administration | Intravenous Intratumoral / Local Delivery Subcutaneous Others |

| By Distribution Channel | Direct Sales to Institutional Customers Third?party Distributors Online / E?commerce Platforms Others |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Research & Development Phase | Preclinical Phase I Clinical Trials Phase II Clinical Trials Phase III Clinical Trials Post?Marketing Surveillance & Lifecycle Management |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinics Utilizing Immunotoxins | 120 | Oncologists, Clinical Researchers |

| Pharmaceutical Companies Developing Immunotoxins | 90 | Product Managers, R&D Directors |

| Regulatory Bodies Overseeing Immunotoxin Approvals | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Patient Advocacy Groups Focused on Cancer Treatments | 60 | Advocacy Leaders, Patient Representatives |

| Healthcare Payers Evaluating Immunotoxin Therapies | 70 | Health Economists, Policy Analysts |

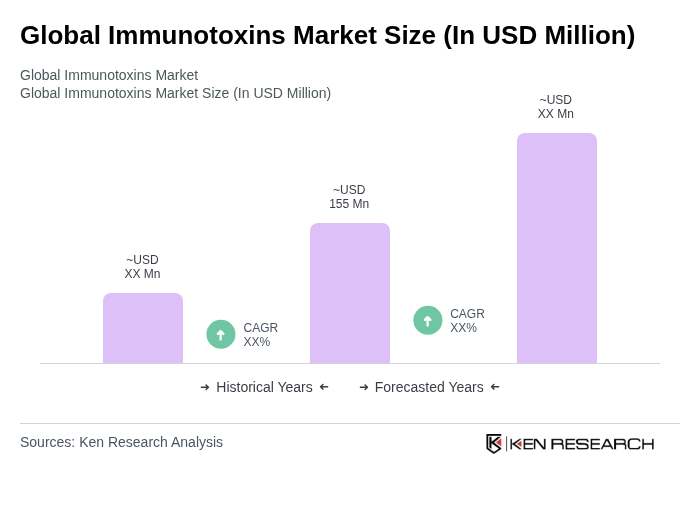

The Global Immunotoxins Market is valued at approximately USD 155 million, driven by the increasing prevalence of cancer and advancements in targeted therapies, including recombinant immunotoxins and antibody-toxin fusion constructs.