Region:Global

Author(s):Shubham

Product Code:KRAA3167

Pages:91

Published On:August 2025

By Type:The market is segmented into various types of services that address distinct aspects of incident response. The primary subsegments include Managed Detection and Response (MDR) Services, Incident Management & Response Services, Forensic Investigation & Analysis Services, Threat Intelligence Services, Security Assessment & Penetration Testing Services, Incident Recovery & Remediation Services, Consulting & Advisory Services, Training & Awareness Services, and Others.Managed Detection and Response (MDR) Servicesare leading the market, driven by their proactive threat identification, real-time monitoring, and rapid mitigation capabilities, which are increasingly preferred by organizations seeking comprehensive security coverage .

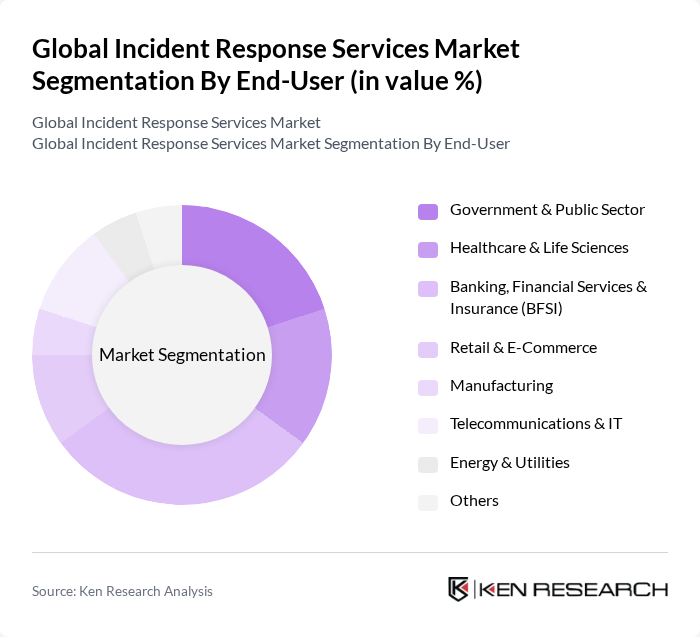

By End-User:The market is segmented based on end-users, including Government & Public Sector, Healthcare & Life Sciences, Banking, Financial Services & Insurance (BFSI), Retail & E-Commerce, Manufacturing, Telecommunications & IT, Energy & Utilities, and Others. TheBFSI sectoris the dominant end-user, reflecting its critical need for robust cybersecurity measures to protect sensitive financial data and comply with evolving regulatory frameworks. The increasing number of cyber threats targeting financial institutions and the introduction of sector-specific regulations have led to heightened demand for incident response services in this segment .

The Global Incident Response Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Security, FireEye, Inc. (now Trellix), CrowdStrike, Inc., Palo Alto Networks, Inc., McAfee, LLC, Cisco Systems, Inc., Check Point Software Technologies Ltd., Rapid7, Inc., Secureworks Corp., Kaspersky Lab, Deloitte Touche Tohmatsu Limited (Deloitte Cyber Risk Services), Accenture Security, Trustwave Holdings, Inc., BAE Systems, Verizon Business (Verizon Enterprise Solutions), Optiv Security Inc., NCC Group, Dell Secureworks, Symantec (Broadcom Inc.), NTT Security contribute to innovation, geographic expansion, and service delivery in this space.

The future of incident response services in the None region is poised for significant transformation, driven by technological advancements and evolving threat landscapes. Organizations are increasingly adopting AI-driven solutions to enhance their incident response capabilities, enabling faster detection and remediation of threats. Additionally, the focus on proactive incident management will likely lead to the development of more comprehensive strategies that integrate threat intelligence, ensuring organizations remain resilient against emerging cyber threats in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed Detection and Response (MDR) Services Incident Management & Response Services Forensic Investigation & Analysis Services Threat Intelligence Services Security Assessment & Penetration Testing Services Incident Recovery & Remediation Services Consulting & Advisory Services Training & Awareness Services Others |

| By End-User | Government & Public Sector Healthcare & Life Sciences Banking, Financial Services & Insurance (BFSI) Retail & E-Commerce Manufacturing Telecommunications & IT Energy & Utilities Others |

| By Industry Vertical | BFSI Energy and Utilities Education Transportation and Logistics IT and Telecom Retail & E-Commerce Healthcare & Life Sciences Government & Defense Others |

| By Service Model | On-Premises Cloud-Based Hybrid |

| By Deployment Type | Managed Services Professional Services |

| By Geography | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Pricing Model | Subscription-Based Pay-Per-Incident Retainer-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Incident Response | 100 | CISOs, IT Security Managers |

| Healthcare Cybersecurity Measures | 60 | Compliance Officers, IT Directors |

| Retail Sector Cyber Incident Management | 50 | Operations Managers, Risk Management Heads |

| Government Agency Response Strategies | 40 | IT Security Analysts, Policy Makers |

| Manufacturing Sector Cyber Resilience | 70 | Plant Managers, Cybersecurity Consultants |

The Global Incident Response Services Market is valued at approximately USD 42 billion, reflecting significant growth driven by increasing cyberattacks, complex IT environments, and the need for rapid incident response and recovery services.