Region:Global

Author(s):Dev

Product Code:KRAA3034

Pages:82

Published On:August 2025

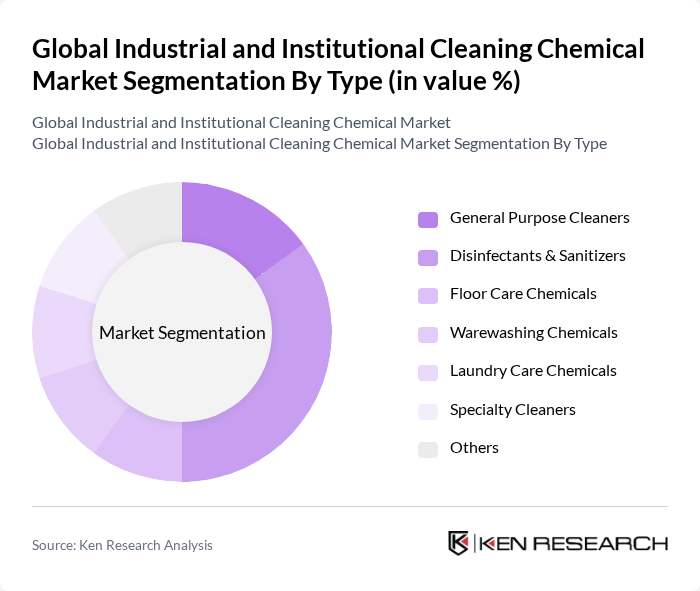

By Type:The market is segmented into General Purpose Cleaners, Disinfectants & Sanitizers, Floor Care Chemicals, Warewashing Chemicals, Laundry Care Chemicals, Specialty Cleaners, and Others. Disinfectants & Sanitizers continue to lead due to heightened hygiene awareness and infection control needs, especially in healthcare and food service sectors. The demand for eco-friendly and high-performance cleaning solutions is driving innovation, with manufacturers introducing plant-based, non-toxic, and biodegradable products to meet sustainability goals.

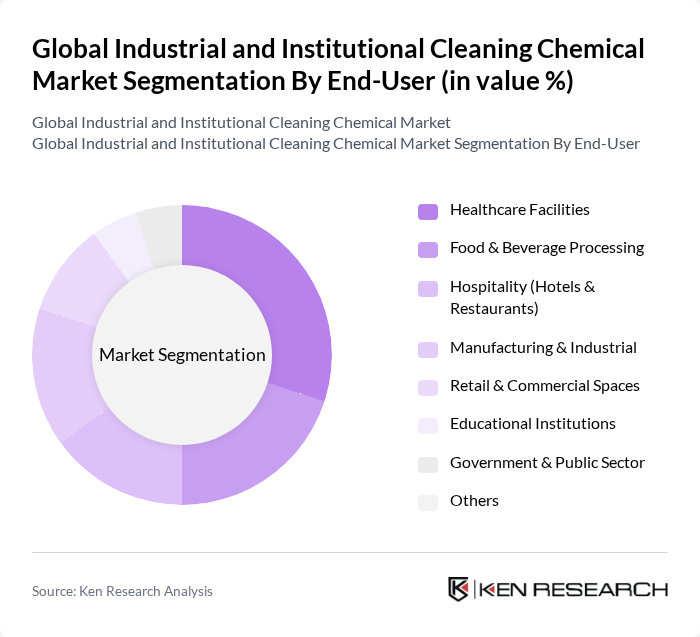

By End-User:This segmentation includes Healthcare Facilities, Food & Beverage Processing, Hospitality (Hotels & Restaurants), Manufacturing & Industrial, Retail & Commercial Spaces, Educational Institutions, Government & Public Sector, and Others. Healthcare Facilities remain the leading segment, driven by ongoing infection control requirements and strict cleaning protocols. The Food & Beverage Processing sector is also a major contributor, supported by rising food safety regulations and the need for specialized cleaning chemicals.

The Global Industrial and Institutional Cleaning Chemical Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ecolab Inc., Diversey Holdings, Ltd., SC Johnson Professional, Reckitt Benckiser Group plc, Procter & Gamble Co., Henkel AG & Co. KGaA, Clorox Professional Products Company, 3M Company, BASF SE, Solvay S.A., Christeyns NV, Zep Inc., Spartan Chemical Company, Inc., Kärcher SE & Co. KG, S.C. Johnson & Son, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial and institutional cleaning chemical market is poised for significant transformation, driven by sustainability and technological integration. As regulations tighten, companies will increasingly adopt eco-friendly practices, with a projected 25% of new products being biodegradable in future. Additionally, the rise of automation in cleaning processes is expected to enhance efficiency, with smart cleaning technologies anticipated to account for 30% of the market in future, reflecting a shift towards innovative solutions that meet modern demands.

| Segment | Sub-Segments |

|---|---|

| By Type | General Purpose Cleaners Disinfectants & Sanitizers Floor Care Chemicals Warewashing Chemicals Laundry Care Chemicals Specialty Cleaners Others |

| By End-User | Healthcare Facilities Food & Beverage Processing Hospitality (Hotels & Restaurants) Manufacturing & Industrial Retail & Commercial Spaces Educational Institutions Government & Public Sector Others |

| By Application | Industrial Cleaning Institutional Cleaning Commercial Cleaning Household Cleaning Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Retail Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging Others |

| By Chemical Composition | Organic Chemicals Inorganic Chemicals Biodegradable Chemicals Others |

| By Price Range | Economy Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Cleaning Solutions | 100 | Facility Managers, Infection Control Officers |

| Educational Institution Cleaning Products | 80 | Procurement Managers, Operations Directors |

| Hospitality Sector Cleaning Chemicals | 90 | Housekeeping Supervisors, General Managers |

| Food Service Cleaning Solutions | 60 | Food Safety Managers, Supply Chain Coordinators |

| Industrial Cleaning Applications | 50 | Maintenance Managers, Safety Officers |

The Global Industrial and Institutional Cleaning Chemical Market is valued at approximately USD 80 billion, driven by increasing hygiene standards, health regulations, and a growing demand for eco-friendly cleaning solutions, particularly in the wake of heightened hygiene concerns post-pandemic.