Region:Global

Author(s):Rebecca

Product Code:KRAA2436

Pages:95

Published On:August 2025

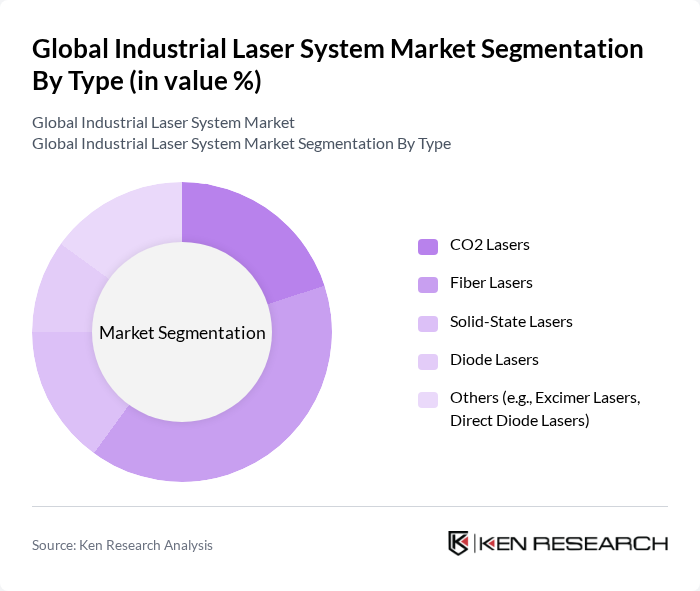

By Type:The market is segmented into various types of lasers, including CO2 Lasers, Fiber Lasers, Solid-State Lasers, Diode Lasers, and Others (e.g., Excimer Lasers, Direct Diode Lasers). Among these,Fiber Lasersare currently dominating the market due to their superior efficiency, versatility, and lower operational costs. Fiber lasers are widely used in cutting, welding, and marking applications, making them a preferred choice for manufacturers seeking to enhance productivity and reduce energy consumption. The increasing adoption of automation and integration with advanced manufacturing processes, such as robotics and additive manufacturing, further propels the demand for fiber lasers, solidifying their market leadership.

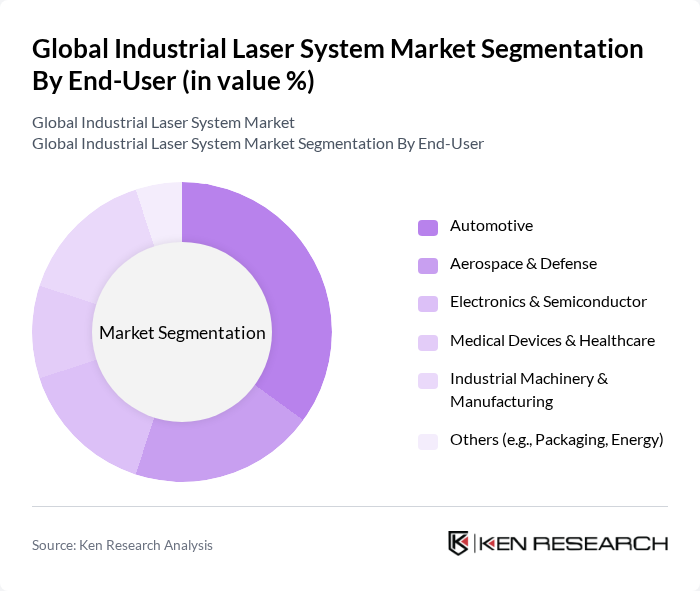

By End-User:The industrial laser system market is segmented by end-user industries, including Automotive, Aerospace & Defense, Electronics & Semiconductor, Medical Devices & Healthcare, Industrial Machinery & Manufacturing, and Others (e.g., Packaging, Energy). TheAutomotive sectoris the leading end-user, driven by the increasing need for precision in manufacturing processes, lightweight material processing, and the growing trend of electric vehicles. The demand for high-quality laser cutting and welding in automotive production lines, along with the adoption of laser systems for battery and electronic component manufacturing, is a significant factor contributing to the sector's dominance.

The Global Industrial Laser System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coherent, Inc., TRUMPF GmbH + Co. KG, IPG Photonics Corporation, Han's Laser Technology Industry Group Co., Ltd., Rofin-Sinar Technologies Inc., Lumentum Operations LLC, Mitsubishi Electric Corporation, Amada Co., Ltd., Laserline GmbH, Prima Industrie S.p.A., Sisma S.p.A., GSI Group Inc., Newport Corporation, Biesse S.p.A., Trotec Laser GmbH, Jenoptik AG, Bystronic Laser AG, FANUC Corporation, II-VI Incorporated (now Coherent Corp.), Epilog Laser contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial laser system market appears promising, driven by continuous technological advancements and increasing automation across industries. As manufacturers seek to enhance productivity and reduce operational costs, the integration of AI and IoT technologies into laser systems is expected to gain traction. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly laser solutions, further shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | CO2 Lasers Fiber Lasers Solid-State Lasers Diode Lasers Others (e.g., Excimer Lasers, Direct Diode Lasers) |

| By End-User | Automotive Aerospace & Defense Electronics & Semiconductor Medical Devices & Healthcare Industrial Machinery & Manufacturing Others (e.g., Packaging, Energy) |

| By Application | Cutting Welding Marking & Engraving Drilling Additive Manufacturing (3D Printing) Others (e.g., Surface Treatment, Micro-Machining) |

| By Component | Laser Source Control Systems & Software Optics (Lenses, Mirrors, Beam Delivery) Cooling Systems Power Supply & Electronics Others |

| By Sales Channel | Direct Sales Distributors & System Integrators Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, ASEAN, Oceania, Rest of Asia Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of MEA) |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Laser Applications | 100 | Manufacturing Engineers, Production Managers |

| Aerospace Component Fabrication | 80 | Quality Assurance Managers, R&D Engineers |

| Electronics Laser Marking | 70 | Operations Managers, Product Development Engineers |

| Medical Device Manufacturing | 50 | Regulatory Affairs Specialists, Production Supervisors |

| Metal Fabrication Industry | 90 | Procurement Managers, Technical Directors |

The Global Industrial Laser System Market is valued at approximately USD 25 billion, reflecting significant growth driven by advancements in laser technology and increasing demand for precision manufacturing across various sectors, including automotive, electronics, aerospace, and healthcare.