Global Additive Manufacturing Market Overview

- The Global Additive Manufacturing Market is valued at USD 35 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in technology, increasing demand for customized products, and the rising adoption of 3D printing across various industries. The market has seen significant investments in research and development, leading to innovative applications and materials that enhance production efficiency and reduce costs. Key growth drivers include the proliferation of industrial 3D printers, rapid prototyping for medical devices, and increasing use of additive manufacturing in electric vehicle production, aerospace, and healthcare sectors .

- Key players in this market include the United States, Germany, and China, which dominate due to their strong industrial base, technological advancements, and significant investments in additive manufacturing technologies. The U.S. leads in innovation and application across sectors like aerospace and healthcare, while Germany is known for its engineering prowess and high-quality manufacturing standards. China, with its vast manufacturing capabilities, is rapidly expanding its footprint in the additive manufacturing space .

- In 2022, the U.S. government launched the Additive Manufacturing Forward Program, an initiative to promote the use of additive manufacturing in defense and other advanced manufacturing applications. This program, coordinated by the White House, encourages major manufacturers to support smaller suppliers in adopting 3D printing, and includes funding for research and development projects to enhance the capabilities of additive manufacturing for military and industrial use. This regulatory initiative is designed to maintain the U.S. competitive edge in advanced manufacturing .

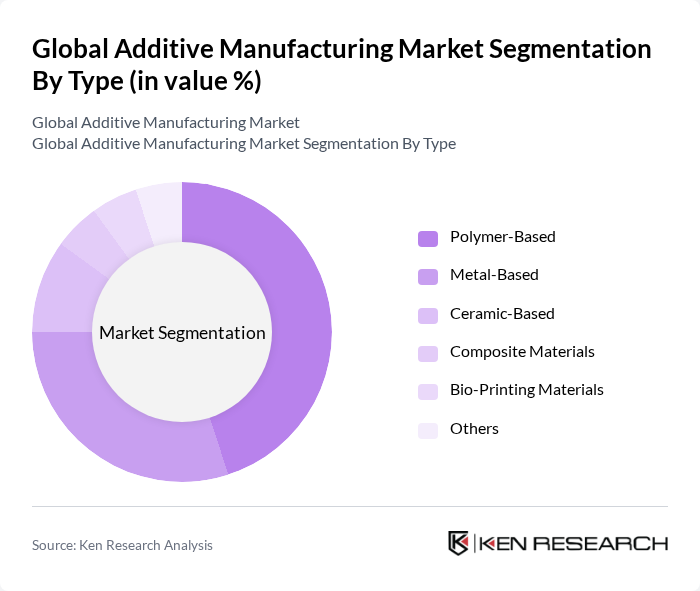

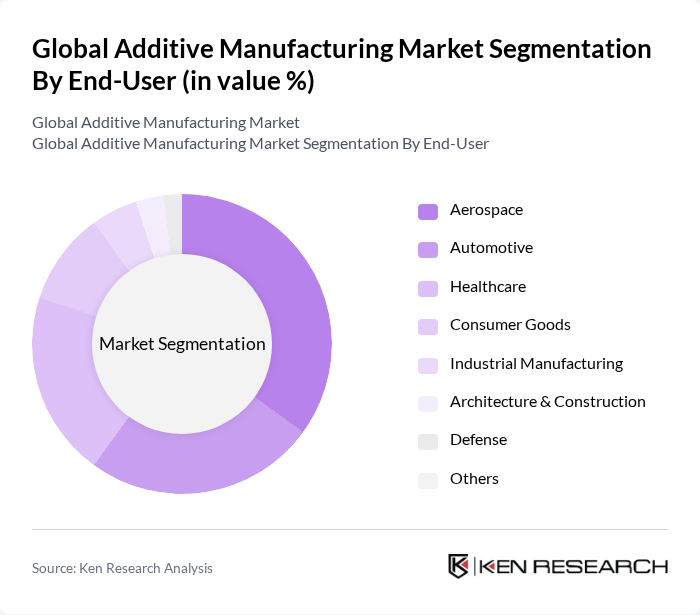

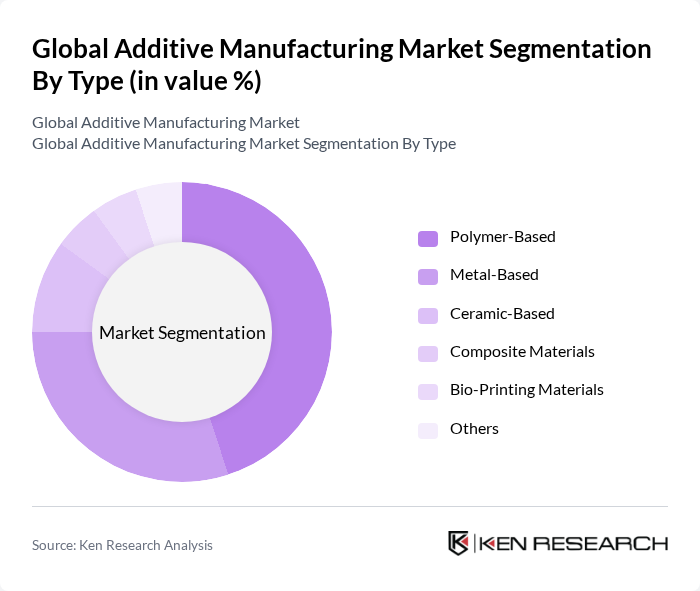

Global Additive Manufacturing Market Segmentation

By Type:The additive manufacturing market is segmented into various types, including Polymer-Based, Metal-Based, Ceramic-Based, Composite Materials, Bio-Printing Materials, and Others. Among these, Polymer-Based materials dominate the market due to their versatility, cost-effectiveness, and wide range of applications in industries such as consumer goods and healthcare. The increasing demand for lightweight and durable components in automotive and aerospace sectors further drives the growth of polymer-based additive manufacturing. Metal-Based additive manufacturing is also experiencing rapid growth, particularly in aerospace and automotive, due to the need for high-strength, complex components .

By End-User:The end-user segmentation includes Aerospace, Automotive, Healthcare, Consumer Goods, Industrial Manufacturing, Architecture & Construction, Defense, and Others. The aerospace sector is a significant contributor to the additive manufacturing market, driven by the need for lightweight components and complex geometries that traditional manufacturing methods cannot achieve. The healthcare sector is also rapidly adopting additive manufacturing for custom implants and prosthetics, further enhancing its market share. Automotive and industrial manufacturing are also major adopters, leveraging additive manufacturing for prototyping, tooling, and production of intricate parts .

Global Additive Manufacturing Market Competitive Landscape

The Global Additive Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stratasys Ltd., 3D Systems Corporation, EOS GmbH, HP Inc., Materialise NV, GE Additive, SLM Solutions Group AG, Renishaw plc, Ultimaker B.V., Formlabs Inc., Xometry Inc., Carbon, Inc., Desktop Metal, Inc., Nikon SLM Solutions AG, Markforged, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Additive Manufacturing Market Industry Analysis

Growth Drivers

- Increased Demand for Customization:The global shift towards personalized products is driving the additive manufacturing market. In future, the customization market is projected to reach $1.5 trillion, with 60% of consumers preferring tailored solutions. This trend is particularly evident in sectors like fashion and consumer electronics, where unique designs and specifications are increasingly sought after. The ability to produce customized items on-demand significantly enhances customer satisfaction and loyalty, further propelling market growth.

- Advancements in Material Science:Innovations in material science are crucial for the additive manufacturing sector. In future, the global advanced materials market is expected to exceed $100 billion, with significant investments in polymers and metals. These advancements enable the production of stronger, lighter, and more durable components, particularly in aerospace and automotive industries. Enhanced material properties not only improve product performance but also expand the range of applications for additive manufacturing technologies.

- Sustainability and Waste Reduction:The growing emphasis on sustainability is a key driver for additive manufacturing. In future, the global green technology market is projected to reach $2 trillion, with additive manufacturing contributing to waste reduction by minimizing excess material usage. This technology allows for efficient production processes, reducing the carbon footprint associated with traditional manufacturing methods. Companies adopting sustainable practices are likely to gain competitive advantages, further boosting market demand.

Market Challenges

- High Initial Investment Costs:One of the significant barriers to widespread adoption of additive manufacturing is the high initial investment required. In future, the average cost of industrial 3D printers can range from $50,000 to over $1 million, depending on the technology and capabilities. This financial burden can deter small and medium-sized enterprises from investing in additive manufacturing, limiting market growth and innovation in the sector.

- Skills Gap in Workforce:The additive manufacturing industry faces a notable skills gap, with a shortage of qualified professionals. In future, it is estimated that 2.4 million manufacturing jobs could remain unfilled due to a lack of skilled workers. This gap hinders the effective implementation of advanced manufacturing technologies and slows down the industry's overall growth. Companies must invest in training and development programs to bridge this gap and enhance workforce capabilities.

Global Additive Manufacturing Market Future Outlook

The future of the additive manufacturing market appears promising, driven by technological advancements and increasing applications across various sectors. As industries continue to embrace digital transformation, the integration of IoT and AI technologies will enhance production efficiency and customization capabilities. Furthermore, the focus on sustainability will lead to innovative practices that reduce waste and energy consumption. These trends indicate a robust growth trajectory, positioning additive manufacturing as a pivotal component of modern manufacturing strategies.

Market Opportunities

- Expansion in Aerospace and Automotive Sectors:The aerospace and automotive industries are increasingly adopting additive manufacturing for lightweight components and complex geometries. In future, the aerospace sector alone is expected to invest over $3 billion in additive technologies, enhancing performance and reducing costs. This trend presents significant opportunities for manufacturers to innovate and capture market share in these high-value sectors.

- Growth in Healthcare Applications:The healthcare sector is witnessing a surge in the use of additive manufacturing for customized implants and prosthetics. In future, the global market for 3D-printed medical devices is projected to reach $2 billion. This growth is driven by the demand for personalized healthcare solutions, offering manufacturers a lucrative opportunity to develop specialized products that cater to individual patient needs.