Region:Global

Author(s):Dev

Product Code:KRAA3081

Pages:84

Published On:August 2025

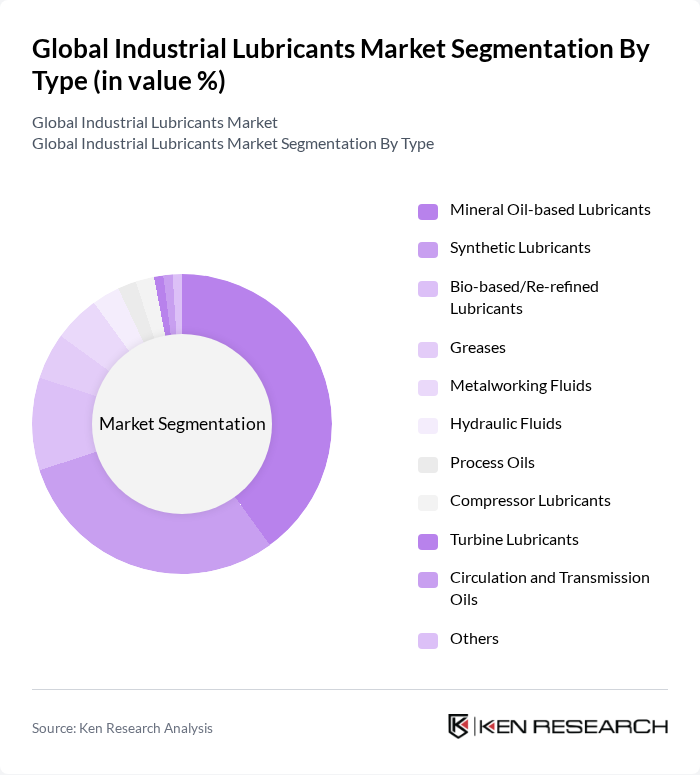

By Type:The market is segmented into various types of lubricants, including Mineral Oil-based Lubricants, Synthetic Lubricants, Bio-based/Re-refined Lubricants, Greases, Metalworking Fluids, Hydraulic Fluids, Process Oils, Compressor Lubricants, Turbine Lubricants, Circulation and Transmission Oils, and Others. Among these,Mineral Oil-based Lubricantsdominate the market due to their widespread use in general industrial applications, driven by cost-effectiveness and broad availability.Synthetic Lubricantsare gaining traction due to their superior performance, longer service intervals, and suitability for high-temperature and high-stress environments. The shift towardsbio-based and re-refined lubricantsis accelerating, supported by regulatory pressure and sustainability initiatives.

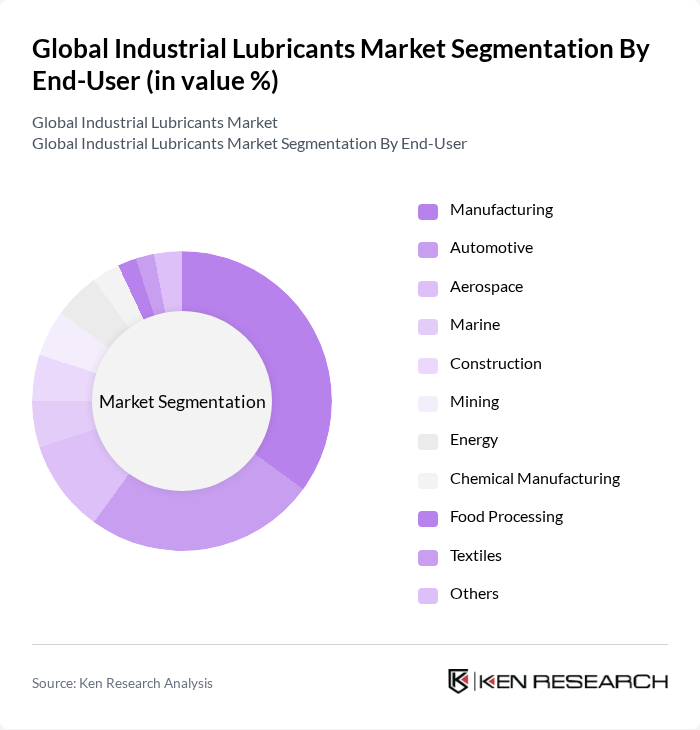

By End-User:The end-user segmentation includes Manufacturing, Automotive, Aerospace, Marine, Construction, Mining, Energy, Chemical Manufacturing, Food Processing, Textiles, and Others. TheManufacturing sectoris the largest consumer of industrial lubricants, driven by the need for efficient machinery operation and maintenance. TheAutomotive sectorfollows closely, with increasing vehicle production and maintenance activities fueling demand for high-quality lubricants. Sectors such as mining, energy, and food processing are also witnessing increased adoption due to their expanding industrial activities and the need for specialized lubricant solutions.

The Global Industrial Lubricants Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Shell plc, BP plc, Chevron Corporation, TotalEnergies SE, Fuchs Petrolub SE, Klüber Lubrication (Freudenberg Group), Castrol Limited (BP Group), Valvoline Inc., and The Lubrizol Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial lubricants market is poised for transformation, driven by sustainability and technological advancements. As industries increasingly adopt eco-friendly practices, the demand for bio-based lubricants is expected to rise significantly. Additionally, the integration of digital technologies in lubrication management will enhance operational efficiency, allowing for predictive maintenance and reduced downtime. These trends indicate a shift towards more sustainable and efficient lubrication solutions, aligning with global environmental goals and industry needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Mineral Oil-based Lubricants Synthetic Lubricants Bio-based/Re-refined Lubricants Greases Metalworking Fluids Hydraulic Fluids Process Oils Compressor Lubricants Turbine Lubricants Circulation and Transmission Oils Others |

| By End-User | Manufacturing Automotive Aerospace Marine Construction Mining Energy Chemical Manufacturing Food Processing Textiles Others |

| By Application | Engine Oils Gear Oils Compressor Oils Turbine Oils Industrial Oils Hydraulic Oils Metalworking Fluids Greases Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Retail Outlets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Lubricant Usage | 120 | Production Managers, Maintenance Engineers |

| Automotive Industry Lubricant Procurement | 90 | Procurement Managers, Quality Control Officers |

| Aerospace Lubricant Applications | 60 | Technical Directors, R&D Managers |

| Marine Lubricants Market Insights | 50 | Fleet Managers, Marine Engineers |

| Energy Sector Lubricant Requirements | 70 | Operations Managers, Environmental Compliance Officers |

The Global Industrial Lubricants Market is valued at approximately USD 74 billion, driven by the increasing demand for high-performance lubricants across various industries, including manufacturing, automotive, and energy sectors.