Region:Asia

Author(s):Shubham

Product Code:KRAE0449

Pages:98

Published On:December 2025

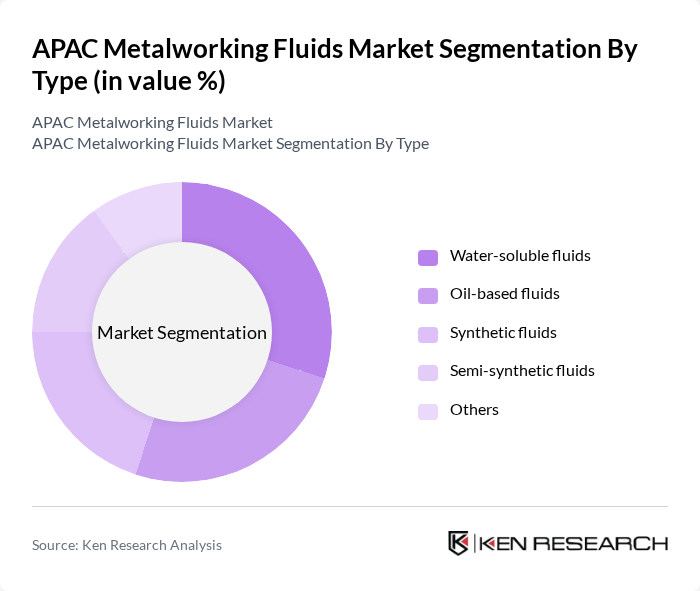

By Type:The market is segmented into various types of metalworking fluids, including water-soluble fluids, oil-based fluids, synthetic fluids, semi-synthetic fluids, and others. Water-soluble fluids are gaining traction due to their cooling properties and ease of use, while synthetic fluids are preferred for their superior performance and environmental benefits. Oil-based fluids continue to hold a significant share due to their traditional use in various applications.

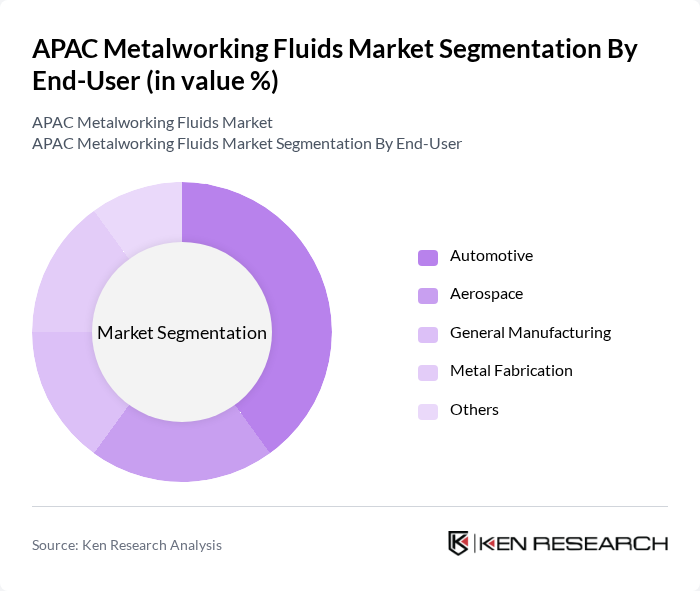

By End-User:The end-user segmentation includes automotive, aerospace, general manufacturing, metal fabrication, and others. The automotive sector is the largest consumer of metalworking fluids, driven by the need for precision machining and high-quality finishes. Aerospace and general manufacturing also contribute significantly, as they require specialized fluids for complex manufacturing processes.

The APAC Metalworking Fluids Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil, Castrol, TotalEnergies, Fuchs Petrolub, Chevron, Houghton International, Quaker Chemical Corporation, BP, Idemitsu Kosan, Milacron, Master Fluid Solutions, Blaser Swisslube, JAX Inc., Lube-Tech, Chemtool contribute to innovation, geographic expansion, and service delivery in this space.

The APAC metalworking fluids market is poised for significant transformation driven by technological advancements and sustainability trends. As industries increasingly adopt automation and smart manufacturing practices, the demand for high-performance and eco-friendly metalworking fluids will rise. Additionally, the focus on health and safety standards will shape product development, ensuring compliance with evolving regulations. This dynamic environment presents opportunities for innovation and growth, positioning the market for a robust future in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-soluble fluids Oil-based fluids Synthetic fluids Semi-synthetic fluids Others |

| By End-User | Automotive Aerospace General Manufacturing Metal Fabrication Others |

| By Application | Machining Grinding Forming Cutting Others |

| By Chemical Composition | Mineral oil-based Biodegradable Non-toxic Others |

| By Packaging Type | Bulk packaging Drums Pails Others |

| By Distribution Channel | Direct sales Distributors Online sales Others |

| By Region | North Asia Southeast Asia South Asia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing | 100 | Production Managers, Quality Control Engineers |

| Aerospace Component Production | 80 | Process Engineers, Supply Chain Managers |

| Metal Fabrication Shops | 70 | Shop Floor Supervisors, Operations Managers |

| Machinery Manufacturing | 90 | Technical Directors, Product Development Managers |

| Research & Development in Metalworking | 60 | R&D Managers, Chemical Engineers |

The APAC Metalworking Fluids Market is valued at approximately USD 8.20 billion, reflecting significant growth driven by the expanding manufacturing sectors, particularly in automotive, electronics, and machinery industries.