Global Industrial Refrigeration System Market Overview

- The Global Industrial Refrigeration System Market is valued at USD 21 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for energy-efficient refrigeration solutions across industries such as food and beverage, pharmaceuticals, and chemical processing. The need for reliable cold storage, expansion of global food supply chains, and the adoption of advanced refrigeration technologies are key market drivers. The integration of IoT-enabled monitoring, automation, and predictive maintenance is further enhancing operational efficiency and reducing costs, while the shift toward natural refrigerants like CO? and ammonia is accelerating in response to sustainability goals and regulatory requirements .

- Key players in this market are concentrated in regions such as North America, Europe, and Asia-Pacific. The United States and Germany lead due to their advanced industrial infrastructure and significant investments in refrigeration technologies. China and India are rapidly emerging as major markets, driven by industrialization, urbanization, and the expansion of cold chain logistics to support food, pharmaceutical, and chemical sectors .

- The F-Gas Regulation (EU) No 517/2014, issued by the European Parliament and Council, aims to reduce greenhouse gas emissions by phasing down the use of hydrofluorocarbons (HFCs) in refrigeration systems. This regulation mandates the adoption of low-GWP refrigerants, requiring manufacturers and operators to transition toward more environmentally friendly alternatives and comply with strict leak detection, reporting, and maintenance protocols .

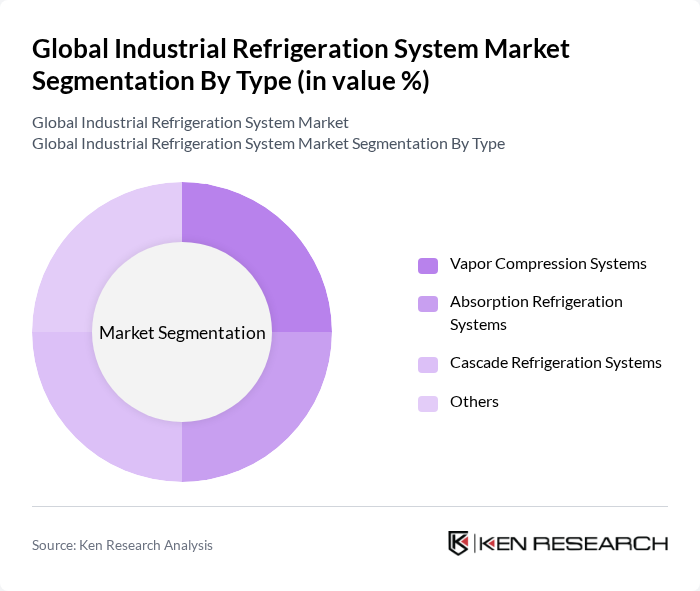

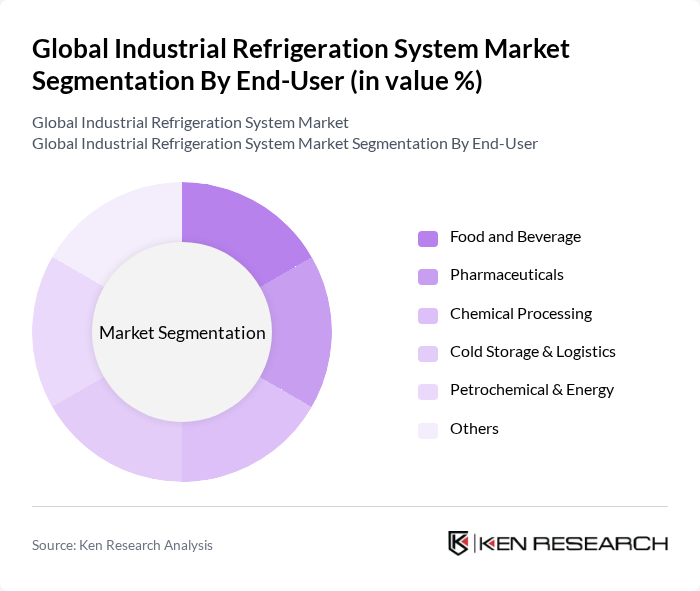

Global Industrial Refrigeration System Market Segmentation

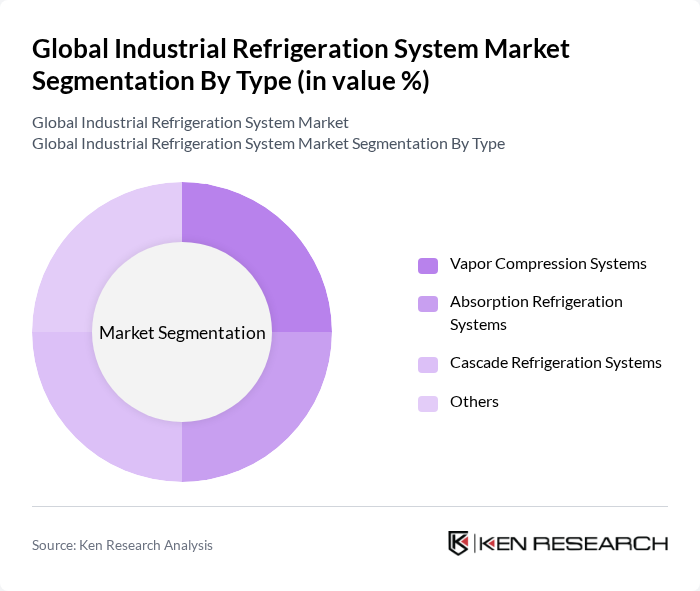

By Type:The market is segmented into various types of refrigeration systems, including Vapor Compression Systems, Absorption Refrigeration Systems, Cascade Refrigeration Systems, and Others. Among these, Vapor Compression Systems account for the largest market share due to their high efficiency, reliability, and broad applicability across industrial sectors. The increasing focus on energy efficiency, cost-effectiveness, and the integration of smart technologies further drives the preference for these systems, solidifying their position as the leading choice for industrial refrigeration .

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Chemical Processing, Cold Storage & Logistics, Petrochemical & Energy, and Others. The Food and Beverage sector represents the largest end-user segment, driven by the critical need for safe storage and preservation of perishable goods. The expansion of cold chain logistics, rising demand for processed and packaged foods, and stringent food safety regulations further reinforce the dominance of this segment in the industrial refrigeration market .

Global Industrial Refrigeration System Market Competitive Landscape

The Global Industrial Refrigeration System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrier Global Corporation, Daikin Industries, Ltd., Johnson Controls International plc, Emerson Electric Co., GEA Group AG, Lennox International Inc., Trane Technologies plc, Bitzer SE, Danfoss A/S, Mitsubishi Electric Corporation, Panasonic Corporation, Hillphoenix, Inc., AHT Cooling Systems GmbH, Frigel Firenze S.p.A., Kysor Warren LLC, Parker Hannifin Corporation, Copeland (formerly Emerson Climate Technologies), Rivacold S.r.l., SCM Frigo S.p.A., Weiss Umwelttechnik GmbH contribute to innovation, geographic expansion, and service delivery in this space.

Global Industrial Refrigeration System Market Industry Analysis

Growth Drivers

- Increasing Demand for Energy-Efficient Systems:The global push for energy efficiency is driving the industrial refrigeration market, with energy-efficient systems projected to reduce energy consumption by up to 30%. According to the International Energy Agency, energy-efficient technologies could save approximately 1,500 terawatt-hours (TWh) annually in future. This demand is particularly strong in regions where energy costs are high, prompting industries to invest in advanced refrigeration solutions that lower operational costs and enhance sustainability.

- Expansion of the Food and Beverage Industry:The food and beverage sector is a significant driver of industrial refrigeration, with the global market expected to reach $5 trillion in future. This growth is fueled by increasing consumer demand for fresh and frozen products, necessitating robust refrigeration systems. The World Bank reports that food production must increase by 70% to meet global demand by 2050, further emphasizing the need for efficient refrigeration solutions to maintain product quality and safety.

- Rising Environmental Regulations:Stricter environmental regulations are compelling industries to adopt sustainable refrigeration practices. The European Union's F-Gas Regulation aims to reduce greenhouse gas emissions by 70% in future, pushing companies to transition to low-GWP refrigerants. Compliance with these regulations is expected to drive investments in eco-friendly refrigeration technologies, with the market for natural refrigerants projected to grow significantly, reaching $1.2 billion in future.

Market Challenges

- High Initial Investment Costs:The upfront costs associated with industrial refrigeration systems can be a significant barrier to entry, often exceeding $100,000 for large-scale installations. Many companies face challenges in justifying these expenses, especially in regions with limited access to financing. This financial hurdle can delay the adoption of advanced refrigeration technologies, impacting overall market growth and innovation in the sector.

- Complexity of Installation and Maintenance:The installation and maintenance of industrial refrigeration systems require specialized skills and knowledge, which can be a challenge in many regions. According to industry reports, approximately 30% of refrigeration systems experience operational issues due to improper installation or lack of maintenance. This complexity can lead to increased downtime and operational inefficiencies, discouraging potential investments in new systems.

Global Industrial Refrigeration System Market Future Outlook

The future of the industrial refrigeration market is poised for significant transformation, driven by technological advancements and sustainability initiatives. As industries increasingly adopt IoT-enabled refrigeration systems, operational efficiency and monitoring capabilities will improve, reducing energy consumption. Additionally, the shift towards natural refrigerants will align with global environmental goals, fostering innovation. Emerging markets, particularly in Asia-Pacific and Africa, present substantial growth opportunities, as rising urbanization and food demand necessitate advanced refrigeration solutions to support local economies.

Market Opportunities

- Growth in Cold Chain Logistics:The cold chain logistics sector is expected to expand significantly, with the global market projected to reach $500 billion in future. This growth is driven by the increasing need for temperature-controlled supply chains, particularly in the pharmaceutical and food industries. Enhanced refrigeration systems will be crucial in maintaining product integrity and safety throughout the supply chain.

- Adoption of IoT in Refrigeration Systems:The integration of IoT technologies in refrigeration systems is set to revolutionize the industry, with an estimated market value of $1.5 billion in future. IoT-enabled systems will provide real-time monitoring and predictive maintenance, significantly reducing operational costs and improving system reliability. This trend will attract investments and drive innovation in the industrial refrigeration sector.